On Monday, Bitcoin’s price surged past the psychological $105,000 mark, fueling renewed confidence among institutional investors and prompting capital inflows into spot Bitcoin exchange-traded funds (ETFs).

That day, inflows into these funds exceeded $650 million, led by BlackRock’s IBIT ETF.

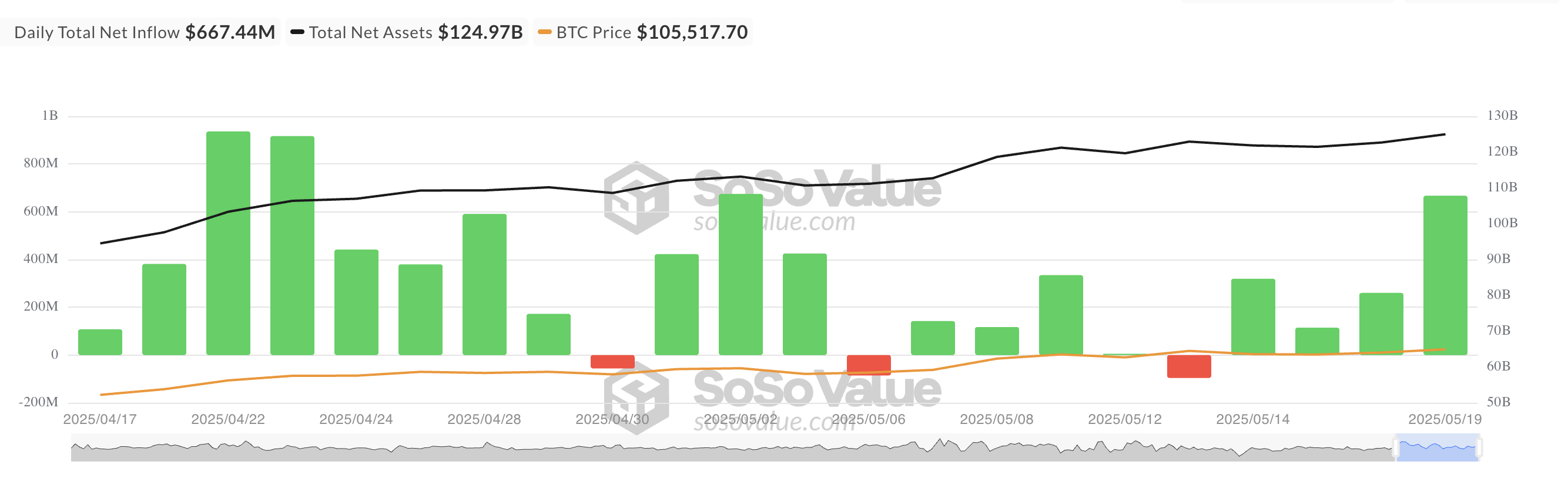

Spot BTC ETFs Post Four-Day Inflow Streak

Yesterday, US-listed spot BTC ETFs recorded a combined net inflow of over $667.44 million—their highest single-day inflow since May 2. It also marked the fourth consecutive day of positive inflows into these funds, reflecting growing institutional appetite amid signs of a broader market recovery.

During Monday’s intraday trading session, BTC briefly rallied to a daily high of $107,108. Although it experienced a slight pullback, closing above the key $105,000 level was enough to trigger renewed investor confidence and drive significant inflows into spot ETFs.

BlackRock’s ETF IBIT recorded the largest daily net inflow, totaling $305.92 million, bringing its total cumulative net inflows to $45.86 billion.

Fidelity’s ETF FBTC recorded the second-highest net inflow of the day, attracting $188.08 million. The ETF’s total historical net inflows now stand at $11.78 billion.

