Solana has struggled to breach the critical $201 resistance level, falling below it a week ago. Despite favorable market conditions that could support a recovery, the lack of investor confidence remains a significant concern.

For Solana to make meaningful progress, it will need increased backing from the market.

Solana Is Not Facing Bearishness

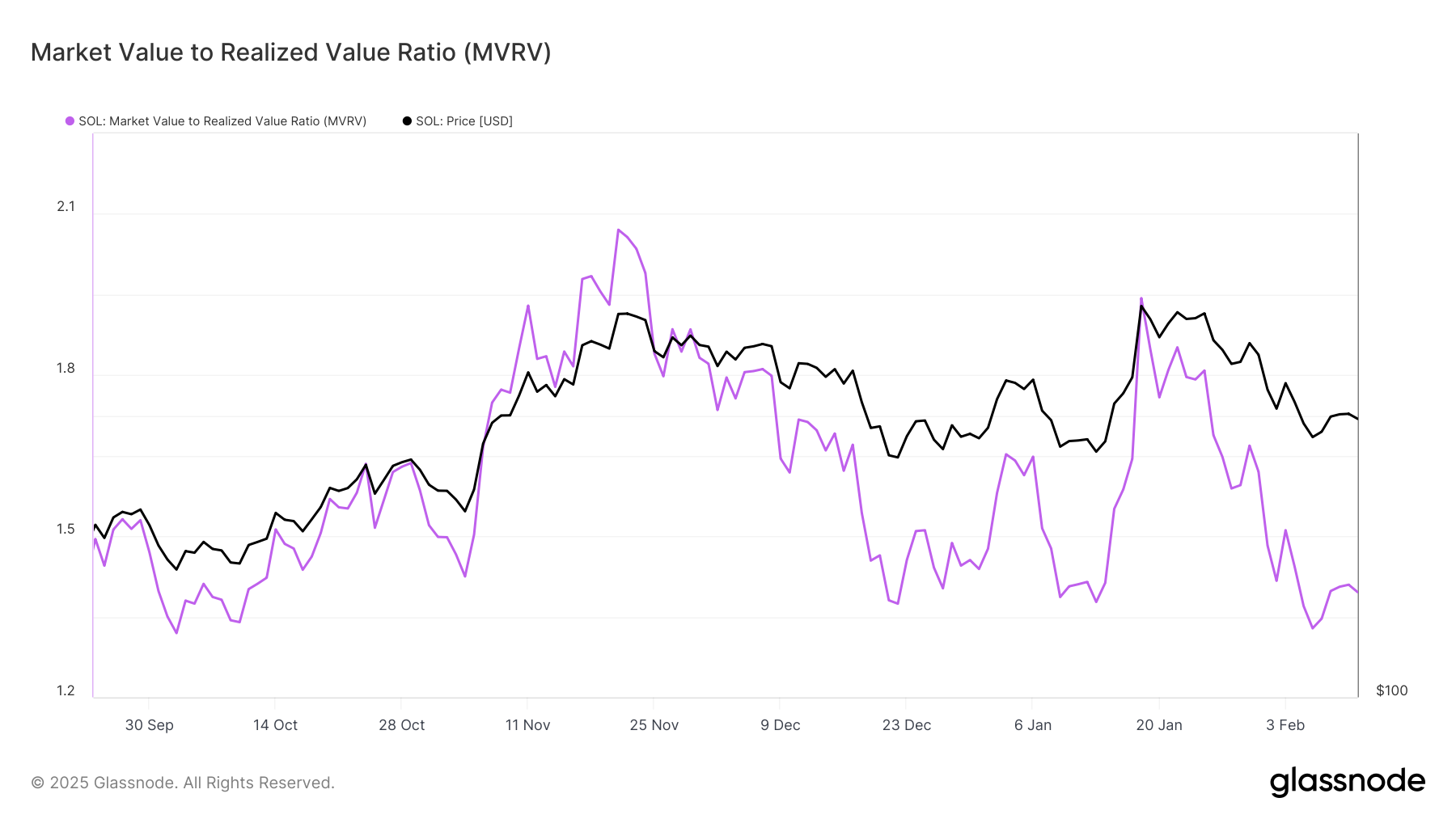

The Market Value to Realized Value (MVRV) ratio for Solana currently stands at 1.40, a level that has historically been a precursor to price increases. This low MVRV indicates that the asset is not overvalued, which is crucial for maintaining market stability. The lower valuation helps keep selling pressure in check, offering a shot at recovery.

A healthy MVRV ratio suggests that Solana may have room to grow without triggering a significant sell-off. This favorable condition provides a foundation for potential upside, especially if investor sentiment shifts positively. For now, the MVRV signals that the market is still cautiously optimistic about Solana’s future.

