Dogecoin has suffered a significant downturn, dropping nearly 25% in the past week and reaching a two-month low. The recent price decline has weakened investor confidence, leaving DOGE vulnerable to further corrections.

While bearish sentiment dominates, there is possible scope for recovery if key market conditions align in favor of buyers.

Dogecoin Investors Have A Shot

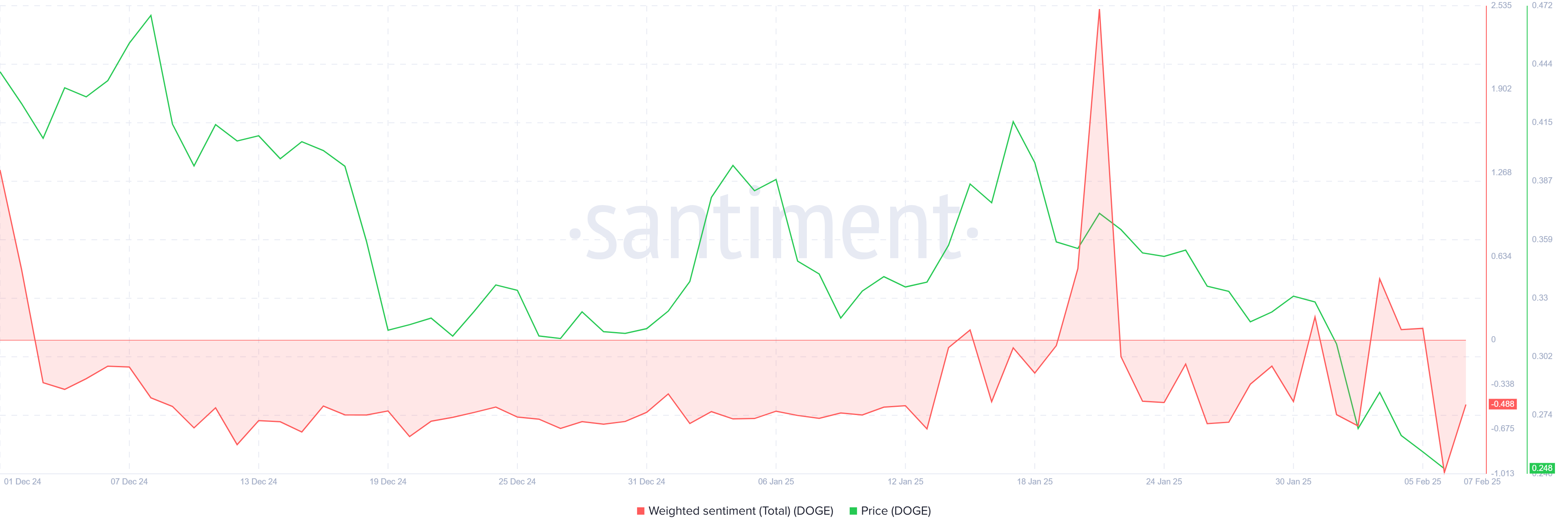

The weighted sentiment for Dogecoin has entered negative territory as skepticism grows among investors. The ongoing decline and lack of a meaningful recovery have contributed to bearish outlooks.

Without a strong upward push, DOGE holders may continue exiting their positions, further increasing selling pressure and slowing any potential rebound.

As uncertainty rises, liquidity and active addresses could decline, making it difficult for DOGE to sustain buying momentum. Historically, prolonged periods of negative sentiment have resulted in lower network participation.

If this trend persists, Dogecoin may struggle to recover in the short term, keeping price action constrained under key resistance levels.

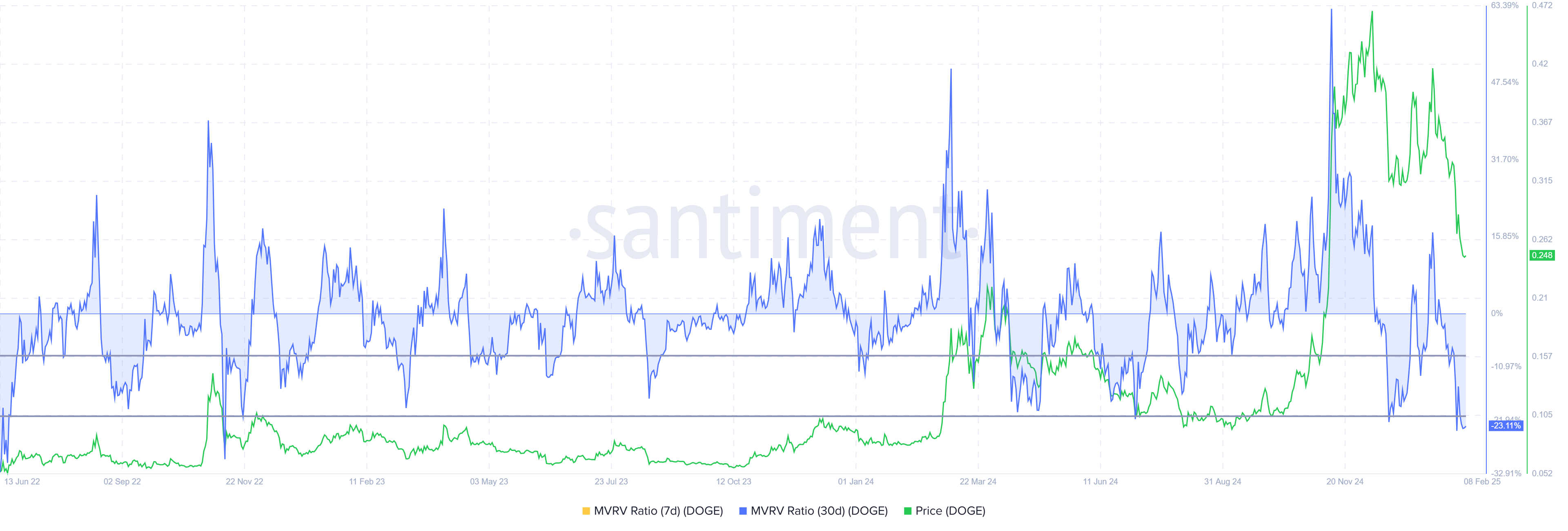

The broader market outlook for Dogecoin suggests a potential buying opportunity, as indicated by the Market Value to Realized Value (MVRV) ratio. Currently sitting at -23%, the metric is below the historical opportunity zone, which ranges between -9% and -21%. In past cycles, DOGE has rebounded from these levels.

Investors seeking to accumulate at lower prices could take advantage of current conditions, potentially driving DOGE’s price higher. If accumulation increases, the meme coin may experience a gradual recovery.

DOGE Price Prediction: Breaching Barriers

Dogecoin is trading at $0.248, marking a 25% crash over the past week. If the bearish pressure continues, the price could drop further toward $0.220, extending recent losses.

The ability to maintain support at this level will be crucial in determining whether DOGE can stabilize.

The current market signals remain mixed, suggesting that DOGE may consolidate between $0.220 and $0.268. Without a breakout, price movement could remain stagnant within this range.

For Dogecoin to regain lost ground, it must breach the $0.268 resistance level. Successfully flipping this barrier into support would open the door for a rally toward $0.311.

If achieved, this move would invalidate the bearish outlook and help DOGE recover a portion of its recent losses.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.