XRP has remained in a consolidation phase for the past two weeks, preventing it from establishing a new all-time high (ATH).

While the altcoin continues to hold above a key support level, it struggles to gain the necessary momentum for a breakout. A shift in investor behavior could change this trajectory.

XRP Investors Are Facing Losses

XRP’s transaction volume has been largely dominated by losses. As a new ATH remains elusive, investors have begun moving their holdings. This trend has resulted in many XRP holders facing losses on their transactions for the past two weeks, impacting overall market confidence.

If this pattern continues, traders may begin pulling back from participation, reducing transaction activity. A decline in on-chain engagement could negatively affect XRP’s price, increasing the risk of extended consolidation or a potential drop below key support levels.

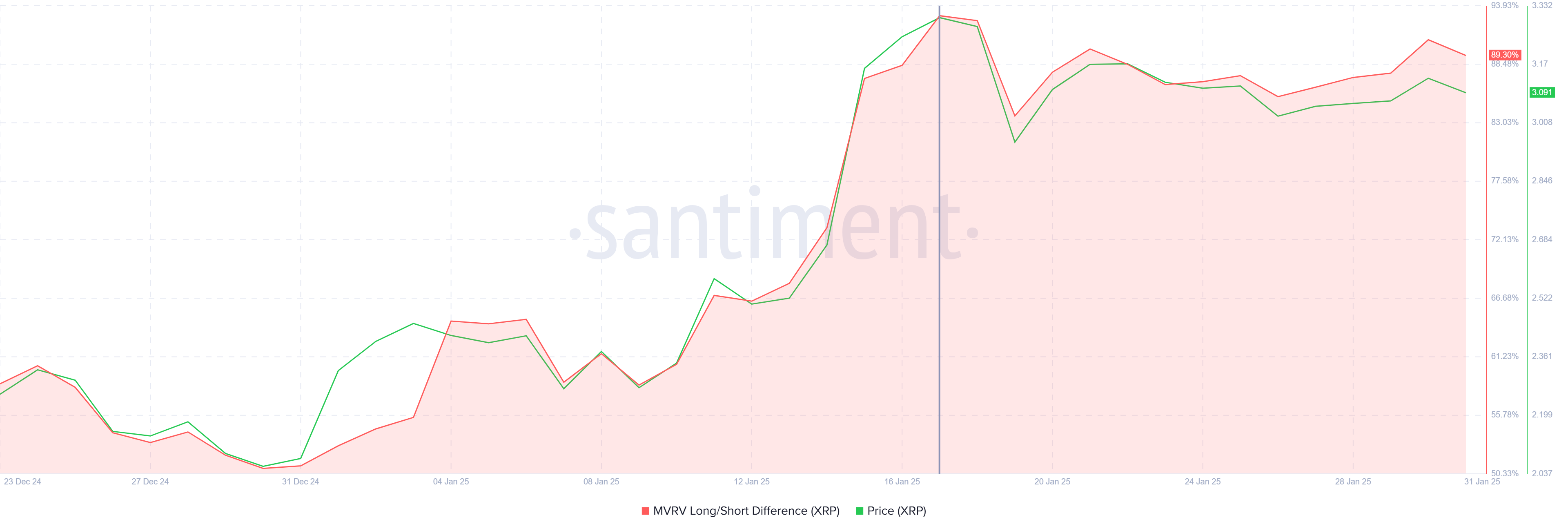

The MVRV Long/Short Difference indicates that long-term holders (LTHs) remain in profit, benefiting from XRP’s recent price action. These investors have yet to move toward selling, demonstrating resilience despite short-term volatility. Their continued holding is critical to maintaining stability.

If LTHs maintain their positions, XRP’s price is less likely to experience a sharp correction. This behavior signals confidence in the asset’s long-term potential. It also suggests that XRP could sustain its uptrend if market conditions remain favorable.

XRP Price Prediction: Uptrend To a New High

XRP is currently experiencing a micro uptrend after bouncing off the $2.95 support level. While the altcoin briefly fell below this level during an intraday low, it quickly recovered and remained above the trend line. This reinforced the bullish momentum.

The cryptocurrency now sits less than 10% away from forming a new ATH beyond $3.40. If the uptrend continues and long-term holders remain steadfast, XRP could break past this resistance and set a new price record in the coming days.

However, if XRP retests $2.95 and fails to hold this support, the price could decline further. A break below this level would increase bearish pressure. This could potentially push XRP down to $2.73 or lower, invalidating the bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.