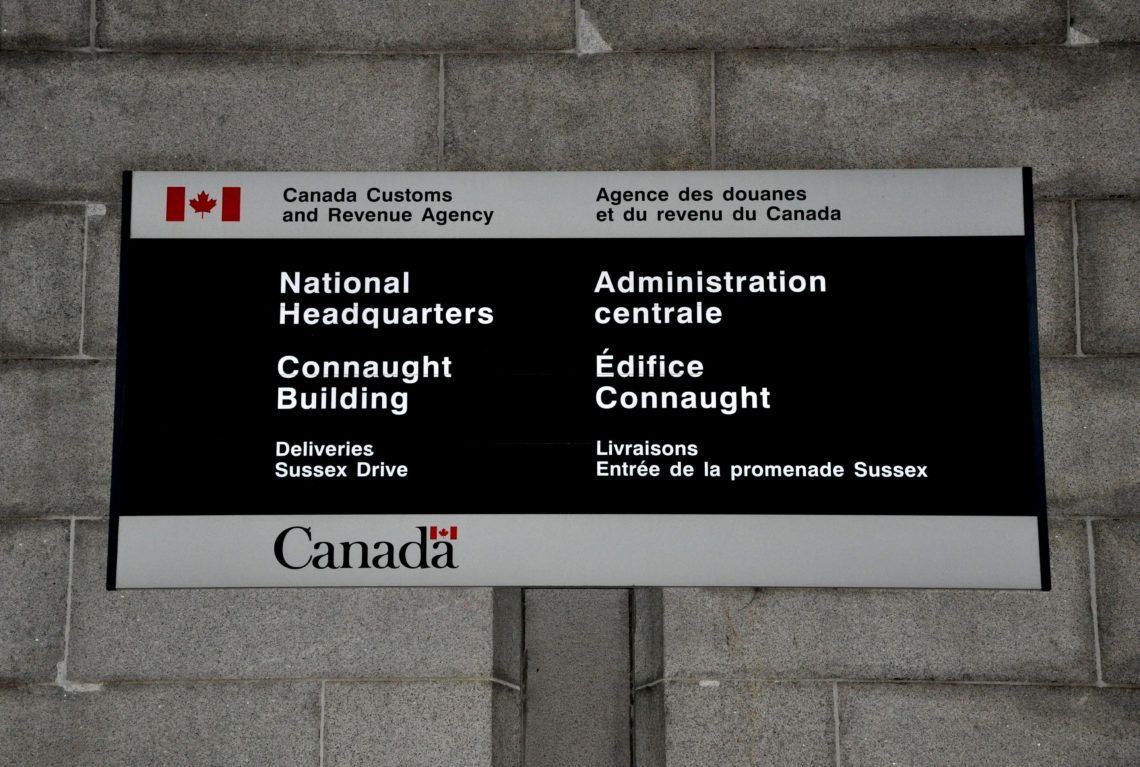

The Canadian Revenue Agency (CRA), which is responsible for collecting taxes in Canada, has started a process of auditing cryptocurrency users.

The primary purpose of the audit invoked by the agency is the assessment of risks related to cryptocurrencies. The CRA wants to improve its risk assessment systems in order to monitor and, ultimately, enforce compliance for the digital asset space.

The auditing process has started with a detailed questionnaire sent to citizens that might have been using or trading cryptocurrencies. The questionnaire pertaining to digital assets is relatively extensive and contains very specific questions.

Highly-Specific Questionnaire

In its 13-page long document, the CRA wants to know when the users started trading or owning cryptocurrencies, where they acquired it, and how they store it. The questions become even more specific, asking the interviewees whether they can provide a trading history, multiple addresses they might own, and whether they used mixing services. Mixing services allow users to obfuscate their spending and maintain their privacy, hence making it difficult for third parties to use analytics software on these transactions. The agency also wants to know how much fiat users invested in digital assets and whether they used services or exchanges that do not provide data about their traders — like Changelly or Shapeshift in the past. The CRA confirmed that a lot of citizens do report taxes for their cryptocurrency gains, but the questionnaire also serves as a reminder for everyone else to do the same.Bitcoin users in Canada are being targeted with audits by the Canada Revenue Agency (federal tax agency). Attached are some images of the questionnaire being sent out to individuals in relation to the audits.

— Kyle Torpey (@kyletorpey) March 7, 2019

Full story here: https://t.co/dzRXsdh3TH pic.twitter.com/HFNVo2op29

Does Cryptocurrency Taxation Need to Change?

Nonetheless, the CRA has a reputation for being one of the more progressive agencies and has been actively working on getting a better understanding of the digital asset space. The agency established a dedicated cryptocurrency unit in 2017 and currently has over 60 audits related to the industry. The emergence of digital assets as a medium of exchange or store of value means that government agencies will need to adapt their approaches to taxing their citizens. Are you a Canadian citizen that used cryptocurrencies? Did you receive the questionnaire from CRA? Share your story in the comments below!Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Christian Gundiuc

After finishing his studies in International Business Administration at the Frankfurt School of Finance & Management, Christian started working at a real estate development company. Upon discovering Bitcoin and the cryptocurrency space, he switched his focus to learn, analyze and write about all things digital.

After finishing his studies in International Business Administration at the Frankfurt School of Finance & Management, Christian started working at a real estate development company. Upon discovering Bitcoin and the cryptocurrency space, he switched his focus to learn, analyze and write about all things digital.

READ FULL BIO

Sponsored

Sponsored