Crypto whales have been accumulating Optimism (OP), Movement (MOVE), and Onyxcoin (XCN), signaling potential opportunities despite recent market corrections. Based on the accumulation pattern, these three tokens could potentially be considered the best crypto to buy now.

OP has struggled this cycle, down over 81% in the past year, but whale activity suggests a possible trend shift. MOVE has shown resilience, consolidating while other cryptos dropped. Its recent institutional backing has kept investor interest high. Meanwhile, XCN, one of 2025’s top-performing coins, is correcting after a 400% rally. Yet, if momentum returns, it could reclaim key resistance levels.

Optimism (OP)

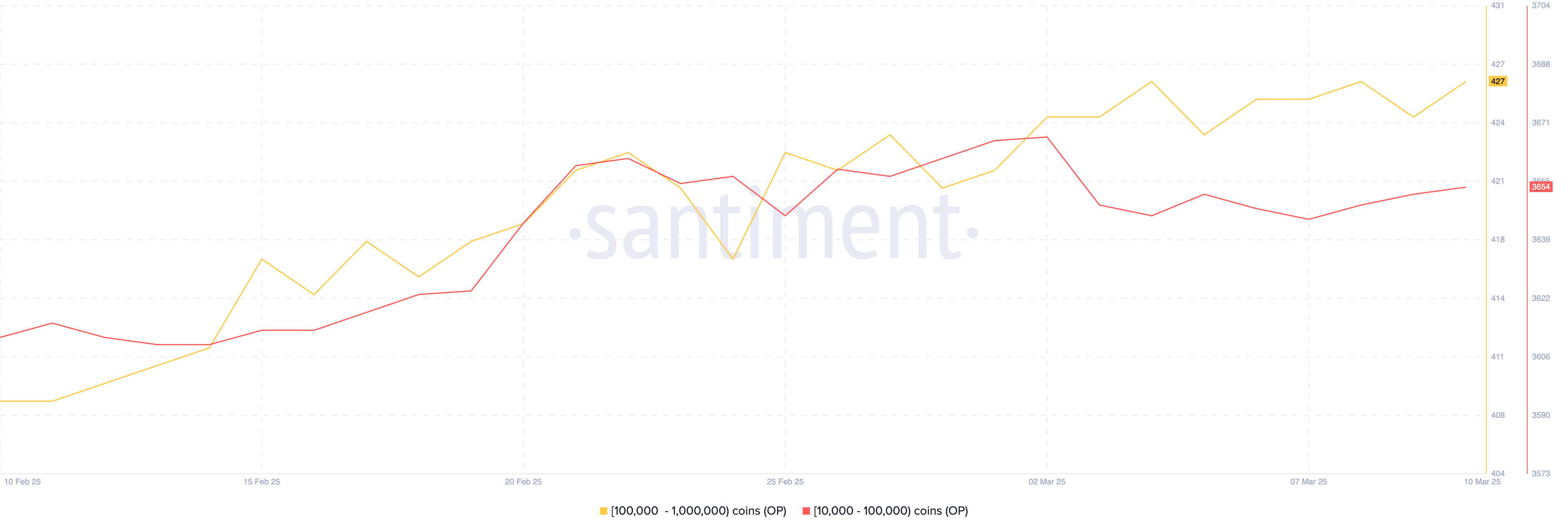

The number of wallets holding at least 10,000 OP has increased from 4,071 to 4,081 over the past four days, signaling that some larger investors are accumulating despite Optimism’s prolonged downtrend.

Unlike other major cryptocurrencies that have seen strong surges this cycle, OP has struggled significantly, with its price down more than 81% in the last 365 days. Since January 5, 2025, OP has remained below $2, highlighting sustained selling pressure and weak demand.

If this accumulation leads to renewed bullish momentum, OP could attempt to reclaim key resistance levels, starting with $0.87. A breakout above this level could trigger a move toward $1.06, and if bullish momentum strengthens further, OP might even test $1.17.

However, if selling pressure continues and the current bearish trend remains intact, OP could face further declines, potentially dropping below $0.70.

