Dogecoin’s price has shown little momentum recently, holding around $0.25, with no clear direction emerging. This uncertainty has extended into the futures market, where traders are unsure of the coin’s next move.

However, long-term holders (LTHs) are exhibiting resilience, continuing to HODL their positions and providing some support for recovery.

Dogecoin Is Facing Uncertainity

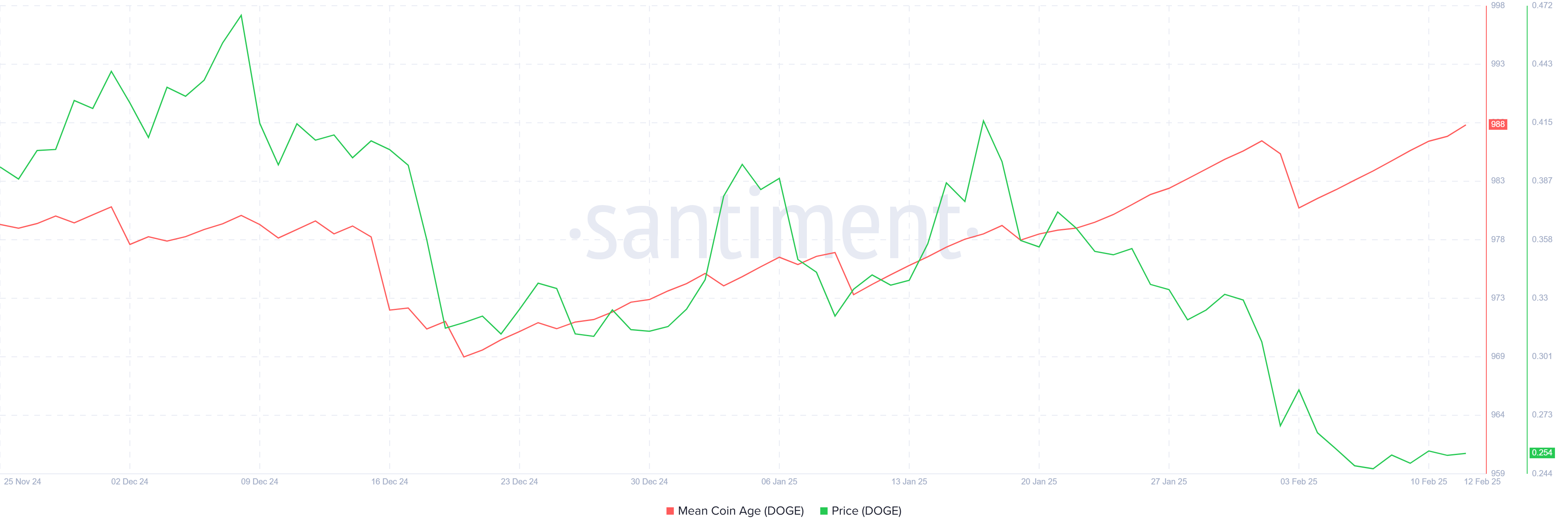

The Mean Coin Age (MCA) indicator is showing a noticeable uptick, signaling that long-term holders are refraining from liquidating their DOGE. Instead, these investors are maintaining their positions, which is a good sign for Dogecoin’s price stability. Their continued holding behavior suggests they are confident in a potential recovery.

This resilience from LTHs plays a crucial role in supporting Dogecoin’s price, particularly during times of uncertainty. While short-term traders may be reacting to market fluctuations, the steadfast actions of LTHs offer the potential for price recovery and a foundation for future growth should broader market conditions improve.

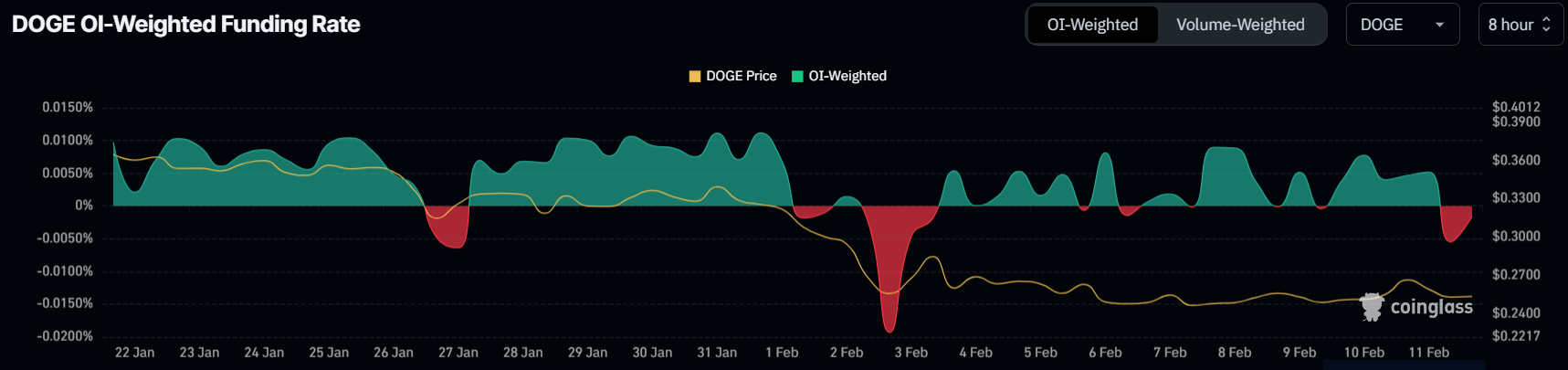

The broader macro momentum for Dogecoin remains uncertain, as the funding rate has been fluctuating between positive and negative. This fluctuation reflects a market in which traders are uncertain of the direction and shifting their positions accordingly. As the funding rate becomes more negative, short contracts are dominating over long contracts, pointing to increased bearish sentiment.

This uncertainty in market sentiment has left Dogecoin vulnerable to further volatility. Negative funding rates suggest that traders are betting on further price declines, and a shift toward bearish sentiment may weigh heavily on DOGE’s performance. The lack of clear, bullish indicators means the market remains on edge, especially for short-term investors.

DOGE Price Prediction: Bouncing Back

Dogecoin is currently priced at $0.254, finding itself back within a descending wedge pattern after briefly slipping out of it. This pattern often suggests potential for upward movement in the future. While the target for the pattern remains above $0.400, the immediate goal for DOGE is to reclaim the $0.268 support level.

Securing $0.268 as support would be crucial for Dogecoin, enabling the altcoin to move towards $0.311. If the price can establish a solid footing at this level, it may signal the beginning of a more substantial price recovery, drawing in additional buying interest from both retail and institutional investors.

However, failing to breach $0.268 could set the stage for another downtrend. If the price fails to hold this support, Dogecoin could fall to as low as $0.220, invalidating the bullish thesis and prolonging the current uncertainty. This scenario would signal continued weakness and likely result in further selling pressure.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.