Onyxcoin (XCN) has experienced a significant downtrend recently, with its price falling 34% in just one week.

This sharp decline has worsened the situation for XCN holders, especially as large-scale investors, also known as whales, are pulling out of the market. Their sell-off has only added to the negative sentiment surrounding the coin.

Onyxcoin Whales Are Pulling Back

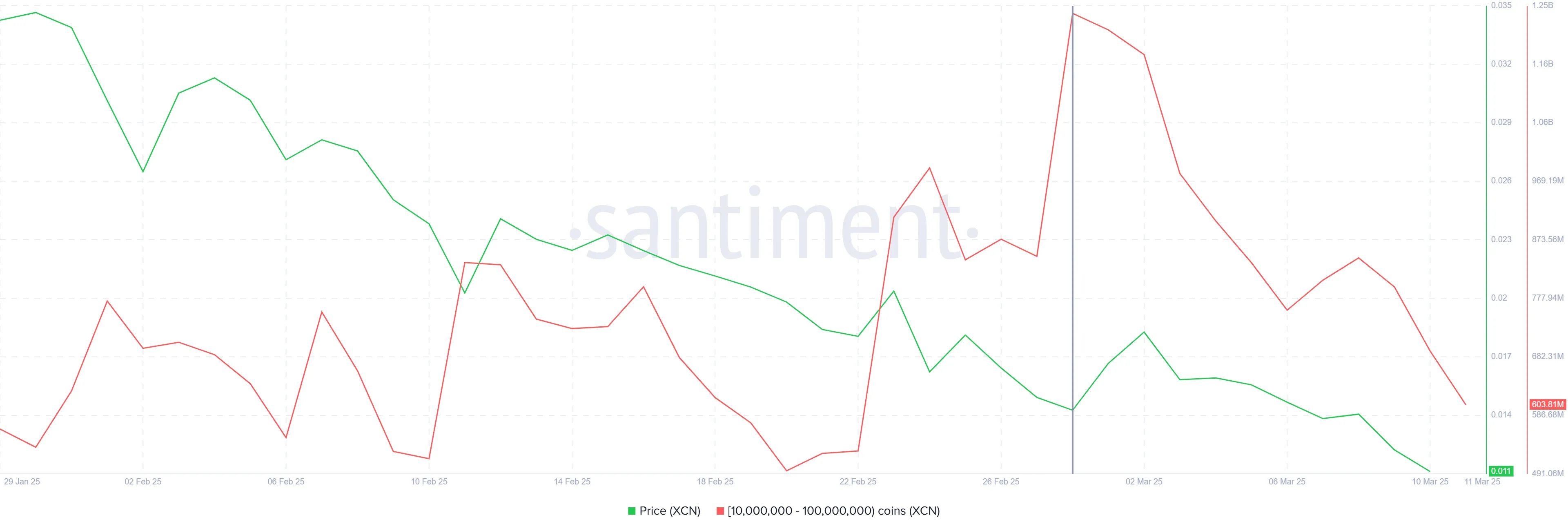

Whale addresses holding between 10 million and 100 million XCN, have sold over 50% of their holdings, resulting in a significant reduction in their positions. This sell-off saw the amount of Onyxcoin held by these whales drop from 1.24 billion XCN to 603 million XCN, equating to roughly 637 million XCN sold, worth $76 million. Such substantial sales from influential market players are a bearish sign, as their actions often prompt retail investors to follow suit, fearing further declines.

As these whales lose confidence in Onyxcoin’s potential for recovery, their massive liquidation has caused a ripple effect throughout the market. The sentiment surrounding XCN will likely remain negative, potentially delaying any potential price rebound.

