Bitcoin’s price fell below $85,000 during Friday’s early Asian hours as the market reacted to US President Donald Trump’s latest executive order to establish a Strategic Bitcoin Reserve.

The announcement, intended to solidify BTC’s role in the nation’s economy, has fueled volatility, with liquidations exceeding $250 million in the past 24 hours.

Trump’s Bitcoin Move Triggers Liquidations

On Thursday, President Trump signed the executive order establishing a Strategic Bitcoin Reserve. However, contrary to expectations, the market’s response has been far from bullish. Traders have rushed to offload their holdings, triggering a decline in BTC’s value.

During the early Asian trading hours on Friday, BTC plummeted to a low of $84,667. While its price has since rebounded slightly, the leading cryptocurrency is still down 5% in the past 24 hours.

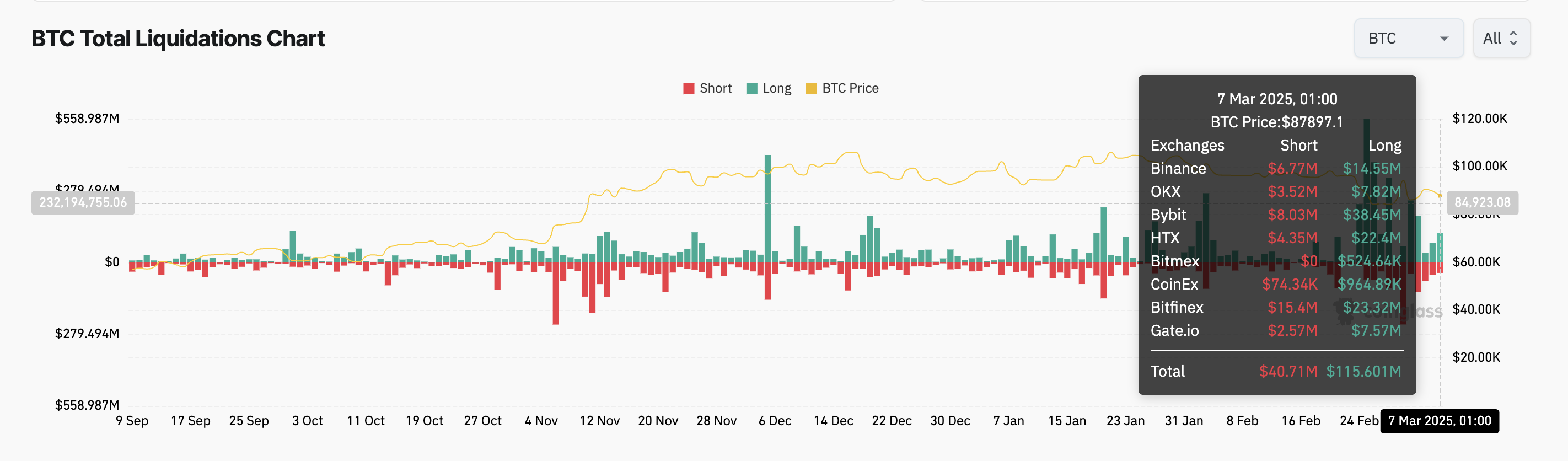

This price decline has triggered a wave of liquidations in BTC’s futures market, which have totaled $261 million in the past 24 hours, according to Coinglass data.

On-chain data reveals that most of these losses come from long positions, indicating that traders anticipating a price rally were caught off guard by the sudden downturn. Per Coinglass, BTC long liquidations currently stand at $115.60 million—the highest in three days.

Long liquidations happen when traders with long positions are forced to sell the asset at a lower price to cover their losses as the price declines. This usually occurs when the asset’s price falls past a certain threshold, forcing traders betting on a price increase to exit the market.

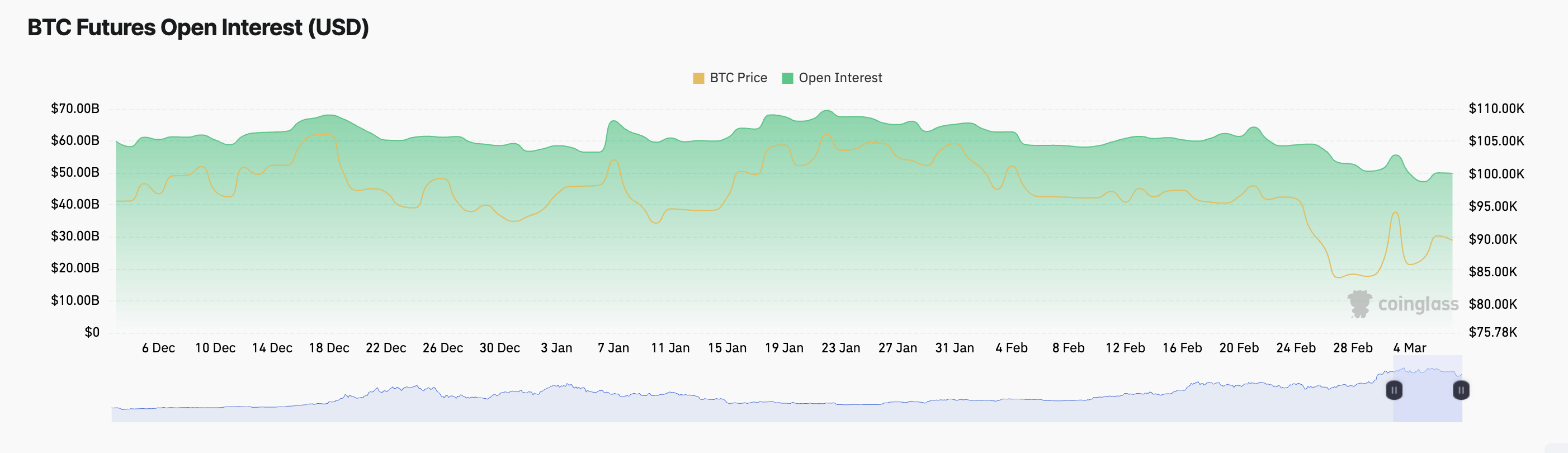

Moreover, BTC’s open interest has declined, highlighting the decline in trading activity since Trump’s executive order. At $50 billion as of this writing, it has plummeted 5% in the past 24 hours.

An asset’s open interest measures the total number of outstanding derivative contracts that have not been settled. When it drops alongside a declining price, traders are closing positions rather than opening new ones. This suggests weakening market conviction among BTC holders and hints at the likelihood of an extended decline.

BTC Slides Ahead of Crypto Summit

BTC’s decline comes just hours ahead of a highly anticipated crypto summit scheduled for later today. If demand stalls and the downtrend continues, the coin’s price could again retest the support formed at $85,357.

If the bulls fail to defend this level, the coin could extend its decline in the coming days and fall toward $80,580.

However, a bullish resurgence would invalidate this bearish projection. If new demand enters the market, it could push BTC’s price back above $90,000 and cause it to trade at $92,247.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.