The Solana-based memecoin TRUMP is today’s top performer. It has climbed more than 10% in the past 24 hours as trading activity rockets.

This surge in demand comes as anticipation builds for tomorrow’s private dinner, where President Donald Trump will host the top 220 holders of the TRUMP token at his Virginia golf club just outside Washington, D.C.

TRUMP Memecoin Rallies 13% Amid Strong Buying Pressure

TRUMP is up 13% over the past day, and currently ranks as the market’s top gainer. This double-digit rally reflects growing investor enthusiasm ahead of tomorrow’s dinner, which has attracted widespread attention from the crypto community.

Adding to the bullish momentum is a recent post on X by Justin Sun, the billionaire founder of the Tron Network.

In his post, Sun revealed that he is the largest holder of the TRUMP memecoin. Many may have seen this post as a significant vote of confidence, amplifying buying pressure and investor interest over the past 24 hours.

Technical indicators further support the positive sentiment around TRUMP. For example, on the daily chart, the meme coin has bounced off the dynamic support offered by its 20-day Exponential Moving Average (EMA) at $12.99

This key moving average measures an asset’s average price over the past 20 trading days, giving weight to recent prices. When the price climbs above the indicator, it signals a bullish trend and positive momentum. This suggests that TRUMP’s recent buying pressure is strong, and the token may continue to rise in the short term.

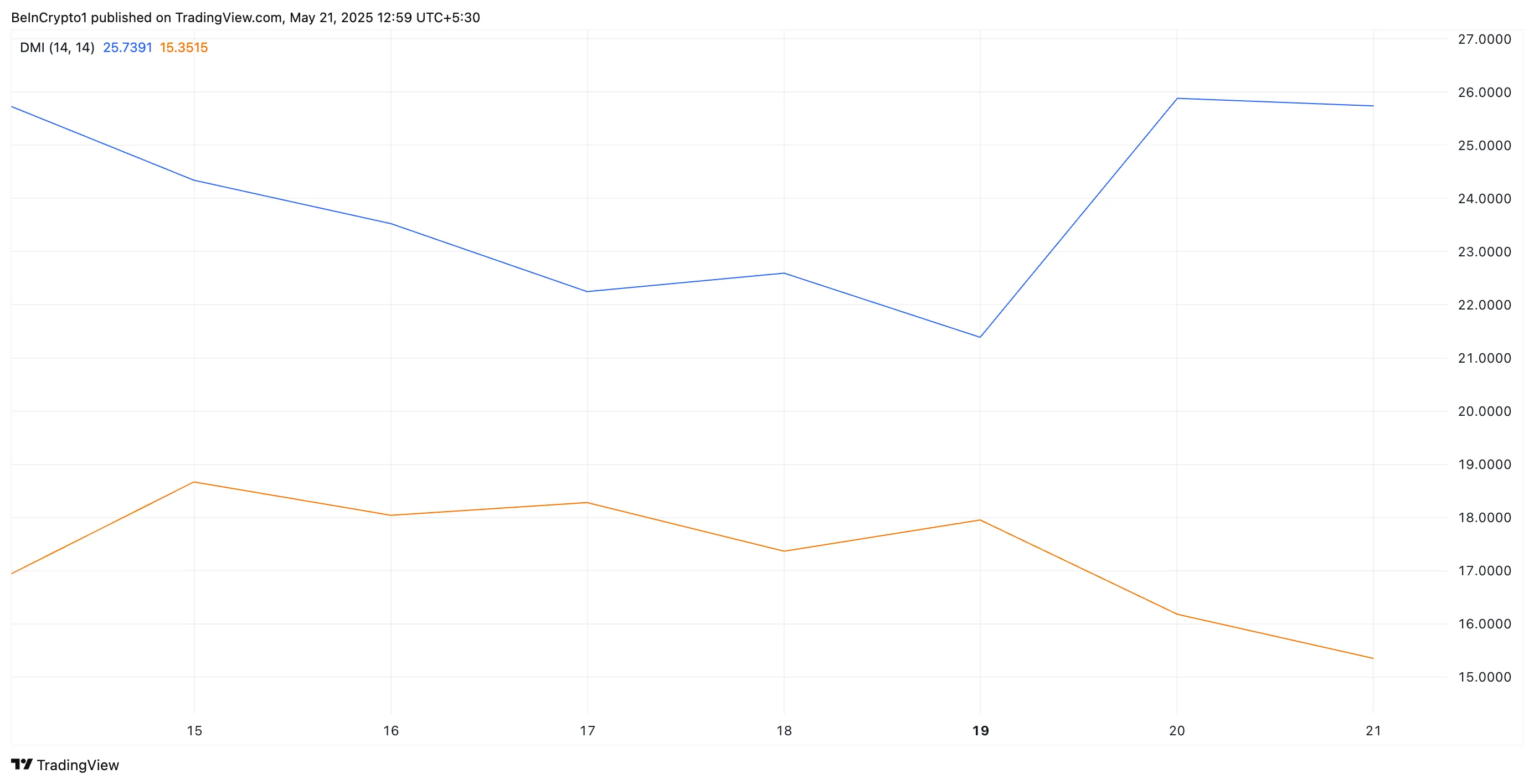

Moreover, readings from TRUMP’s Directional Movement Index (DMI) confirm the buying activity in its spot markets. As of this writing, the token’s positive directional index (+DI, blue) rests above its negative directional index (-DI, orange), with a widening gap.

When an asset’s DMI is set up this way, it indicates that bullish momentum is stronger than bearish momentum. This signals a prevailing uptrend and buying pressure in the TRUMP market.

Bullish Momentum Could Push TRUMP Towards $19.28, But Risks Linger

At press time, TRUMP trades at $14.32, resting above the $12.99 support provided by its 20-day EMA. If demand increases, this support floor will strengthen, driving TRUMP’s price toward $19.28.

However, if profit-taking commences, TRUMP risks breaking below $12.99. Should this happen, its price could fall further to $10.76.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.