Ripple’s XRP has surged by almost 10% in the past week, riding the wave of a broader market uptrend. As of this writing, the fourth-largest crypto by market capitalization trades at $2.33.

However, on-chain metrics suggest the token may be overvalued, raising concerns about a potential price correction as traders look to lock in profits.

Overvaluation and Profit-Taking Could Cause Decline

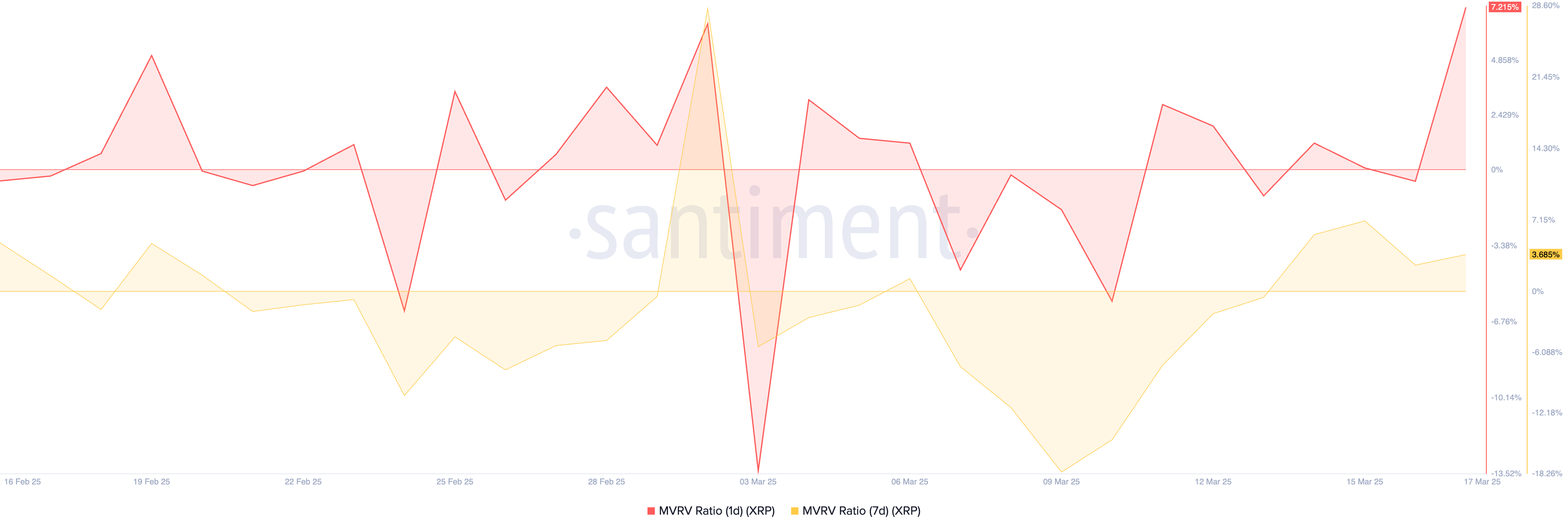

One key indicator flashing warning signs is XRP’s Market Value to Realized Value (MVRV) ratio. This metric, measured using the one-day and seven-day moving averages, currently stands at 7.21% and 3.68%, respectively.

The MVRV ratio measures the relationship between an asset’s market value and its realized value to identify whether it is overvalued or undervalued.

When an asset’s MVRV ratio is negative, its market value is lower than its realized value. This suggests that the coin is undervalued compared to what people originally paid for it.

Conversely, as with XRP, when this metric returns a positive value, the asset’s market value is higher than the realized value, suggesting it is overvalued.

This provides a profit-taking avenue for XRP investors who bought at lower prices. They may see this as an opportunity to cash out before a potential correction, increasing selling pressure in the market. As more holders sell, XRP supply outpaces demand, putting downward pressure on its price.

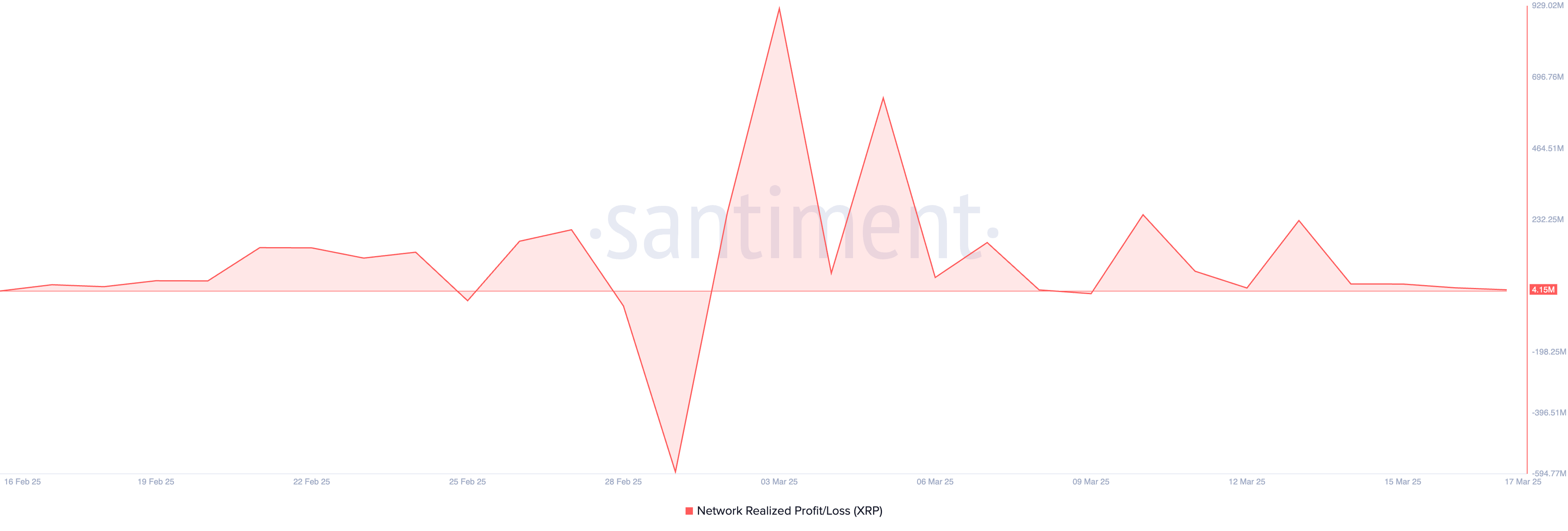

Furthermore, the positive readings from the token’s Network Realized Profit/Loss (NPL) support this bearish outlook. At press time, this stands at 4.15 million.

The NPL measures the difference between the price at which an asset was last moved or sold and its current market price. It tracks how much profit or loss coin holders “realize.”

When an asset’s NPL is positive, it indicates that more investors are selling at a gain than at a loss. This trend could lead to increased XRP supply in the market, which may cause the asset’s price to fall if demand does not match the sell-off.

XRP Under Selling Pressure—Is a Steeper Drop on the Horizon?

XRP trades at $2.30 at press time, noting a 3% price decline in the past day. As more traders heed this sell signal and distribute their holdings for gains, the downward pressure on XRP would skyrocket.

In this scenario, its price could drop to $2.13. If the bulls are unable to defend this support, XRP could extend its decline and fall toward $1.47.

However, if profit-taking loses momentum, the altcoin will resume its uptrend and could rally to $2.61.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.