Bitcoin is showing signs of a potential recovery, emerging from a validated bullish pattern. The crypto has managed to regain momentum, with whale investors playing a crucial role in its price surge.

As larger holders accumulate more BTC, Bitcoin is inching closer to critical resistance levels.

Bitcoin Investors Are Uncertain

Whale holders have been actively accumulating Bitcoin during the recent mid-sized drop and volatile market conditions. Unlike smaller retail traders, who have been liquidating their holdings, large investors are taking advantage of the price swings to expand their portfolios. This trend highlights a growing divide between seasoned investors and newcomers.

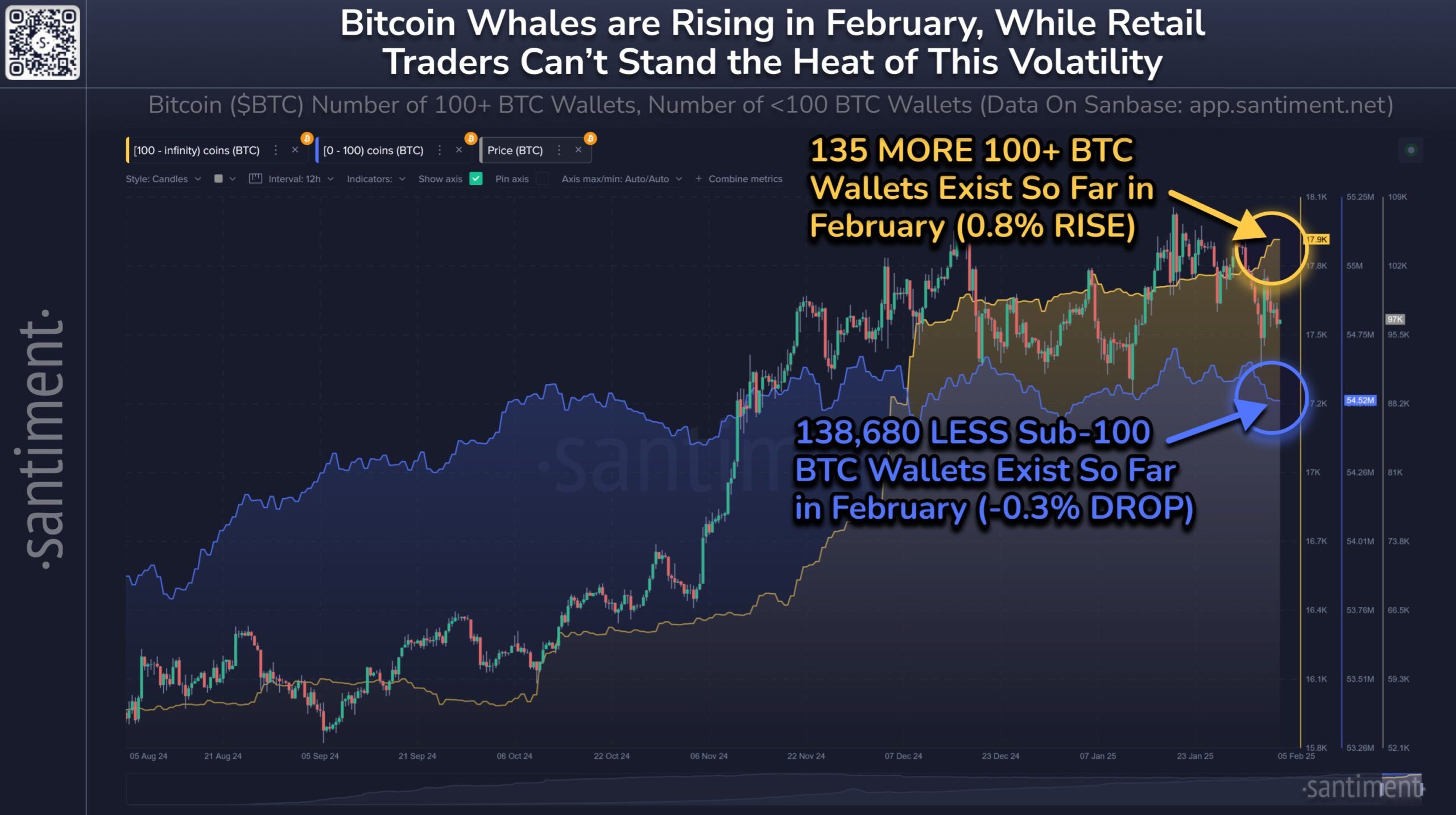

February data reveals a notable shift in wallet distribution. The number of wallets holding 100+ BTC has grown by 135, while smaller wallets holding less than 100 BTC have declined by 138,680. This shift indicates that whale investors are reinforcing their positions while smaller traders exit the market.

