Bitcoin price briefly dropped below $80,000 on Monday, hitting a four-month low of $77,393. This sharp decline triggered a wave of miner capitulation, prompting them to offload their holdings.

On-chain data has revealed an uptick in miner sell-offs—a trend that increases bearish sentiment in the market and puts more downward pressure on BTC’s price.

Bitcoin Price Drops to Multi-Month Low as Miners Flood Exchanges

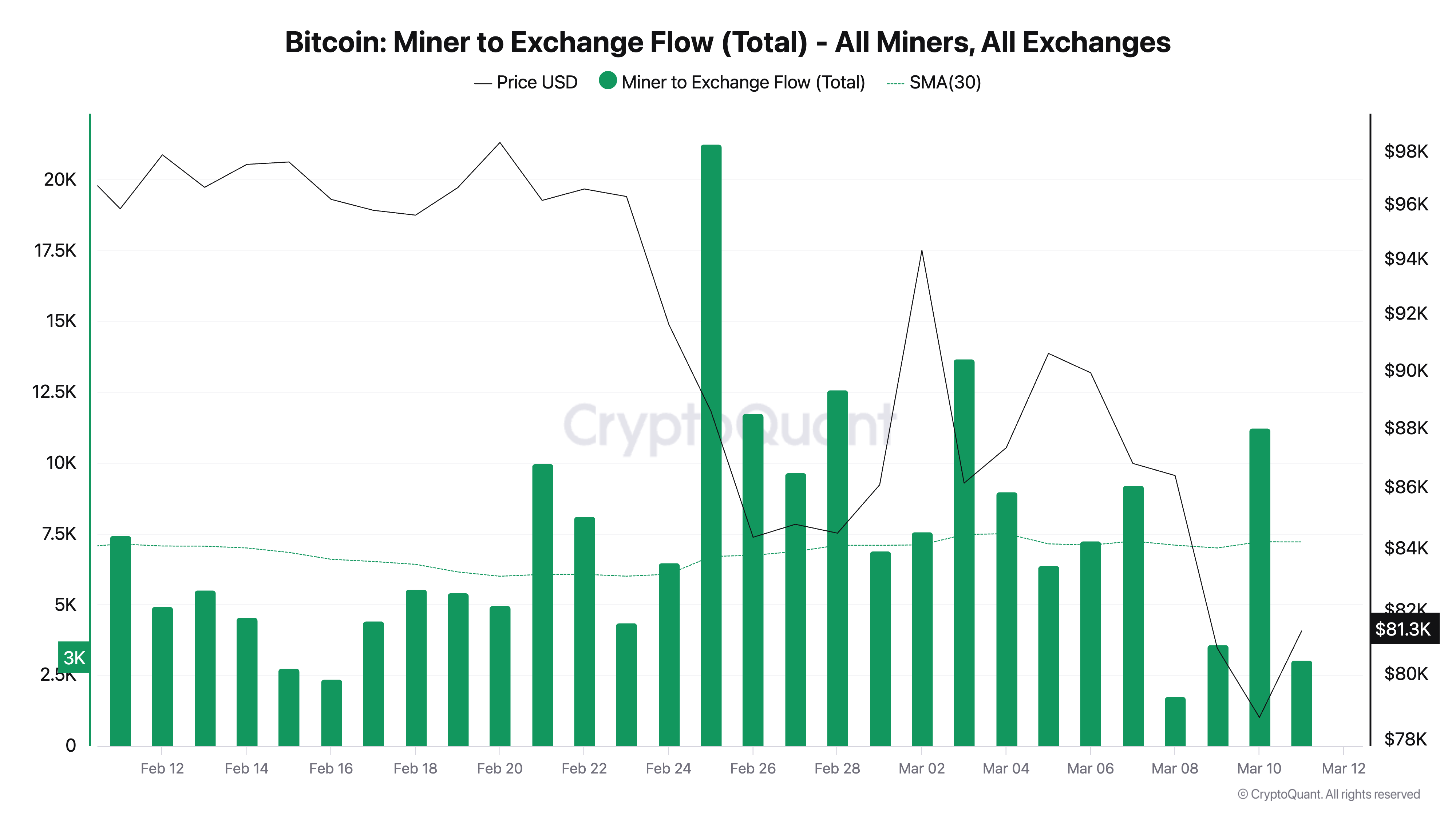

As Bitcoin fell to a multi-month low on Monday, miner transfers to exchanges surged sharply. According to CryptoQuant, BTC’s Miner-to-Exchange Flow—which measures the total amount of coins sent from miner wallets to exchanges—spiked to 11,250 BTC during this period.

When BTC’s Miner-to-Exchange Flow climbs like this, it suggests that miners are offloading their holdings, often to cover operational costs or mitigate losses. This increased selling pressure can weaken BTC’s price and accelerate market downturns.

Further, today’s drop in BTC miner netflow confirms the coin sell-off trend among miners on the Bitcoin network. At press time, the metric’s value is negative at -620.01.

Miner netflow tracks the net amount of coins that miners are buying or selling. It is calculated by subtracting the amount of BTC miners are selling from the amount they are buying.

When it is negative like this, it indicates that miners are selling more coins than they are buying. This is a bearish signal and often a precursor to an extended downward trend in the coin’s price.

BTC Struggles at $80K Amid Heavy Selling

Historically, miners tend to sell more during price declines to cover operational expenses, which adds to selling pressure and can accelerate market downturns. BTC currently trades at $81,686, shedding 1% of its value over the past 24 hours.

During that period, its trading volume has rocketed over 50%, reflecting the high selling activity in the market. If this selling trend continues, it could hinder BTC’s near-term recovery, as the coin could drop below $80,000 again to trade at $73,631.

However, if strong demand steps in to absorb the additional supply, it could drive BTC’s value up to $86,601.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.