Onyxcoin (XCN) has faced challenges in the past month, with its price largely stagnating. The lack of bullish movement is likely a result of opposing forces—investor behavior and market conditions—acting on the cryptocurrency.

However, there is some positive news surrounding the upcoming OIP-56 proposal, which will bring gas-free voting for the users. This could act as a trigger for XCN price rise.

Onyxcoin Is Overvalued

The NVT (Network Value to Transactions) ratio for Onyxcoin is currently at a five-month high, which indicates a sharp rise in network valuation relative to transaction activity. This spike signals a potential overvaluation of XCN, as the network’s actual transaction activity is not keeping pace with its valuation.

This discrepancy can create a sense of inflated value, which historically points to a price correction. With the NVT ratio showing a disconnect between price and real-world usage, Onyxcoin could experience increased selling pressure if investors start to realize the overvaluation.

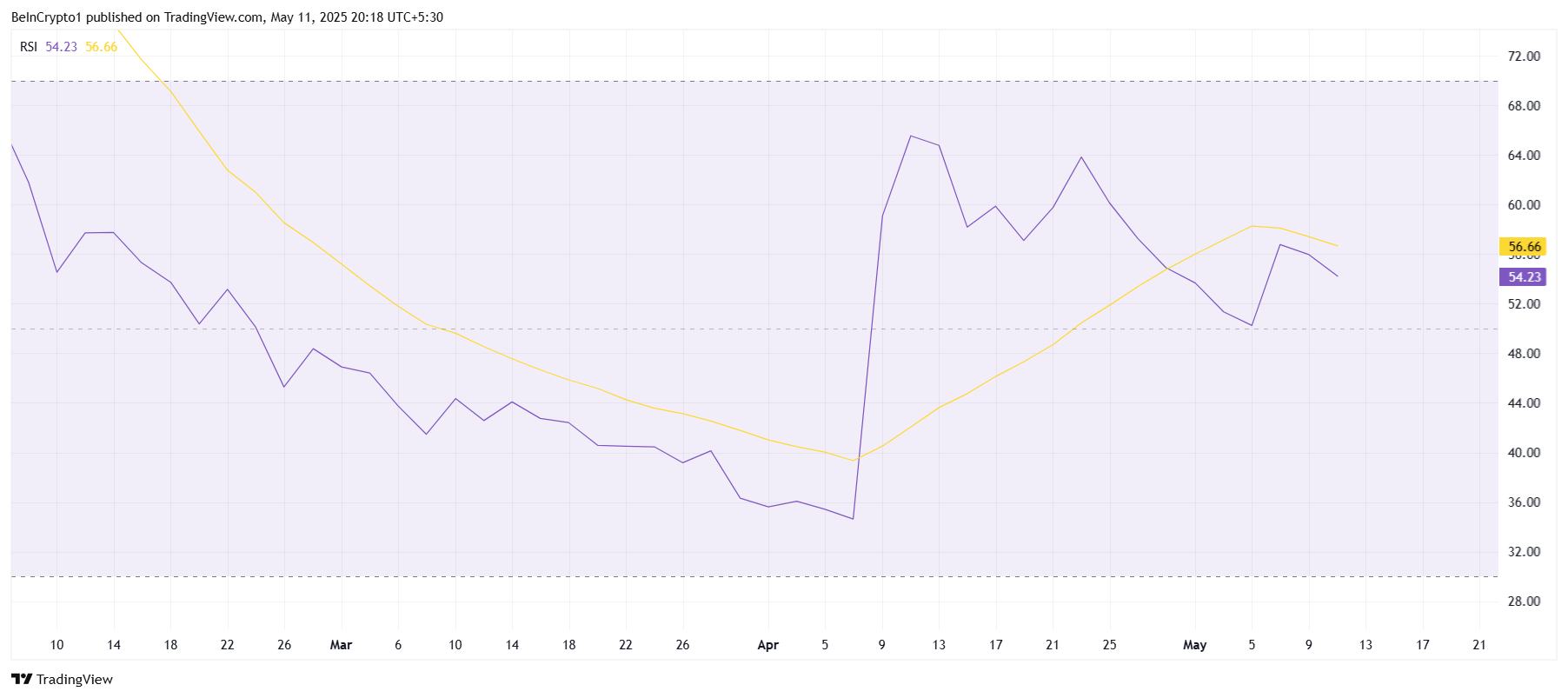

Despite the signs of overvaluation, Onyxcoin is not facing significant bearish momentum, as shown by its Relative Strength Index (RSI). Currently, the RSI is sitting above the neutral 50.0 mark, indicating that, although the market is less favorable, XCN is still in a positive price zone.

The RSI’s position suggests that Onyxcoin could remain relatively stable or even experience some upward momentum. If the broader market conditions improve or if OIP-56 succeeds in providing further utility to the network, the price may have the potential to recover.

XCN Price Aims For Recovery

Onyxcoin’s price is currently trading at $0.0180, consolidating between $0.0214 and $0.0165. The lack of bullish momentum in the past few weeks has kept the price from rising above $0.0214, reflecting market hesitation.

Given the mixed signals from both market sentiment and technical indicators, Onyxcoin’s price may continue to consolidate in this range for the time being.

This consolidation phase is likely to continue unless a significant catalyst pushes the price in one direction. If market conditions worsen, Onyxcoin could face a drop below the $0.0165 level, possibly falling to $0.0150.

This would further validate concerns about the cryptocurrency’s overvaluation and could signal a deeper correction in its price.

However, if Onyxcoin’s price begins to align with investor behavior and bullish momentum, it could break past the $0.0214 resistance. This would pave the way for a potential rise to $0.0237 and eventually towards $0.0300.

A successful breach of these levels would invalidate the current bearish outlook, indicating a stronger uptrend for Onyxcoin in the near future.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.