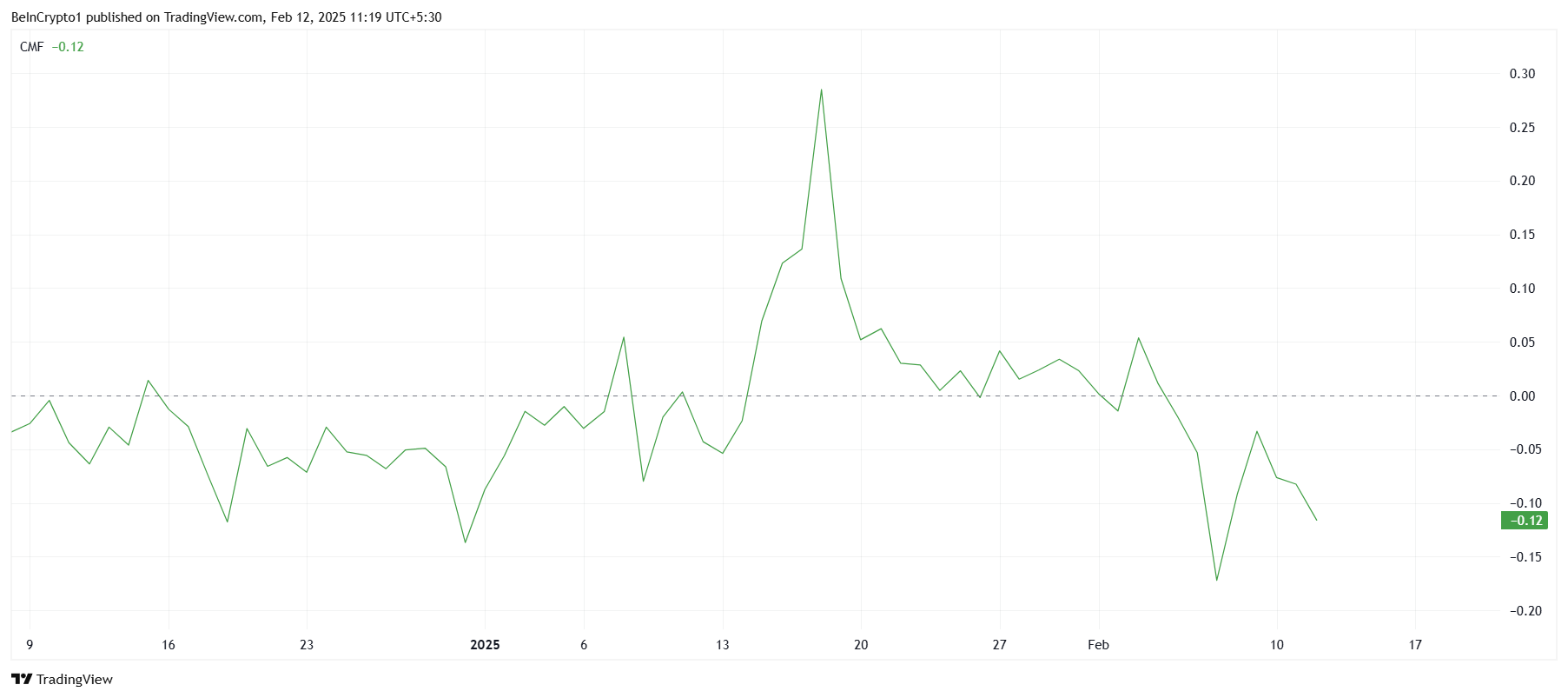

Solana’s broader momentum remains mixed, with technical indicators like the Chaikin Money Flow (CMF) showing ongoing struggles. Although there has been an uptick in inflows, the CMF remains below the zero line, indicating that the positive movements are overshadowed by outflows. This suggests that investor skepticism continues to weigh on the altcoin’s performance.

Despite recent inflows, the fact that Solana has not yet seen sustained buying activity underscores the cautious nature of its investor base. Until the CMF crosses the zero line decisively, the altcoin may continue facing resistance in securing consistent upward movement.

SOL Price Prediction: Key Barrier Ahead

Solana is currently trading at $195, holding above key support at $183. Additionally, the altcoin is maintaining its uptrend line, which has been in place for over a month and a half. This suggests that the macro outlook remains positive, and the market is positioning itself for a potential recovery.

The mixed market signals indicate that Solana could soon manage to flip the $201 resistance into support. However, even with this potential shift, reaching $221 will be challenging unless there is a more significant shift in investor sentiment. The path to higher price targets will require stronger buying pressure.

On the other hand, if Solana fails to breach the $201 barrier once again, it could continue to struggle below $200. A prolonged inability to break through this resistance may weaken investor confidence, leading to further tests of the $183 support. If this level is breached, it could signal additional downside risk for SOL.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.