Although the “altcoin season” has not officially begun, Solana (SOL) is witnessing growing interest from institutional investors, with significant accumulation moves noted in May 2025.

Recent reports and analyses indicate that Solana is attracting capital from institutions and experiencing growth in new developer activity, alongside positive signals from on-chain data.

Altcoin Season Yet to Arrive, But SOL Draws Institutional Attention

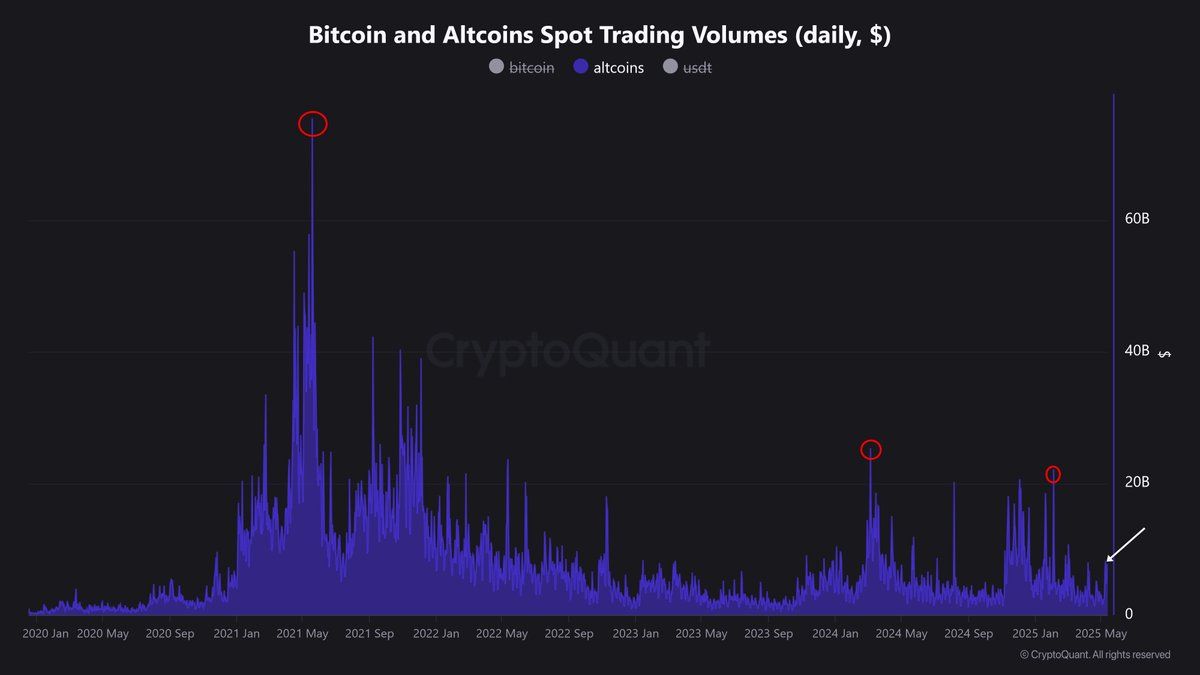

Data shows that the spot trading volume of altcoins remains lower than the levels seen in January 2025 and 2024. Naturally, it is still far from the peak levels of 2021. This suggests that the altcoin market as a whole has yet to reach the vibrancy needed to kickstart a strong growth cycle.

“We have a long way to go before we see the same levels of interest in alts that we saw in previous rallies,” shared Nic Puckrin, co-founder of Coin Bureau.

However, despite this backdrop, Solana (SOL) is emerging as a bright spot, capturing the attention of institutional investors.

Specifically, several institutions have increased their SOL holdings before the altcoin season. According to OnchainLens, a whale recently increased its holdings by 17,226 SOL while investing $1 million in FARTCOIN and $300,000 in LAUNCHCOIN.

Another whale withdrew 296,000 SOL from FalconX and staked it, signaling a trend of accumulation and long-term commitment to the Solana ecosystem.

Moreover, DeFi Development Corp recently increased its Solana holdings by over 170,000 SOL, pushing the total value above $100 million. Similarly, SOL Strategies added over 122,524 SOL to its investment portfolio in May.

These moves reflect strong confidence from institutional investors in Solana’s future growth potential.

