Bitcoin continues to hover around the $110,000 mark despite reaching a new all-time high last week. The lack of further breakout momentum is likely due to profit-taking by new whales, according to on-chain data.

Since April 20, Bitcoin’s price has surged over 30% from $84,000. However, the rally has stalled since hitting a record peak of $111,970 on May 22. Analysts say the price plateau may be tied to selling pressure from recently established whale addresses.

Are New Whales Restricting Bitcoin’s Price?

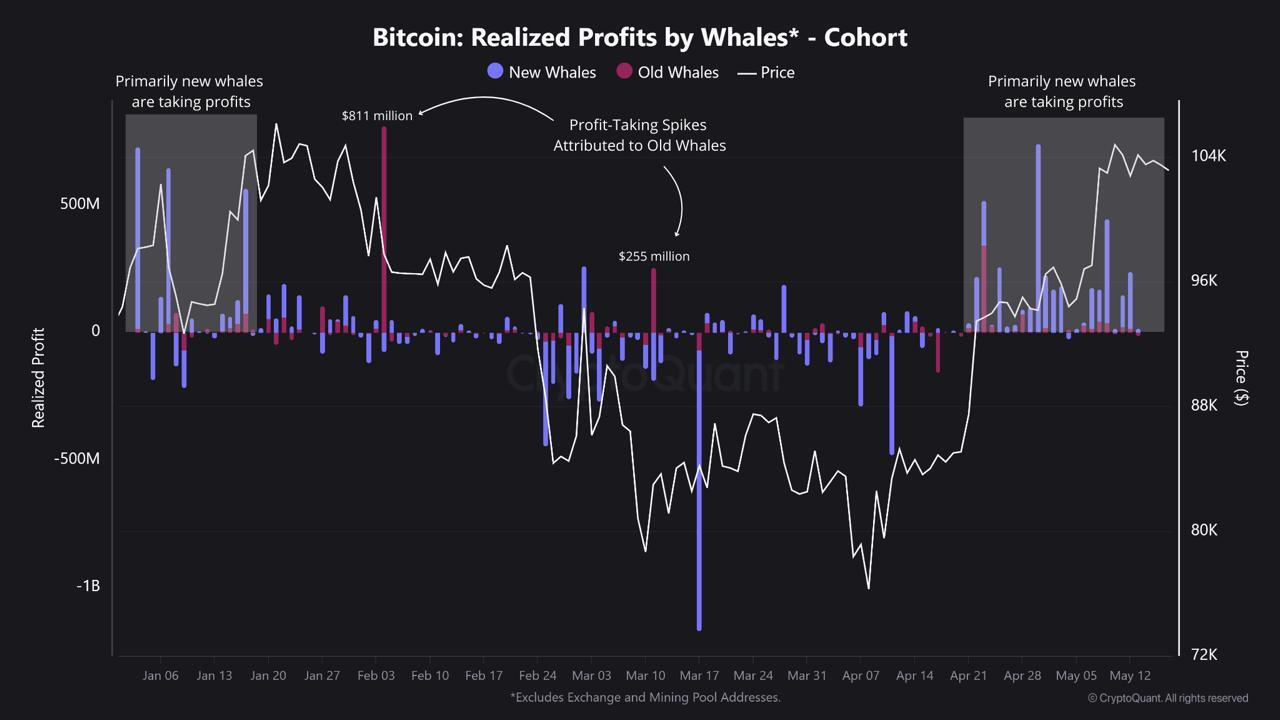

CryptoQuant’s cohort analysis shows a clear pattern. The majority of profit realization over the last month came from new whales, who have taken advantage of the rally to lock in gains.

More specifically, these are investors who bought BTC at an average cost basis of $91,922.

“With such a rally, it’s important to monitor whether profits are being realized by new or old whales. Surprisingly, the data shows that 82.5% of the profit-taking since April 20th has come from new whales,” J.A. Maartunn of CryptoQuant told BeInCrypto.

The data further shows that new Bitcoin whales realized approximately $3.21 billion in profits. It’s significantly larger compared to $679 million by older whale wallets.

This rotation of gains appears to be exerting resistance just below the $112,000 level.

Also, the following CryptoQuant chart reflects how this trend materialized before BTC hit an all-time high last week. Blue bars, representing new whales, dominate the profit-taking columns since late April.

The most recent grey-shaded section highlights increased activity from these newer market participants.

In contrast, earlier spikes in realized profits—such as the $811 million and $255 million events in February and March—were attributed to older whales.

Meanwhile, the trend of profit-taking has continued this week.

This behavioral shift suggests that new whales are seizing recent highs to exit positions they likely entered during Q1’s downturn. These exits create persistent overhead selling pressure, stalling further upward movement.

At the same time, older whales remain largely inactive. Their reluctance to sell may signal longer-term confidence in Bitcoin’s trajectory, potentially limiting downside risk in the near term.

Until this new whale selling subsides, Bitcoin may struggle to decisively break above current levels. Market watchers will be closely tracking whether this cohort continues to offload or pauses, allowing the price to find renewed momentum.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.