Movement (MOVE)

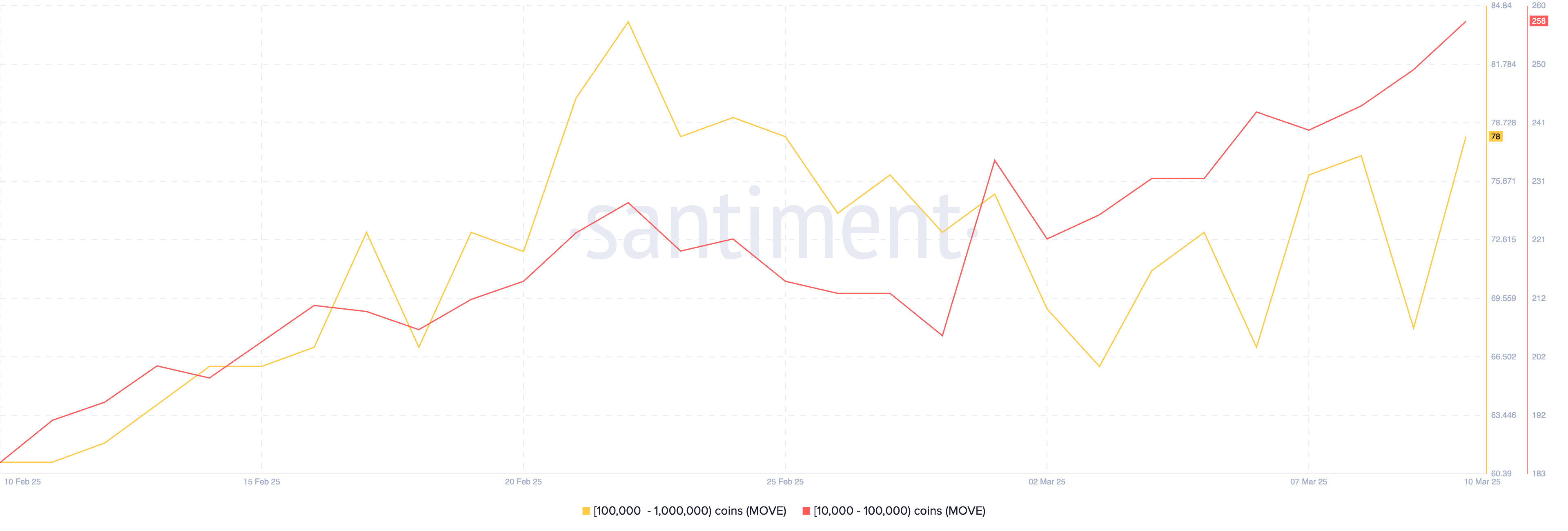

The number of wallets holding between 10,000 and 1,000,000 MOVE has increased from 291 on March 2 to 336, indicating that crypto whales have been actively accumulating.

This accumulation comes after MOVE’s Mainnet Beta launch and ETF filings, which have driven increased investor interest.

Additionally, MOVE has been in the spotlight over the past few months, particularly after securing $100 million in Series B funding in January.

While many cryptocurrencies have faced sharp corrections this week, MOVE has remained relatively stable, showing signs of consolidation rather than severe losses.

If this accumulation translates into bullish momentum, MOVE could break out of its consolidation phase and test key resistance levels at $0.55 and $0.59, with a potential extension toward $0.76 if buying pressure accelerates.

However, if a new downtrend emerges, MOVE could face critical support tests at $0.41, and a further breakdown could send it as low as $0.37.

Onyxcoin (XCN)

The number of wallets holding between 100,000 and 10,000,000 Onyxcoin has increased from 3,681 on March 6 to 3,736, suggesting that crypto whales have been accumulating despite recent market volatility.

Onyxcoin has been one of the most trending altcoins of 2025, with its price surging more than 400% this year, attracting significant investor interest. However, after such an explosive rally, Onyxcoin has entered a correction phase, dropping more than 20% in the last seven days.

If XCN can regain its bullish momentum, it could challenge key resistance levels at $0.014 and $0.017, potentially extending gains toward $0.022 if demand strengthens.

However, if the correction deepens, XCN could drop below $0.010 for the first time since January, signaling further weakness in price action.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.