Solana has experienced a sharp drawdown, dropping below the $200 mark earlier this week. The decline comes amid broader market volatility, leaving investors uncertain about the altcoin’s next move.

However, the recent downturn may present a bullish opportunity, provided market participants shift their stance and capitalize on the dip.

Solana Investors Are Uncertain

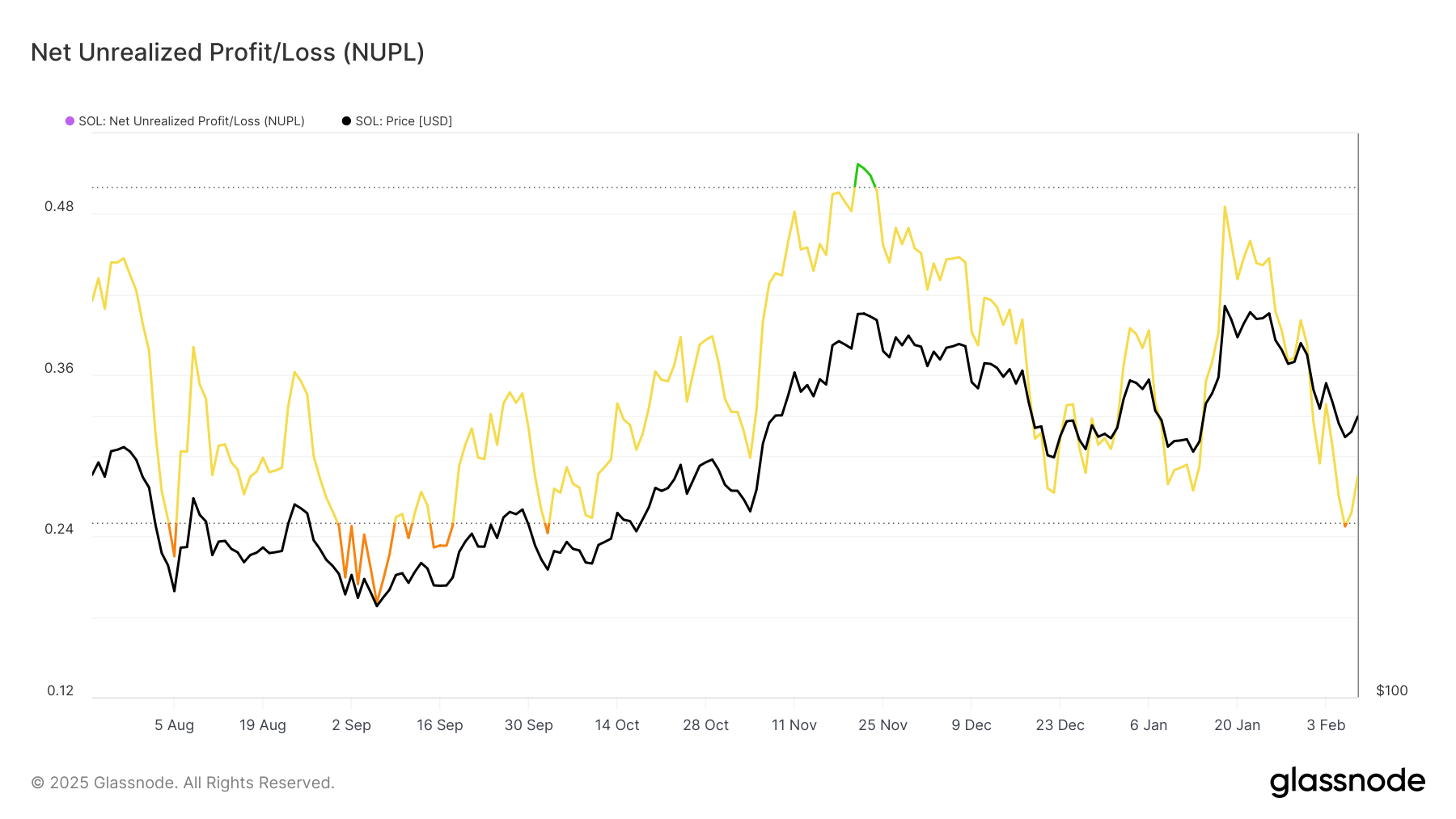

The Net Unrealized Profit/Loss (NUPL) indicator has fallen into the Fear zone, retreating from the Optimism zone. This shift suggests that investor sentiment has weakened, contributing to increased selling pressure. Historically, similar dips into the Fear zone have often preceded price reversals, signaling potential recovery.

If past trends hold, Solana could see a rebound in the coming days. Previous instances of NUPL dropping to these levels have triggered renewed buying interest, supporting price recoveries.

A shift in sentiment could provide the momentum needed for SOL to reclaim lost ground and reestablish bullish momentum.

