Notcoin (NOT) recently experienced a sharp decline, forming an all-time low (ATL) just last week after nearly a month-long downtrend. Despite this, the altcoin has shown signs of recovery, bolstered by a recent listing on the Kraken exchange.

This listing triggered a 21% rise in price during the intra-day high, signaling renewed investor interest in the token.

Notcoin Has Room For Recovery

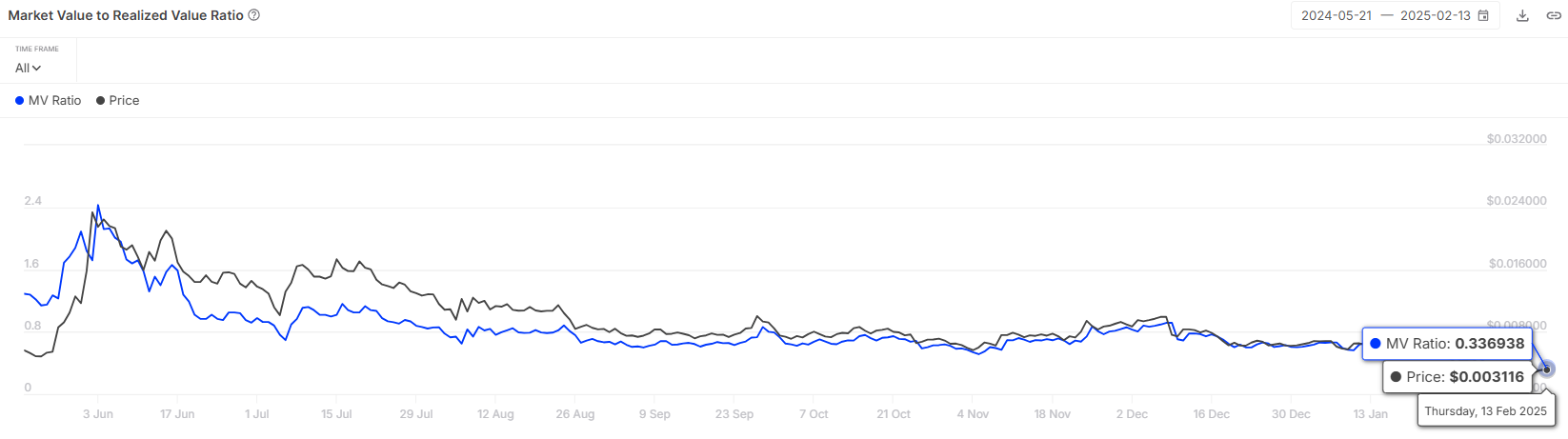

The Market Value to Realized Value (MVRV) ratio for Notcoin recently hit its lowest point, reflecting the ongoing decline and the formation of the ATL. Standing at 0.33, the MVRV ratio indicates that Notcoin has likely reached a saturation point, where investors are unlikely to continue selling. This suggests that the token is more likely to experience upward movement and begin recovering its recent losses.

With the MVRV ratio at such a low point, it signals that Notcoin is undervalued at its current price. This is also a sign of an optimal entry point. The bullish sentiment arising from potential accumulation could help the altcoin’s recovery and create a potential rally in the near future.

