Bitcoin has struggled to break the $100,000 mark since early February amid recent market volatility that has left the leading coin in a holding pattern.

However, a new report suggests that this trend may soon change, with two indicators pointing to a bullish uptrend.

Bitcoin Bull Cycle Not Over Yet, Analyst Says

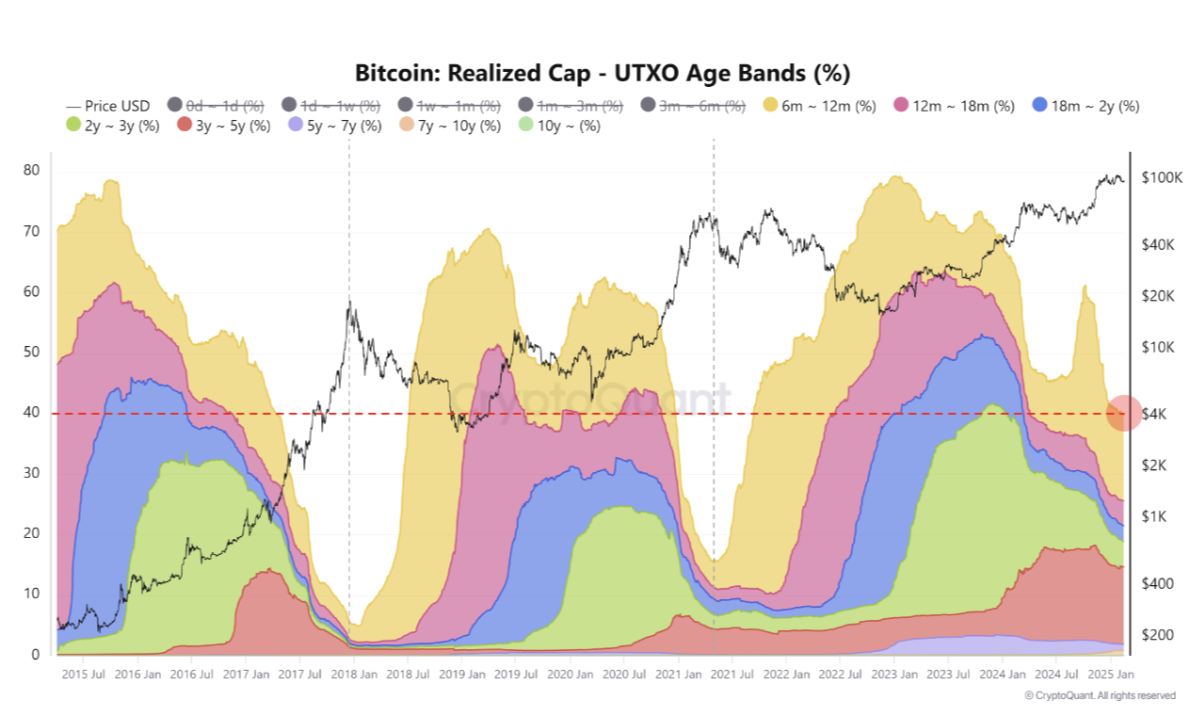

According to CryptoQuant’s pseudonymous analyst MAC_D, “the Bitcoin market’s bull cycle is not yet over.” This is based on the analyst’s assessment of the leading coin’s realized market capitalization and the proportion held by its long-term holders (LTHs).

Bitcoin’s realized market capitalization, which measures its total value at the price it last moved, has risen to an all-time high of $857 billion. This is significant because this metric accurately reflects the value held by long-term investors and the actual cost basis of the coins in circulation.

When BTC’s realized market cap climbs like this, it suggests that long-term investors are holding a larger amount of the coin. It also means that the coins that have changed hands are doing so at increasingly higher prices. This is seen as a sign of confidence in Bitcoin’s future value.

With more coins being held at higher prices, it can reduce selling pressure from LTHs. They are unlikely to sell unless the coin’s value reaches levels well above their acquisition cost. This can reduce the downward pressure on the coin and could lead to more upward momentum in the short term.

Notably, the surge in the proportion of coins held by BTC’s LTHs confirms this trend.

“At the previous cycle’s price peak, their proportion was 15.66%, while it currently stands at 39.74%. This suggests that the market likely hasn’t reached its peak yet, considering the previous cycle’s ratio,” MACD_D writes.

This increase suggests that long-term investors now hold a significant portion of Bitcoin. Given that the previous cycle’s price peak occurred when the ratio was much lower, the current ratio suggests there’s still room for price growth before reaching a cycle top.

BTC Price Prediction: Profit-Taking Could Derail Rally

Bitcoin is currently trading at $96,834, resting above the support level at $95,513. A sustained increase in coins held by LTHs could drive BTC towards the next resistance at $98,118.

Bitcoin could surge past $100,000 if this key resistance is breached, unlocking a new phase in the bull run.

However, should profit-taking intensify, this bullish outlook may be invalidated. In that case, the coin’s price could dip below the $95,513 support, potentially falling to $91,473.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.