Liquid restaking token REZ saw its price rocket by 10% during Tuesday’s early Asian hours. The double-digit rally came after Coinbase announced the token’s addition to its listing roadmap.

However, the hype that followed this announcement may soon start to subside. This will cause REZ to shed some new gains and continue its sideways movements.

REZ Jumps 10% on Coinbase News, But Bears Keep Control

REZ soared by 10% after Coinbase announced the token’s addition to its listing roadmap. While an official launch date has yet to be confirmed, the exchange’s move marks the first step towards integrating the altcoin onto its platform.

However, the excitement surrounding this announcement may soon begin to wane as REZ bears continue to dominate its spot markets. The setup of the token’s Super Trend indicator confirms this bearish outlook.

As of this writing, REZ’s Super Trend indicator forms dynamic resistance above its price at $0.020. The indicator tracks the direction and strength of an asset’s price trend. It appears as a line on the price chart, changing color to signify the current market trend: green for an uptrend and red for a downtrend.

When an asset’s price trades below the Super Trend indicator, it is in a bearish trend. This indicates that market participants favor selling their holdings over accumulating newer tokens. Traders interpret it as a sell signal or a warning to exit long positions and take short ones.

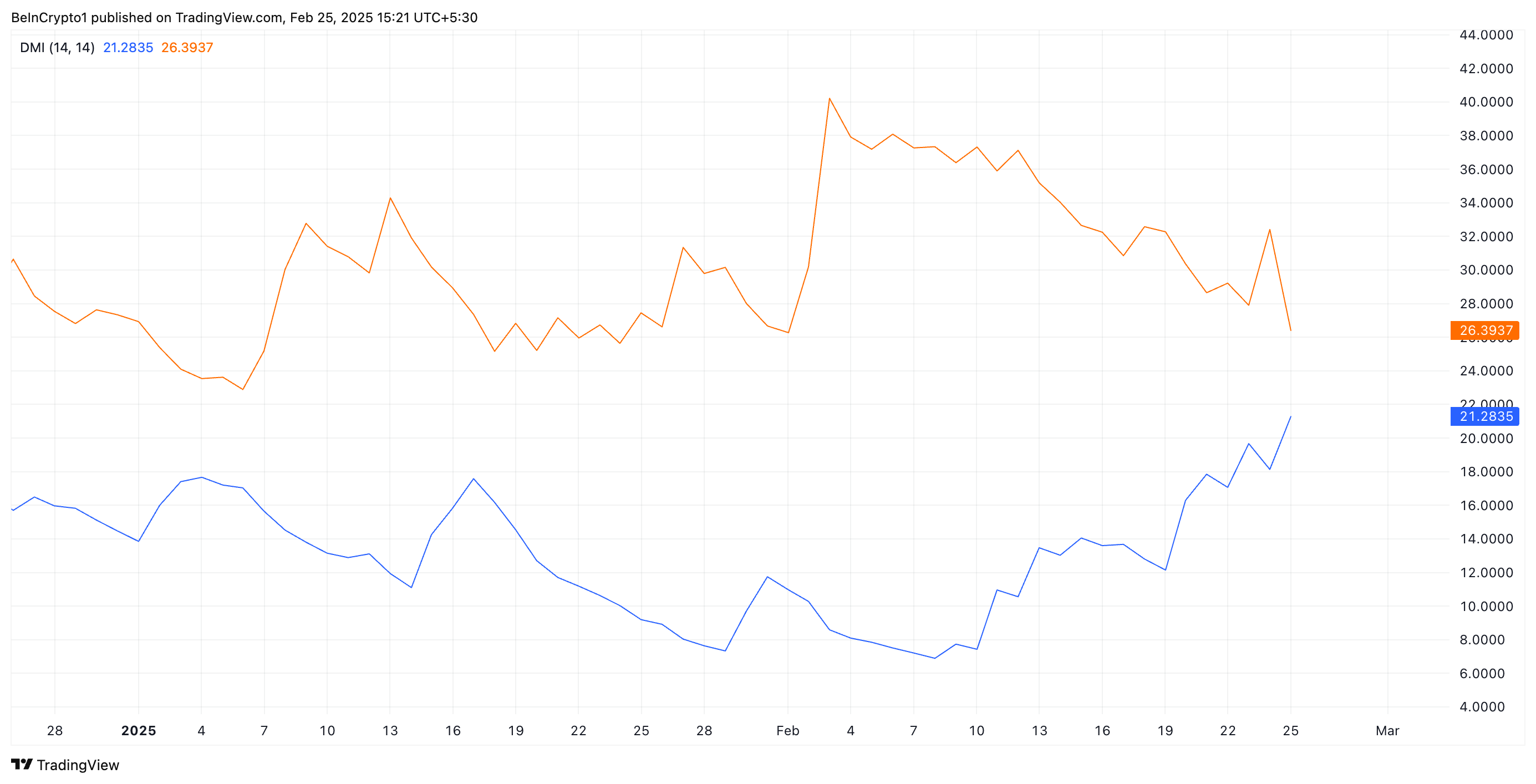

Another indicator of the bearish sentiment against REZ is that its positive directional index (+DI) rests below its negative directional index (-DI). When an asset’s Directional Movement Index (DMI) is set up this way, it signals that bearish momentum is stronger than bullish momentum.

This suggests that REZ sellers are dominating the market, increasing the likelihood of continued downward price movement.

REZ Faces Make-or-Break Moment

If bearish pressure strengthens, REZ risks dropping to an all-time low of $0.013. For context, the altcoin had reached this low during Tuesday’s early sessions and only rebounded on the Coinbase news.

However, if REZ demand soars, its price could rally above the resistance formed by its Super Trend indicator at $0.020. A successful breach of this level could propel the altcoin to $0.026.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.