Solayer (LAYER) is under intense pressure after a sudden 45% crash wiped out weeks of bullish momentum. Once up 460% since February, the token trades below $1.70 as traders scramble to understand what triggered the collapse.

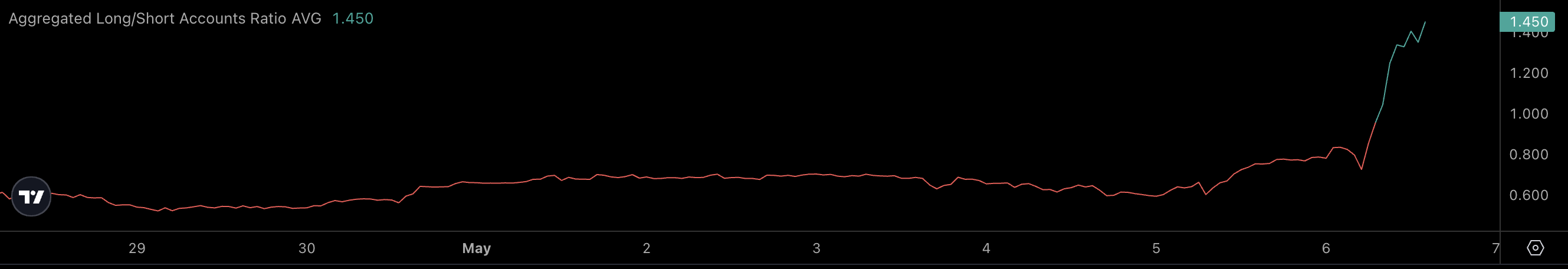

The altcoin lost nearly $350 million in market cap in this crash. With volatility rising and the long/short ratio now at 1.45, the market appears divided between those expecting a rebound and those bracing for further downside.

Solayer Loses Nearly $350 Million Market Cap – What’s Behind the Drop?

LAYER has plunged roughly 35% in just 24 hours, falling from nearly $3.10 to $1.90, leaving the community scrambling for answers. This sharp drop comes despite Solayer’s strong fundamentals—it’s the first hardware-accelerated blockchain designed to offload operations onto programmable chips, aiming for over 1 million TPS and 100 Gbps bandwidth.

The project also offers real-world utility through its Solayer Emerald Card, which allows users to spend USDC seamlessly via Visa, with support for Apple Pay and Google Pay.

From February 18 to May 5, LAYER surged 460%, making it one of the best-performing altcoins of the year—until the sudden crash disrupted momentum.

Right now, confusion reigns. Some blame market makers for triggering a cascade of liquidations, others accuse the founders of shady practices, while a few point to the daily 110,600 LAYER token unlocks.

However, those daily unlocks account for just $219,000 in value—hardly enough to justify a $250 million+ loss in market cap. What’s more concerning is the upcoming major unlock on May 11, when 26.5 million LAYER (worth about $51 million) will be released.

If market sentiment doesn’t recover before then, this influx of supply could intensify selling pressure and potentially push the price even lower.

LAYER Crash Deepens: $3.2 Million in Long Liquidations Fuel Panic

LAYER’s long/short ratio sat at 0.78 over the past 24 hours, with 56.14% of traders positioned short—reflecting rising bearish sentiment.

Around $3.2 million in long liquidations were triggered, more than double the $1.5 million in short liquidations. This forced selling likely accelerated the drop from $3.10 to $1.90, as liquidation cascades compounded the pressure.

With the upcoming May 11 token unlock, the unwind of leveraged positions became a key driver of the crash.

While the long/short ratio has since flipped to 1.45—indicating that more traders are now positioning for a rebound—the lack of order book depth remains a concern. In such environments, price volatility can remain elevated regardless of whether sentiment shifts back to bullish.

Longs Pile In as LAYER Struggles Below $1.90

LAYER’s outlook remains highly uncertain as its price struggles to hold above $1.90 following a steep decline.

Traders and investors are still seeking clarity on the cause of the crash, while sentiment remains fragile ahead of the May 11 token unlock.

In this context, the current long/short ratio of 1.45 reveals an important shift—more traders are now betting on a rebound, with 59.2% of positions long versus 40.8% short.

This rising long bias may suggest that some believe the worst is over, especially after an aggressive selloff.

However, it also introduces new risk: if LAYER fails to recover and drops further, these newly opened long positions could be liquidated just like before—potentially setting off another wave of forced selling.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.