Solana Ecosystem Thrives

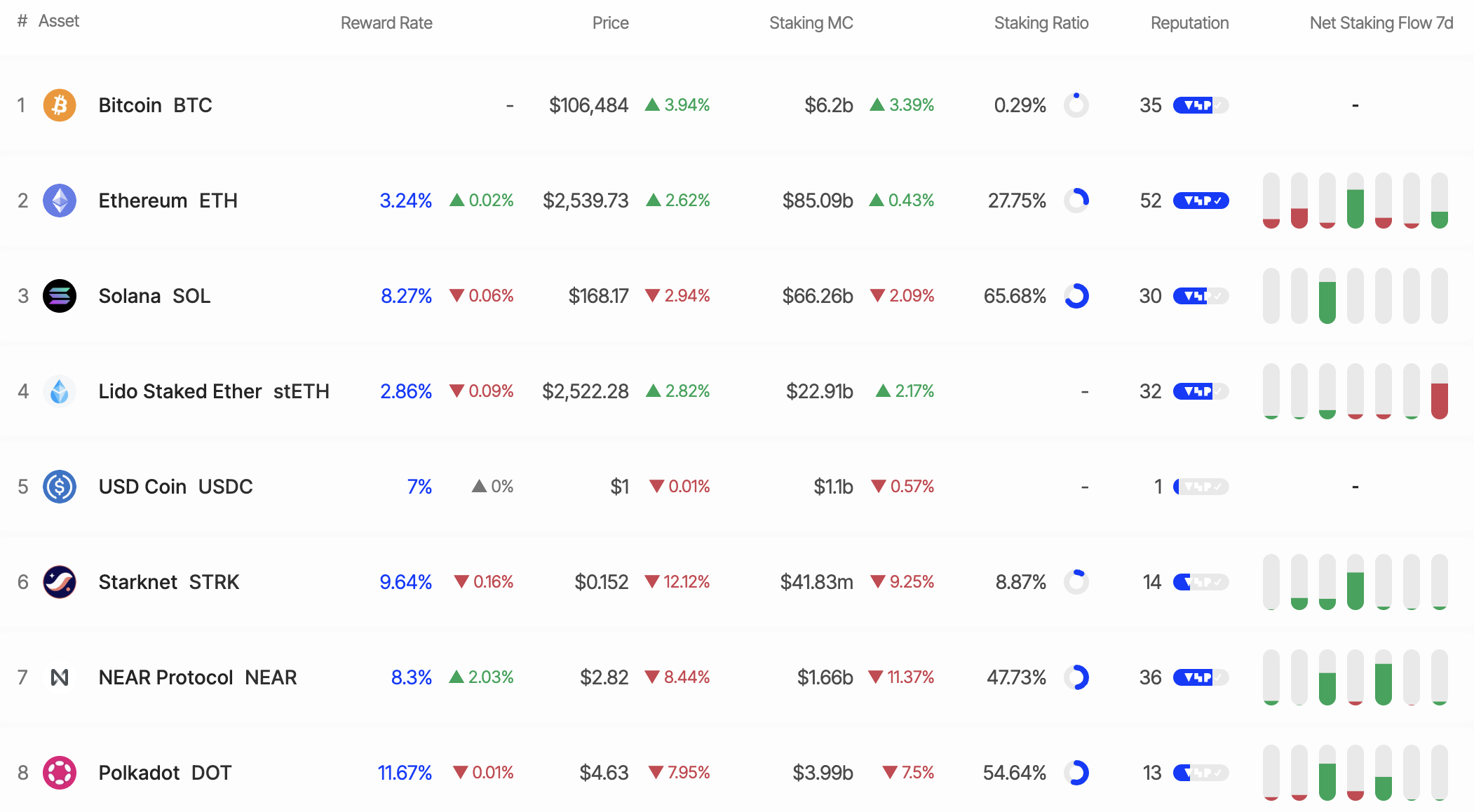

Beyond the interest from institutional investors, Solana is also seeing positive signals from its ecosystem. The fact that 65% of SOL’s total supply is currently staked is a positive sign, reflecting the community’s confidence in Solana’s stability and long-term potential.

As previously reported by BeInCrypto, Solana achieved a total app revenue of $1.2 billion in Q1 2025. This result marks a 20% growth compared to the previous quarter ($970.5 million). It is the highest-performing quarter for Solana in the past 12 months, demonstrating a strong ecosystem recovery after a year of significant volatility.

