TAO, the altcoin that powers Bittensor’s decentralized machine learning network, has soared 10% in the past 24 hours. It has outperformed major cryptocurrencies like Bitcoin (BTC), which has seen a modest gain of 0.13%, and Ethereum (ETH), whose value has dipped by 1.3% over the past day.

With technical indicators hinting at growing bullish pressure, TAO could extend its double-digit rally in the short term.

TAO Flashes Bullish Signal

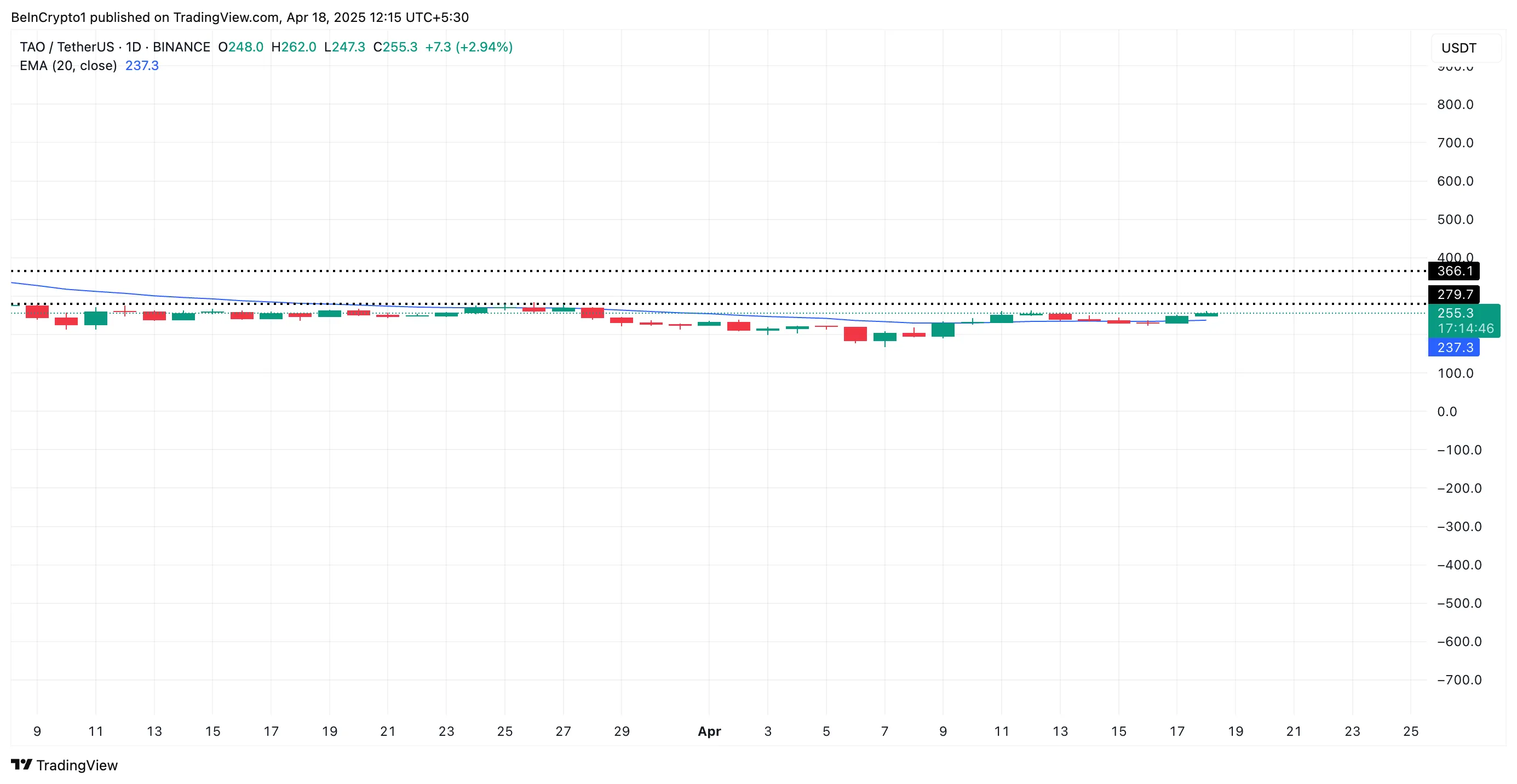

TAO’s price has broken above its 20-day Exponential Moving Average (EMA), an indicator that suggests a strong bullish trend in its spot market.

The 20-day EMA measures an asset’s average price over the past 20 trading days, giving more weight to recent prices. When an asset’s price breaks above this key moving average, it signals a shift in momentum toward a bullish trend. Traders view it as a short-term signal that the asset may continue to rise.

This crossover confirms TAO’s growing buying pressure and renewed investor confidence. It also hints at a sustained price rally as long as the 20-day EMA remains below the token’s price, to offer a dynamic support floor against any significant price dips.

Additionally, the altcoin’s rising Relative Strength Index (RSI) further supports the demand spike, reinforcing the likelihood that TAO’s upward trend could continue. At press time, this is at 54.86.

This indicator ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound

TAO’s RSI confirms that bullish momentum is building gradually. It indicates growing buying interest, with room for further upside before reaching overbought conditions above 70.

TAO Eyes $279.70 Breakout as Bullish Momentum Builds

TAO currently trades at $255.20. With strengthening bullish pressure, the altcoin could extend its gains and break above $279.70, its next major resistance level. A successful breach of this price spot could propel TAO’s price to $366.10.

However, a spike in profit-taking activity will invalidate this bullish outlook. If demand wanes and TAO sellers regain market control, they could force the token’s price below its 20-day EMA, which forms dynamic support at $237.30.

If this happens, the TAO token price could fall further to $163.70.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.