Dogecoin (DOGE) price has recently shown signs of recovery, bouncing off a two-month-old downtrend line and attempting to secure a key support level at $0.26.

However, the meme coin faces challenges in maintaining its upward momentum, as investor action will play a crucial role. If DOGE holders fail to act, market conditions could push the price downward once again.

Dogecoin Investors May Have An Opportunity

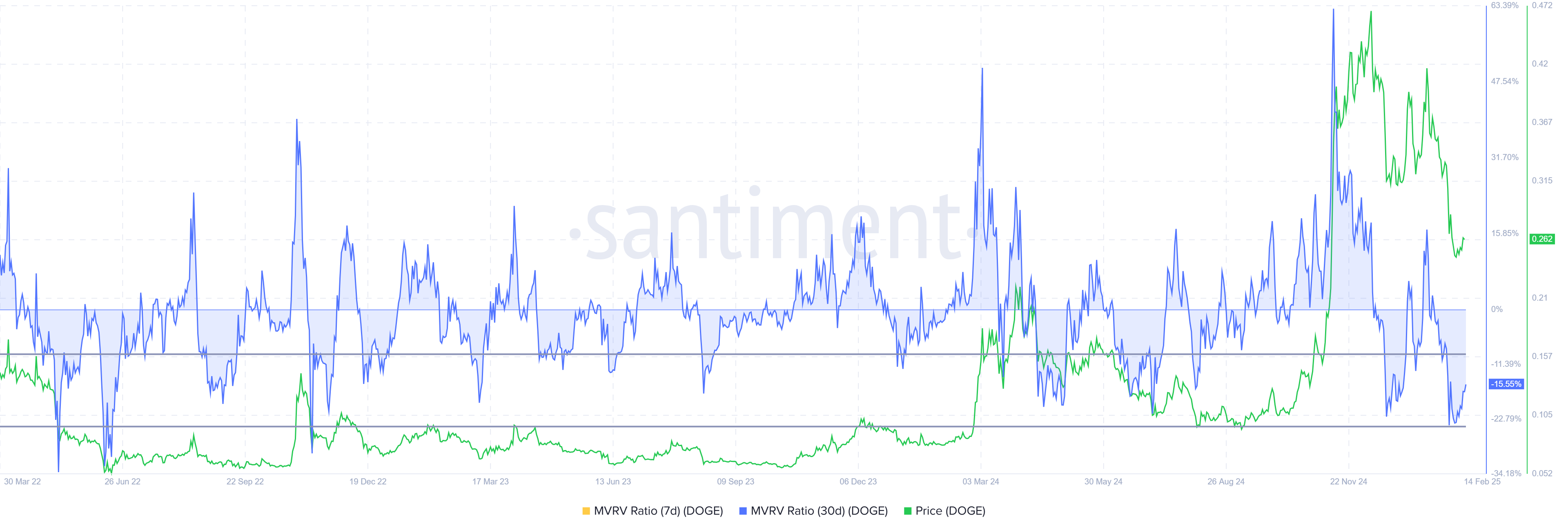

DOGE Market Value to Realized Value (MVRV) ratio stands at -15.5%, placing it in the “opportunity zone” between -10% and -24%. Historically, this zone has been a reversal point for Dogecoin, as selling pressure tends to saturate. When this occurs, investors often step in to accumulate the asset at low prices, anticipating a rebound.

If DOGE investors decide to capitalize on these low prices and begin accumulating, it could trigger a price recovery. The MVRV ratio suggests that the meme coin is undervalued at its current levels, and a shift in sentiment could lead to a rise in price, helping DOGE price overcome its recent downtrend.

The overall macro momentum for Dogecoin is concerning due to the proximity of the 50-day and 200-day exponential moving averages (EMAs). These EMAs are close to forming a “Death Cross,” which occurs when the 200-day EMA crosses below the 50-day EMA. This pattern signals a downtrend and could further weigh on investor sentiment if it materializes, which would end a 4-month-long bullishness.

If Dogecoin’s recovery continues to be delayed, the formation of a Death Cross could signal further bearish pressure. This technical phenomenon would indicate that the altcoin is entering a prolonged downtrend, making it even harder for DOGE to mount a recovery and gain back lost ground.

DOGE Price Prediction: Flipping Resistance Into Support

Dogecoin is currently priced around $0.27, trying to secure the $0.268 level as support. If it manages to hold this support, it could give DOGE the boost it needs to rise toward $0.311. Securing this level would be a positive step, marking the beginning of a potential price recovery for the meme coin.

If investor sentiment improves and they begin accumulating DOGE, the price could gain enough momentum to break through the $0.324 resistance level. Successfully flipping $0.324 into support would invalidate the current bearish outlook and signal that Dogecoin’s recovery is gaining traction.

However, if Dogecoin fails to secure the $0.268 support, the price could fall back toward $0.220. Such a decline would likely lead to the formation of a Death Cross, invalidating the bullish outlook and signaling further downside for the altcoin.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.