MOVE has surged by nearly 10% in the past 24 hours, defying the broader market decline. The rally comes as the Movement Network Foundation launches its Movement Public Mainnet Beta.

This development has fueled investor confidence, driving bullish momentum for MOVE despite prevailing bearish sentiment across the crypto market.

MOVE Rides Mainnet Beta Hype, Signals Further Upside

On Monday, the Movement Network Foundation announced the launch of its Movement Public Mainnet Beta. Described as the first Move-based chain that settles to Ethereum, the network enables permissionless smart contract deployment and seamless developer onboarding.

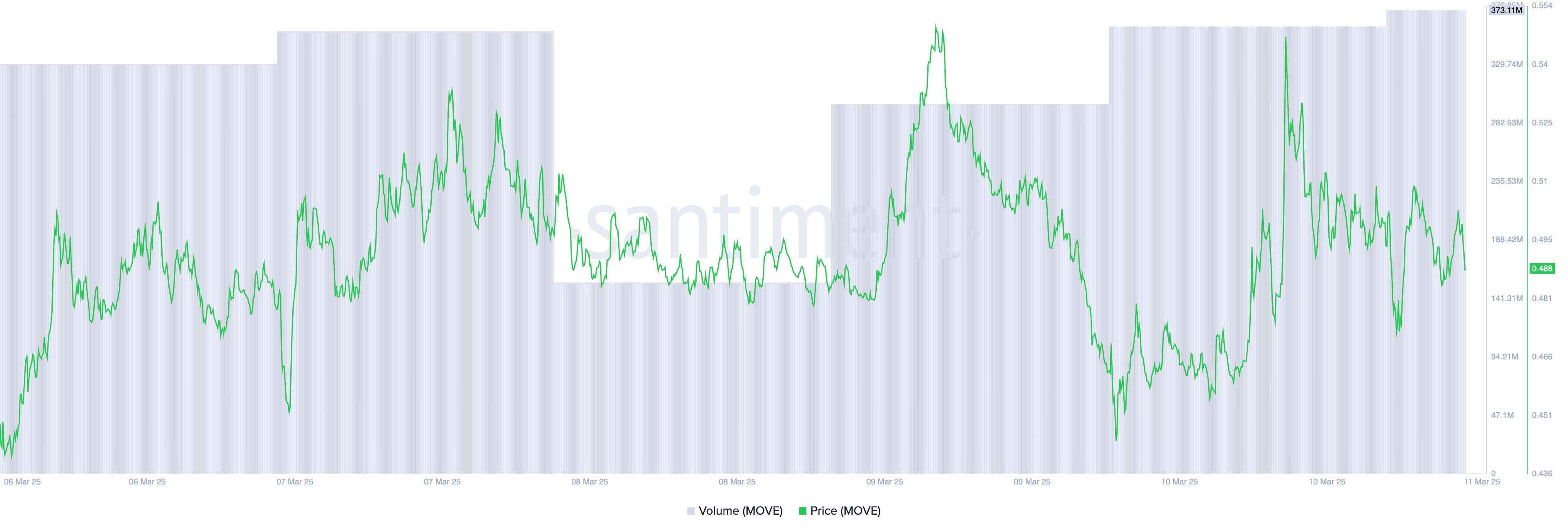

The development has triggered a wave of excitement around MOVE, as it records a spike in market participants’ demand. This is reflected by its daily trading volume, which totals $372 million at press time and has climbed 18% over the past 24 hours.

When an asset’s price and trading volume increase simultaneously, it signals strong market interest and bullish momentum as more traders buy or speculate on its future value. This surge in demand indicates positive sentiment toward MOVE and hints at a continuation of its current uptrend.