BTC Rally Gathers Steam

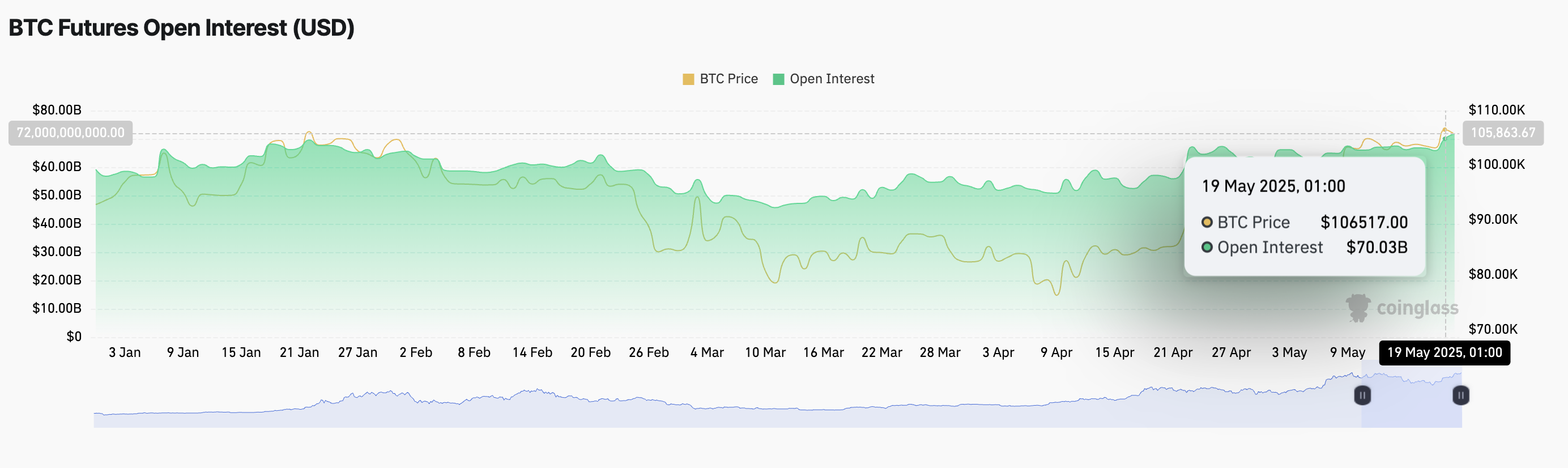

Up 3% over the past day, BTC currently trades at $105,543 and is witnessing a strengthening bullish bias. This is reflected in its futures open interest, which has climbed to its highest level year-to-date. At press time, it is over $70 billion, climbing 1% over the past 24 hours.

When an asset’s open interest rises alongside its price, new money is entering the market to support the upward trend. This trend indicates strong bullish sentiment and the potential for a sustained BTC price rally.

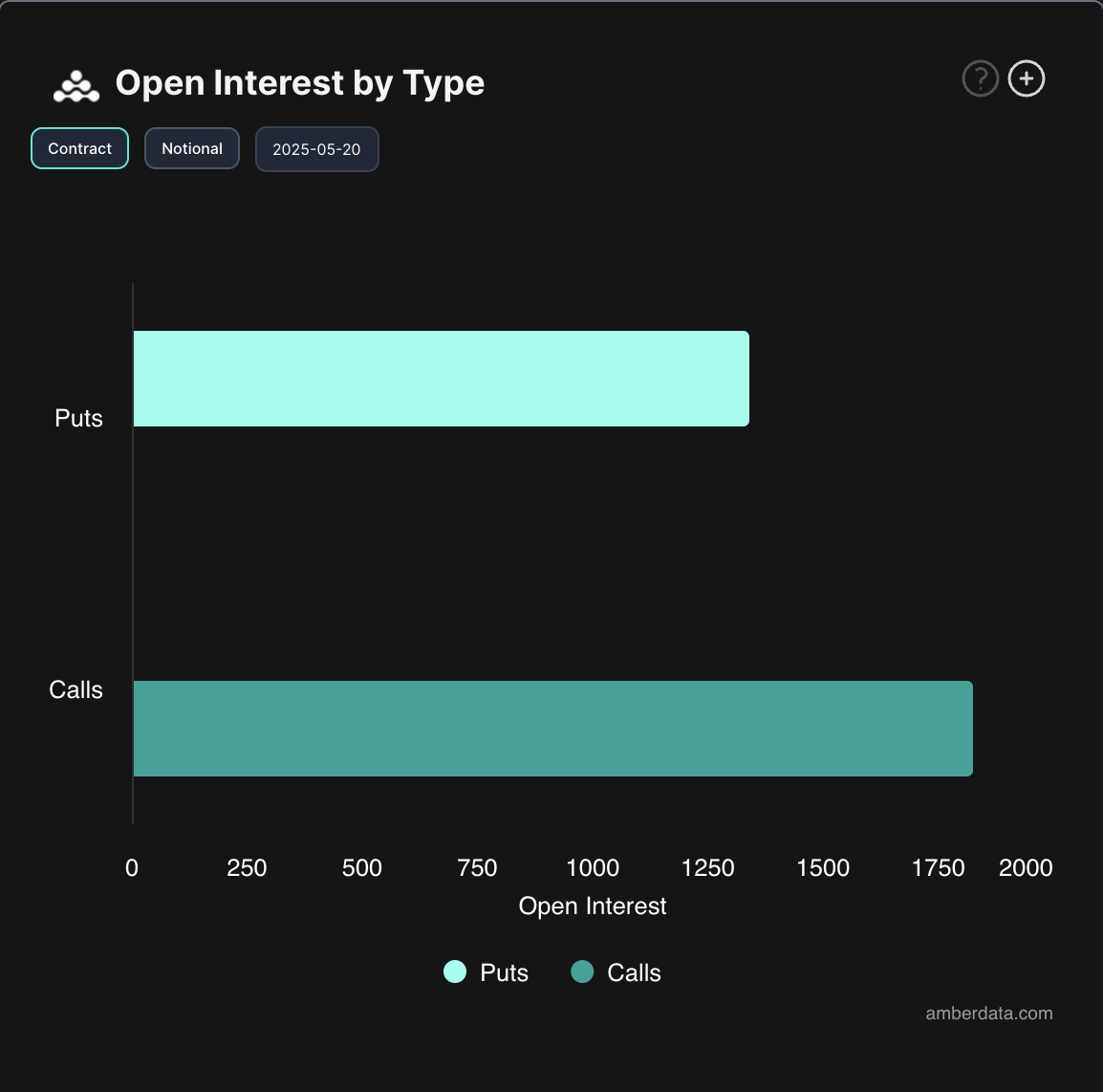

Moreover, today, the options market has seen increased demand for call options—contracts that bet on higher prices—further confirming the prevailing market optimism.

One may say that the significant ETF inflows, climbing derivatives activity, and BTC’s reclaiming of a key psychological price level signal a potential shift in sentiment and hint at the likelihood of the king coin touching a new all-time high in the near term.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.