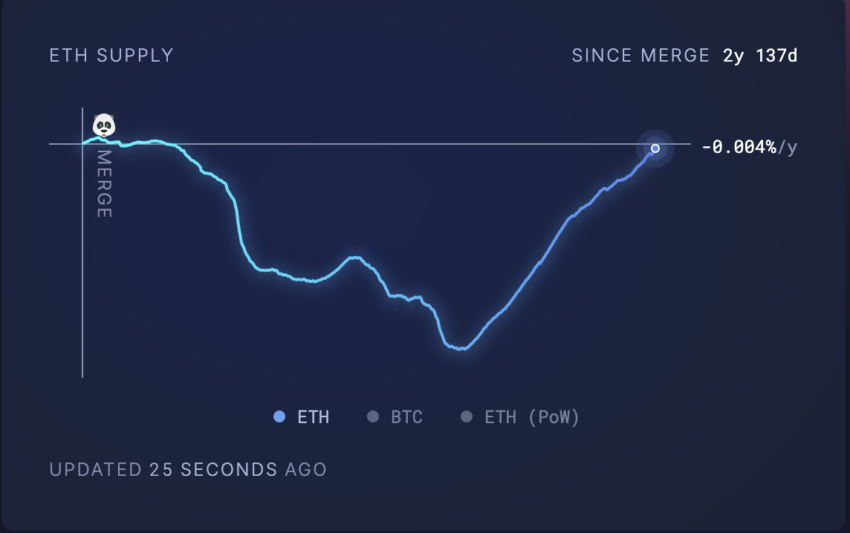

Ethereum’s circulating supply has surged over the past week, reaching levels not seen since February 2023. On-chain data reveals that 12,353 ETH valued above $39 million have been added to circulation over the past seven days.

This comes amid a drop in the network’s demand, which has impacted ETH’s performance.

Ethereum Faces Inflationary Pressure as Circulating Supply Spikes

Ethereum’s circulating supply, which measures the number of coins or tokens currently available to the public, has rocketed by an additional 12,353 ETH in the past seven days. This brings the coin’s total circulating supply to 120.51 million ETH, a high last recorded in February 2023.

Usually, ETH sees a spike in its circulating supply when user activity on the Ethereum network declines. According to Artemis, this has been the case for the proof-of-stake (PoS) network.

In the past week, the number of unique addresses that have completed at least one transaction involving the altcoin has dropped 4%. As a result, the number of daily transactions executed on Ethereum has decreased by 1% during the same period.

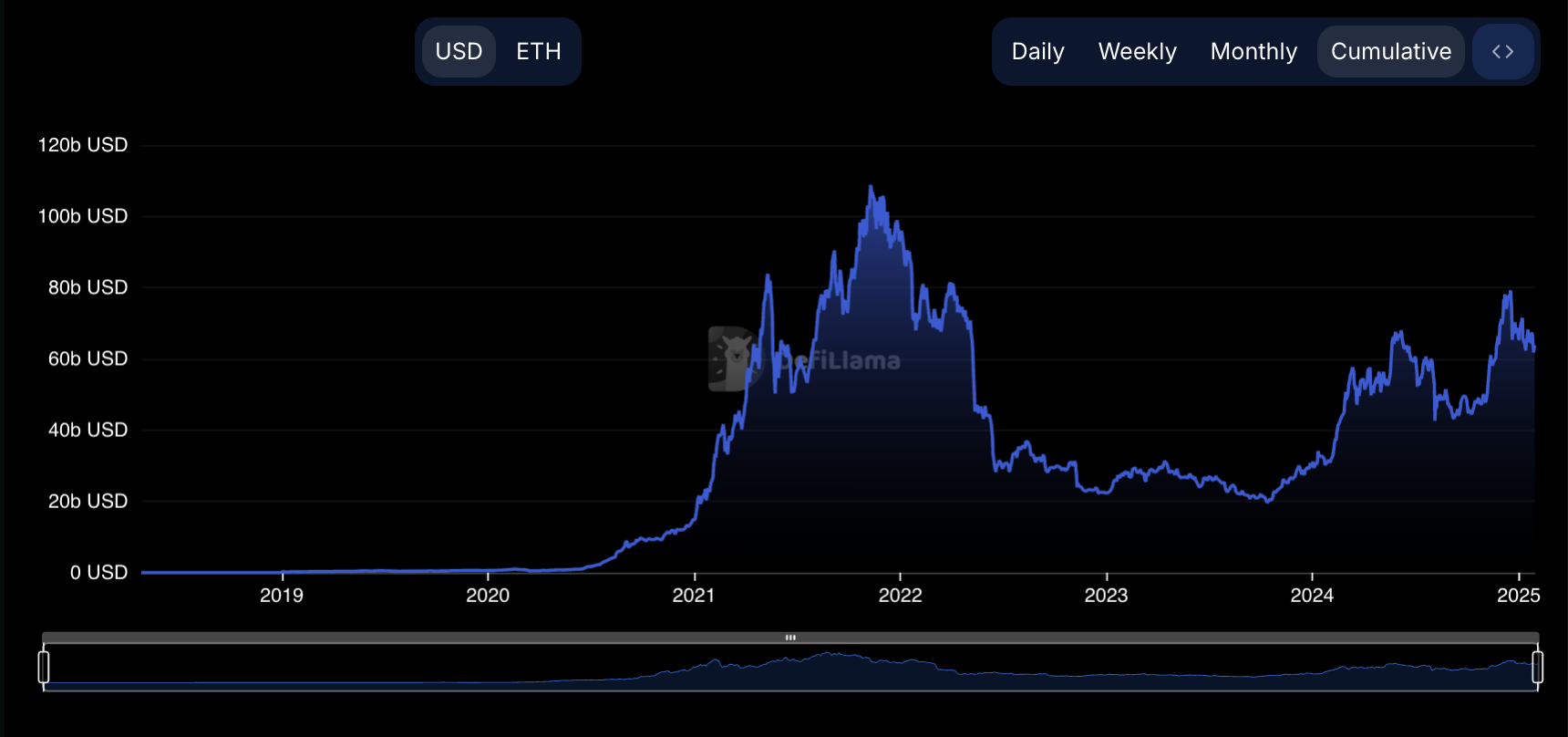

The past week’s decline in Ethereunm’s user activity is reflected by the falling total value locked (TVL) across its decentralized finance (DeFi) ecosystem. Per DefiLlama, this has dropped by 4% during the review period.

ETH Price Prediction: Will It Break Below $3,000?

The decline in activity on the Ethereum network has impacted ETH’s demand, causing its price to drop 4% in the past seven days. An assessment of the ETH/USD one-day chart reveals that buying activity remains minimal among market participants.

Readings from its Moving Average Convergence Divergence (MACD) indicator confirm this bearish outlook. As of this writing, the leading altcoin’s MACD line (blue) rests below its signal line (orange).

The market trend is bearish when this momentum indicator is set up this way. It indicates that selling activity exceeds accumulation among market participants, hinting at a potential extension of ETH’s price decline.

In this scenario, ETH’s price could slip below $3,000 to trade at $2,945. However, if the coin witnesses a surge in new demand, this could drive its value toward $3,369.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.