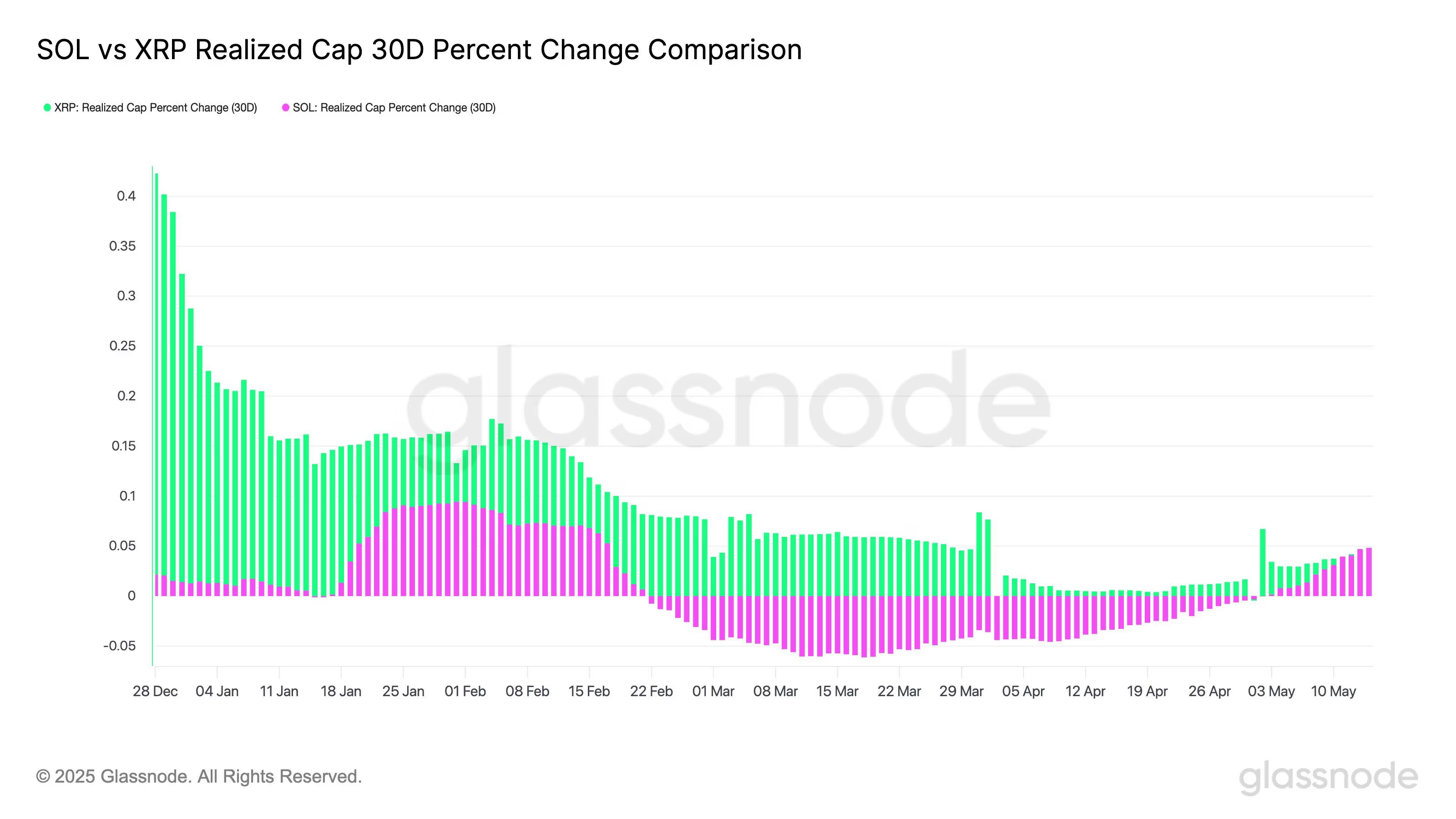

Additionally, Glassnode data shows that the real capital inflow into SOL over the past 30 days has returned to positive territory, growing at a rate on par with XRP. These signals indicate that on-chain demand for Solana shows signs of recovery, even though the broader altcoin market has yet to take off fully.

Solana Mirrors Ethereum’s 2021 Performance

Another noteworthy analysis from the X account jon_charb suggests that SOL’s ATH price at the start of 2025 bears striking similarities to Ethereum in 2021. Specifically, SOL experienced a significant price surge earlier this year, much like Ethereum’s breakout before the 2021 altcoin season.

If history repeats itself, Solana may be in an accumulation phase ahead of a new growth cycle, especially as institutional investors continue to pour capital into its ecosystem. This parallel reinforces confidence in SOL’s potential and highlights the possibility that this blockchain could lead the upcoming altcoin season.

However, it’s worth noting that the altcoin market is still in the early stages of recovery. Spot trading volumes, which are lower than previous highs, indicate that market sentiment remains cautious.

Nevertheless, the accumulation moves by institutional investors and the development of Solana’s ecosystem suggest that SOL may be gearing up for a significant leap when market conditions become more favorable.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.