Cryptocurrency exchange Coinbase is the subject of a newly filed class action lawsuit. The lawsuit accuses the company and its top executives, including CEO Brian Armstrong and CFO Alesia Haas, of delaying the disclosure of a major data breach involving insider misconduct and failing to reveal serious regulatory violations in the company’s UK operations.

It alleges that Coinbase’s lack of transparency around these incidents led to substantial financial losses for stockholders and seeks compensation for the damages incurred.

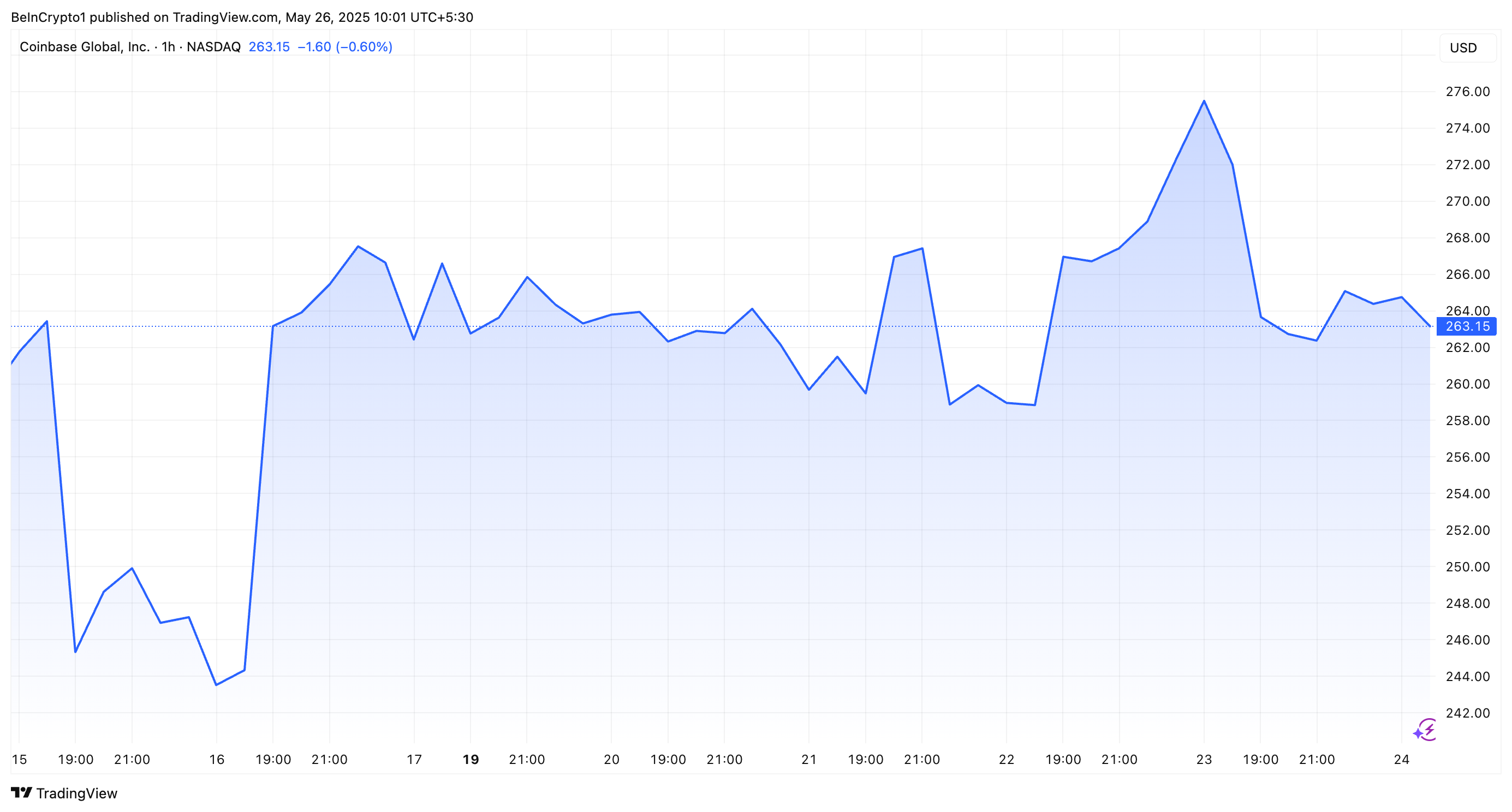

Coinbase Faces Lawsuit After Stock Price Drops

Investor Brady Nessler filed the lawsuit in the US District Court for the Eastern District of Pennsylvania. The suit represents shareholders who purchased Coinbase stock (COIN) between April 14, 2021, and May 14, 2025.

The complaint alleges that Coinbase concealed critical information about a data breach. BeInCrypto reported previously that Coinbase faced a $20 million extortion attempt by cybercriminals who stole sensitive customer data, including names, addresses, and identification details. The criminals bribed overseas support agents to steal this data.

However, the company stressed that the breach impacted “less than 1%” of its monthly active users. According to court documents, the breach, discovered months earlier, was not disclosed until May 15, 2025, following the extortion attempt. Due to this revelation, COIN fell 7.2%, closing at $244 on the same day.

“As a result of Defendants’ wrongful acts and omissions, and the precipitous decline in the market value of the Company’s common shares, Plaintiff and other Class members have suffered significant losses and damages,” Nessler claimed.

The lawsuit also highlights another incident that negatively impacted stock prices. On July 25, 2024, the United Kingdom’s Financial Conduct Authority (FCA) publicly fined Coinbase’s UK subsidiary, CB Payments Ltd. (CBPL), £3.5 million (approximately $4.5 million) for breaching a 2020 regulatory agreement that prohibited onboarding high-risk customers.

The FCA revealed that CBPL had allowed 13,416 high-risk users to access its services, enabling nearly $226 million in crypto transactions despite being explicitly restricted. The lawsuit argues that Coinbase’s failure to disclose these regulatory issues further misled investors about the company’s operational integrity.

“On this news, the price of Coinbase’s common stock fell by $13.52 per share, or 5.52%, to close at $231.52 on July 25, 2024,” the lawsuit read.

The plaintiff is now requesting class certification and is seeking monetary damages, reimbursement of legal fees, and a jury trial. Coinbase has not yet issued a public statement on the Nessler lawsuit.

Meanwhile, COIN managed to recover slightly from its May 15 lows. Nonetheless, Yahoo Finance data showed that on May 23, Coinbase’s stock lost 3.23% of its value when the market closed. That translates to a drop of $8.79, bringing the stock price down to $263.1.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.