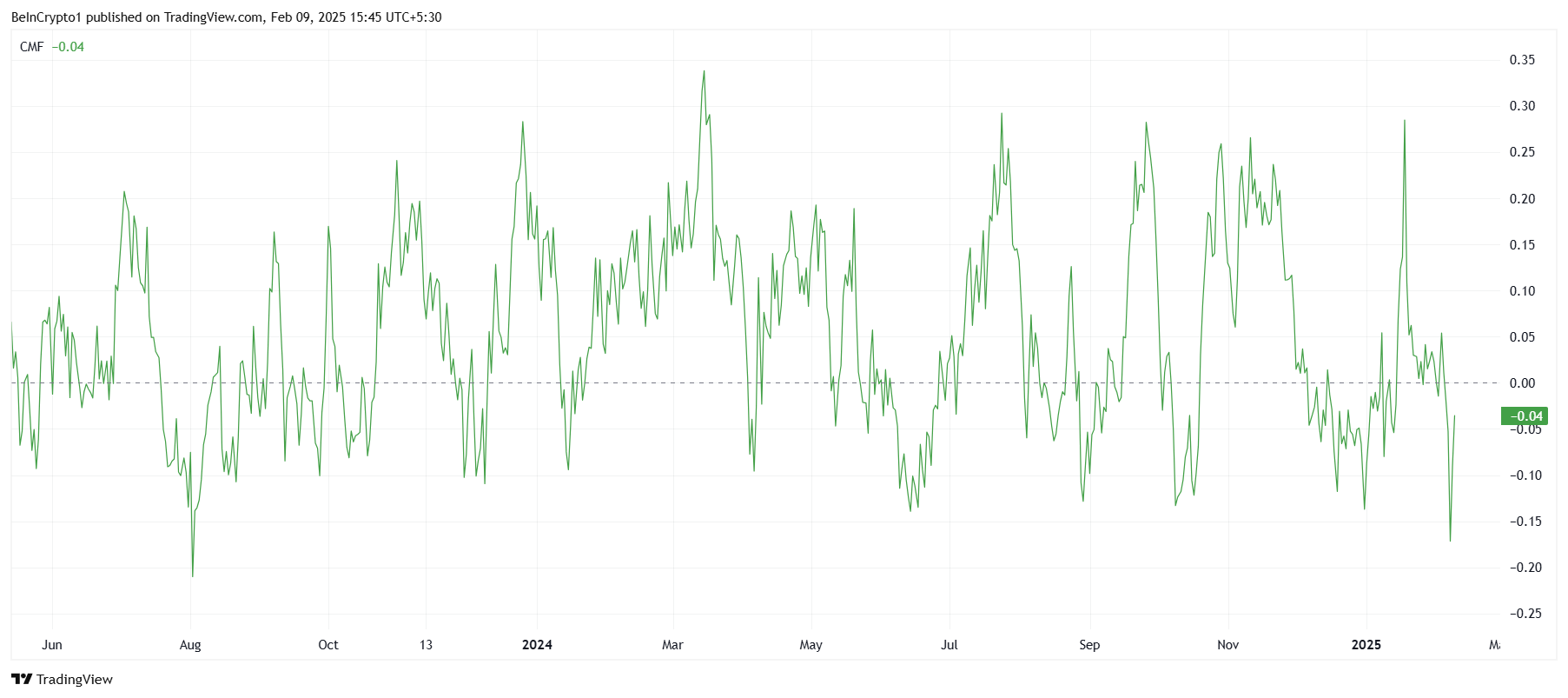

Solana’s Chaikin Money Flow (CMF) indicator has dropped to an 18-month low. This decline reflects a surge in outflows, marking the strongest capital flight from the asset since August 2023.

Increased selling activity suggests that investors remain skeptical, impacting SOL’s ability to sustain upward price movements.

Sustained outflows typically signal bearish momentum as traders move capital away from the asset.

For a trend reversal to occur, Solana must attract renewed buying pressure. If investors regain confidence, the price could stabilize, paving the way for further upside potential in the near term.

SOL Price Prediction: A Rise Ahead

Solana’s price has climbed 6% over the last 48 hours. While this represents a minor recovery, it remains insignificant compared to the 27% decline the altcoin suffered over the past three weeks. More bullish momentum is needed for SOL to establish a sustained uptrend.

Currently trading at $202, Solana has successfully reclaimed the $200 support level. This threshold is crucial in determining the asset’s short-term trajectory.

If SOL manages to push past $221, it would confirm that recovery has begun, increasing the likelihood of further gains.

However, if investor skepticism persists, Solana could face renewed selling pressure. A drop below the $183 support level would invalidate the bullish outlook, leading to extended losses.

The coming days will be critical in determining whether SOL can sustain its recovery or succumb to further declines.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.