Animoca Brands, the Hong Kong-based Web3 investment powerhouse once valued at nearly $6 billion, is preparing to go public in New York.

The move suggests that earlier plans for listings in Hong Kong or the Middle East may be shelved or abandoned.

Animoca Brands Plans to Go Public in New York

In a new interview with the Financial Times, Animoca Brands co-founder and executive chair Yat Siu revealed that Animoca is accelerating plans for a US IPO. According to the report, an announcement could come “soon.”

Yat Siu cited the Trump administration’s favorable stance on digital asset regulation. In his opinion, this is a “unique moment” to enter the world’s largest capital market.

The Animoca Brands executive added that the company is weighing various shareholding structures. He said the listing was unlikely to hinge on market conditions.

“If the US didn’t do what they did with the regulators [under Biden], we probably would have competitors in the US. Normally, we’d be fighting with some giant or something. It’s the biggest market, so we should go there, right? It’s a unique moment in time. I feel like it would be one heck of a wasted opportunity if we didn’t at least try,” Yat Siu told The Financial Times.

Animoca’s pivot to New York marks a strategic shift from earlier intentions. As BeInCrypto reported, the company had been exploring public offerings in Hong Kong or the Middle East by early 2025.

The move to sidestep the Middle East, in particular, a region known for its favorable stance towards cryptocurrency, reflects prospects for better opportunities in the US.

Notably, under Trump’s administration, the US may present as greener pastures. Optimism comes after several enforcement actions initiated during President Biden’s term are reversed.

Indeed, Trump’s return to office has prompted a broader migration of crypto firms to the US, including Deribit, the world’s largest crypto options exchange.

Beyond Animoca, Trump’s pro-crypto policies created a favorable climate for Gemini and Kraken to pursue IPOs, with the former filing confidentially for a public debut. Cathie Wood’s Ark Invest predicted this, citing an IPO window for crypto firms under Trump.

Animoca’s Turbulent History with Public Markets

The IPO repurposing to New York is especially notable given Animoca’s turbulent history with public markets. The Australian Stock Exchange (ASX) delisted the company in 2020, citing concerns over governance and the legal status of some crypto holdings.

Since then, it has reinvented itself as one of the largest investors in the Web3 space, with stakes in over 540 companies, including OpenSea NFT marketplace, ConsenSys, and Kraken exchange. According to Siu, going public now is about more than capital.

“We think we’re the biggest non-financial services crypto firm. I think going public is a way to tell the world that ‘hey there’s a business that is in crypto that isn’t doing the typical crypto stuff’,” he said.

The company’s financials also reflect growing momentum. Animoca reported unaudited EBITDA of $97 million on revenue of $314 million for the year ending December 2024. This represents a 185% surge from $34 million on $280 million in revenue the previous year.

Animoca Brands holds nearly $300 million in cash and stablecoins and $538 million in digital assets.

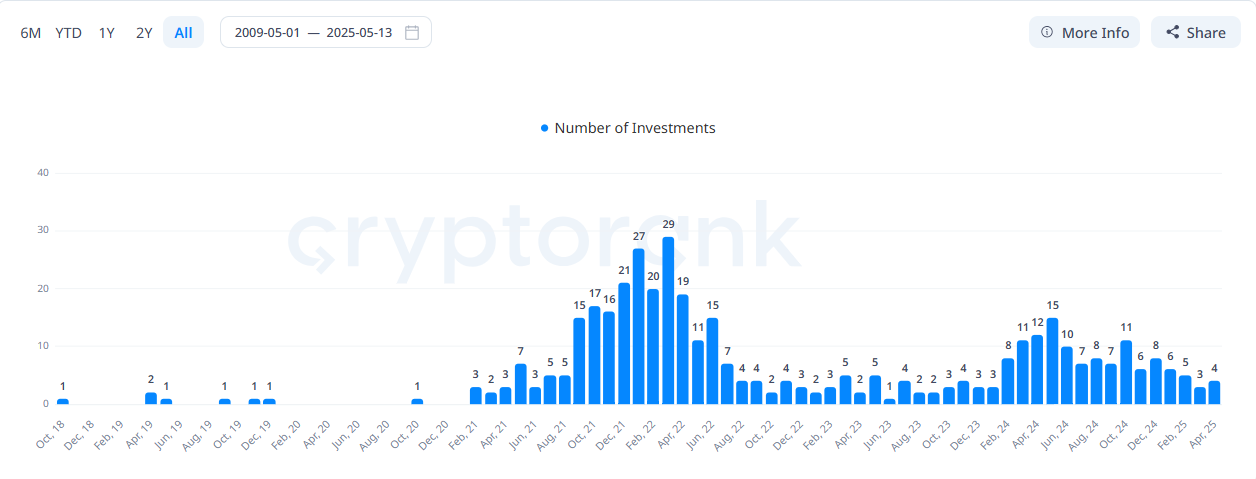

Data on Cryptorank.io also shows Animoca is one of the most active investment firms in the crypto space. It has invested in over 400 projects with an average ROI of 1.93X.

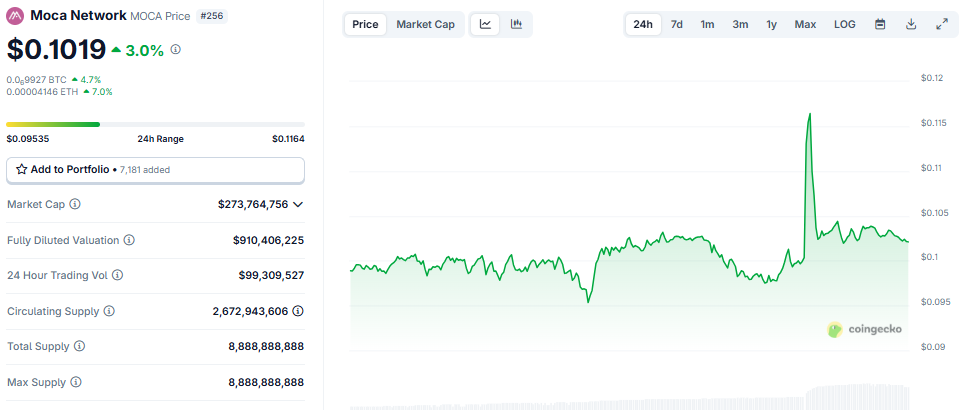

Meanwhile, its recent launch of Moca Coin, a native token designed to support the broader Mocaverse ecosystem, drew additional attention to its growing metaverse and GameFi ambitions.

Animoca’s IPO could mark a watershed moment for the firm, reflecting how regulatory tides can quickly redraw the global map for Web3 innovation.

Data on CoinGecko shows the MOCA token is up by a modest 3% on this news, and was trading for $0.1019 at press time.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.