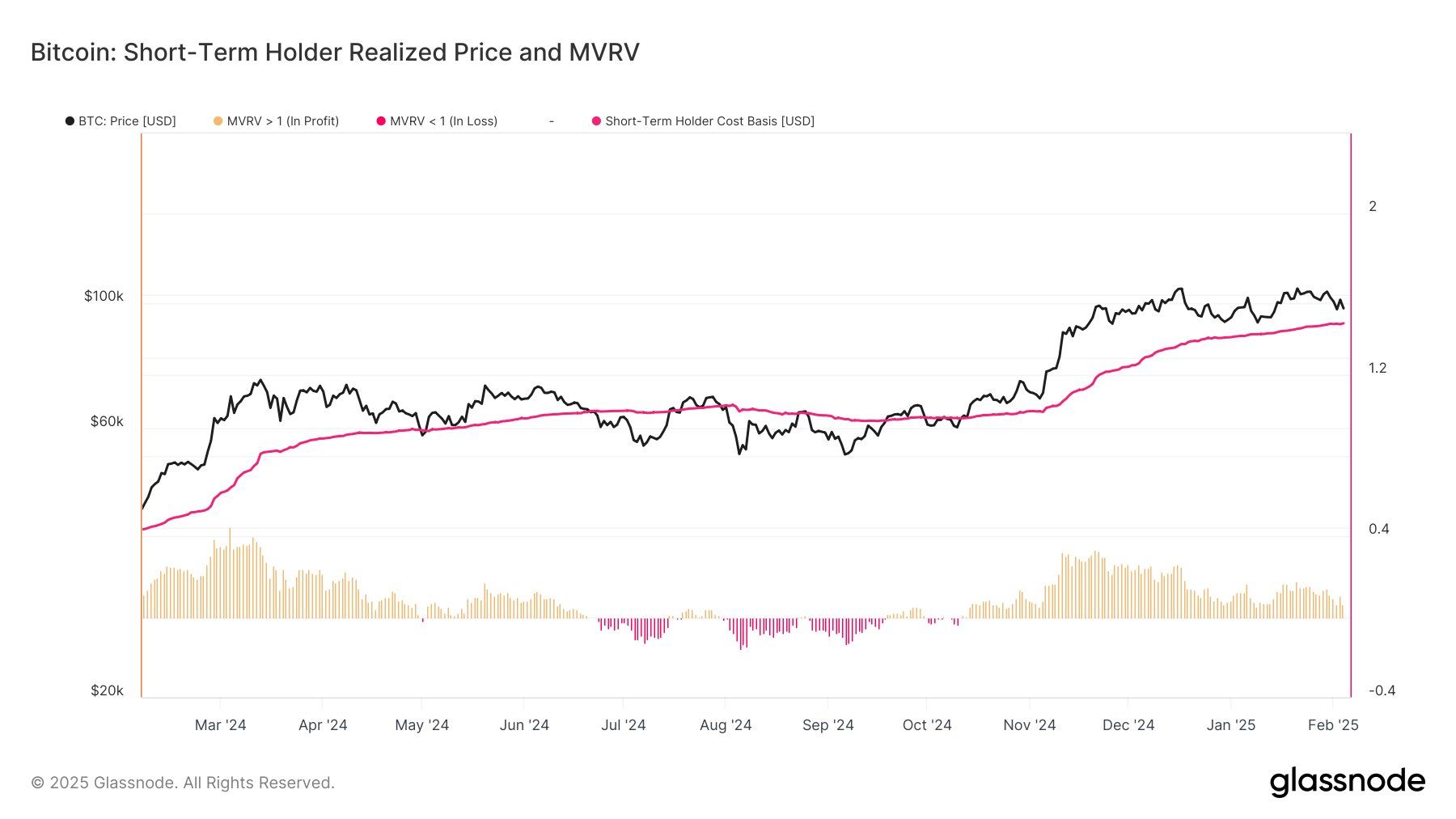

Analyzing Bitcoin’s macro momentum, the Cost Basis Distribution shows that a key support range lies between $97,500 and $99,999. Last month’s data confirms that nearly 200,000 BTC were accumulated at these levels, reinforcing price stability.

Additionally, investors with a cost basis above $99,000 have acquired over 150,000 BTC. This accumulation further strengthens the crucial range between $97,500 and $99,999, serving as a foundation for Bitcoin’s next potential move upwards.

BTC Price Prediction: Recovering for Breakout

Bitcoin’s price is on track to validate an ascending wedge pattern once it reaches $106,100, requiring a 7% increase. However, for this to happen, investors must resist the urge to sell prematurely and maintain upward momentum.

Given the accumulation trends and whale activity, Bitcoin could first retest the $100,000 resistance. If this level is successfully breached, BTC is likely to continue its uptrend, break out of the ascending wedge, and surge toward $106,100 and beyond.

On the downside, failure to break $100,000 could lead to a decline, with Bitcoin potentially dropping to $95,668 or lower. This scenario would invalidate the bullish thesis and extend market losses, disrupting the current recovery trend.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.