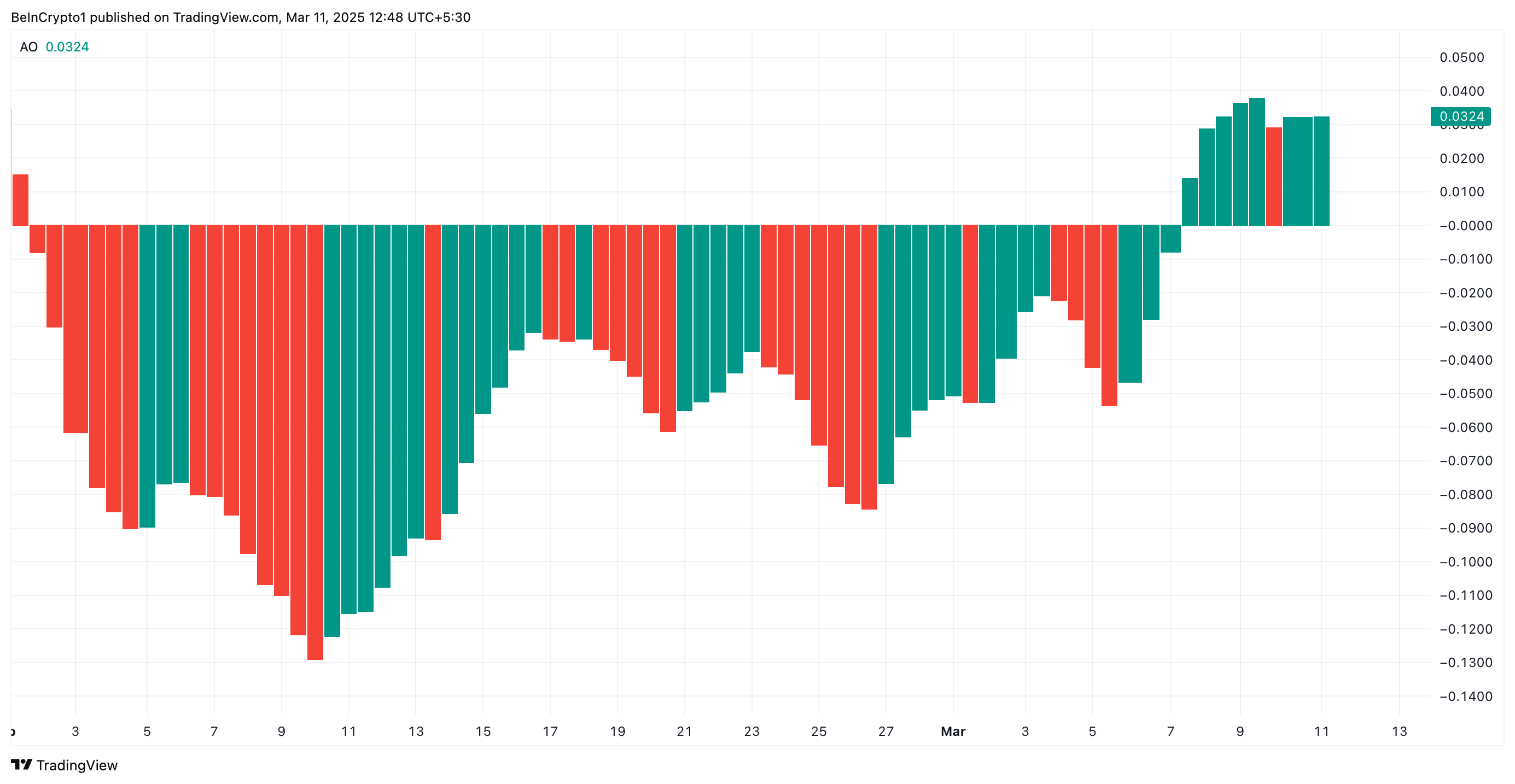

Moreover, on the MOVE/USD one-day chart, readings from the altcoin‘s Awesome Oscillator (AO) support the bullish outlook. At press time, this indicator which measures an asset’s market momentum, posts green histogram bars.

When an asset’s AO bars turn green like this, bearish pressure weakens, and bullish momentum increases. This hints at the possibility of an extended rally for MOVE in the near term.

MOVE Eyes Breakout at $0.49—Will Bulls Push It to $0.61?

At press time, MOVE exchanges hands at $0.48, trading just below the resistance formed at $0.49. If it flips this level into a support zone, it could strengthen its current rally and propel toward $0.61.

On the other hand, a resurgence in profit-taking activity would prevent this. In that scenario, MOVE’s price could revisit its all-time low of $0.37.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.