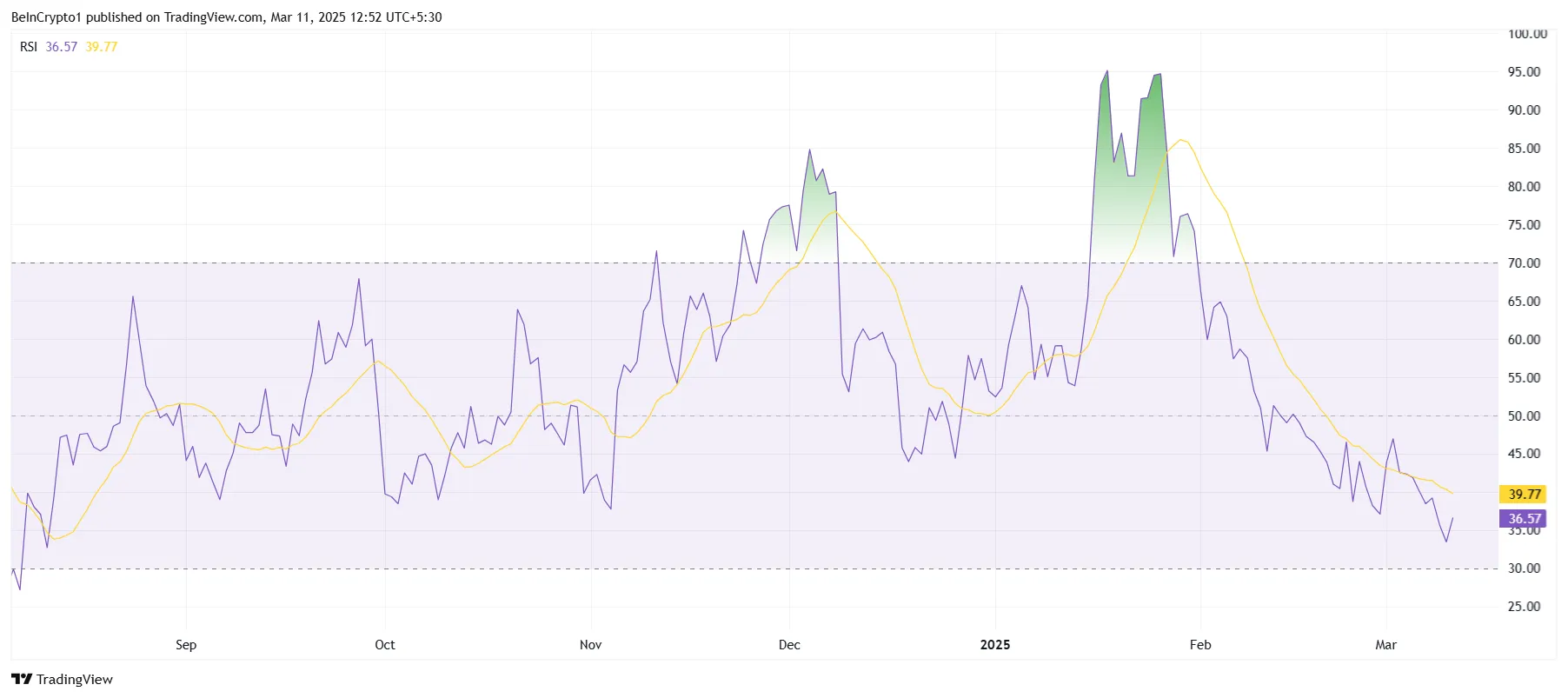

The overall macro momentum of Onyxcoin is currently under pressure, driven largely by the selling behavior of whales and broader market conditions. The Relative Strength Index (RSI) has fallen to a 7-month low, signaling a peak in bearish momentum. This drop suggests that the cryptocurrency is in a vulnerable position, with further corrections likely if the trend continues.

The RSI’s position indicates that Onyxcoin has not been this weak since August 2024. This makes it challenging for XCN to break free from its downward trajectory, as investor sentiment remains sluggish.

XCN Price Is Looking At Further Decline

Onyxcoin has fallen 34% over the last week and is currently trading at $0.0119. For the past month and a half, it has remained stuck under the downtrend line and has been unable to break through the resistance level of $0.0127. Given the persistent downward pressure, it is unlikely to see an immediate rally, and the price could remain under this barrier for some time.

If the bearish sentiment continues and the selling from whales intensifies, XCN could fall to $0.0100 or even lower, potentially reaching $0.0080. Such a decline would result in even greater losses for investors and deepen the negative market sentiment surrounding Onyxcoin.

However, if Onyxcoin can reclaim the $0.0127 level as support, it could signal a potential reversal. Such a move would allow XCN to rally toward $0.0150 or higher, invalidating the current bearish outlook. A breakout above $0.0150 could send XCN to $0.0182, restoring confidence among investors.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.