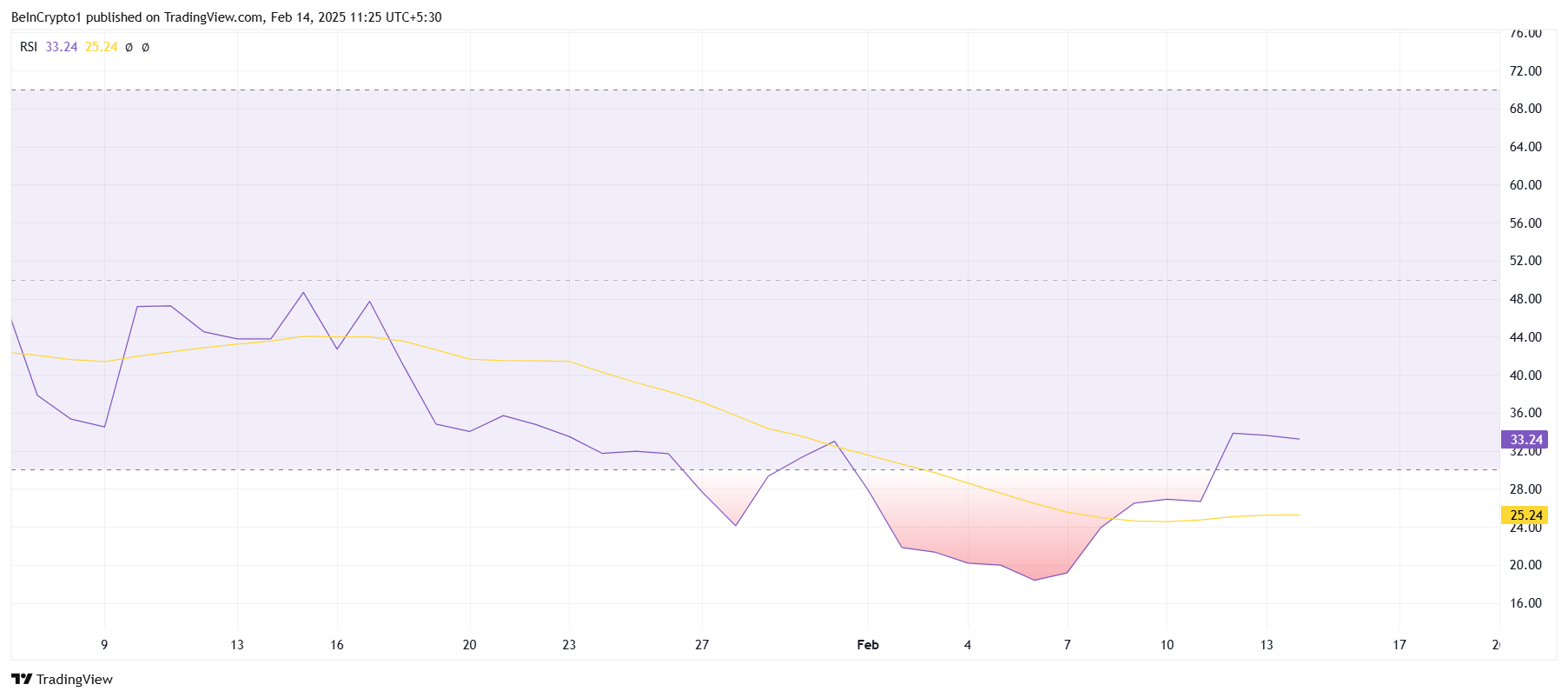

Notcoin’s overall macro momentum is showing signs of reversal. The Relative Strength Index (RSI) recently dipped into the oversold zone, falling below the 30.0 mark. Historically, this has been a key reversal point for many cryptocurrencies, as prolonged bearishness often creates room for a bounce back.

This oversold condition indicates that Notcoin may be approaching a turning point. As the bearish pressure saturates, the altcoin could experience renewed buying interest, pushing its price higher. Investors are watching for signs that the market has fully absorbed the selling pressure, creating conditions for a bullish reversal.

NOT Price Prediction: Breaking Out

Notcoin’s price rose by 21% during the intra-day movement after its listing on Kraken, with investors responding positively to the news. This momentary bullishness sparked renewed interest, although the altcoin later faced some resistance. At the time of writing, Notcoin is trading at $0.0030 and is attempting to establish a support level at $0.0031.

For Notcoin to continue its recovery, it will need to break above the $0.0031 barrier. Flipping this resistance into a solid support floor would signal the end of the descending wedge pattern. At the same time, it would confirm a breakout, setting the stage for further upward movement. A successful breach would pave the way for a price target of $0.0040.

If Notcoin fails to breach $0.0031, it could remain consolidated under this resistance level. In such a case, the altcoin may stay above its all-time low of $0.0021 but failed to make significant progress toward recovery. This would invalidate the bullish outlook and delay any potential price recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.