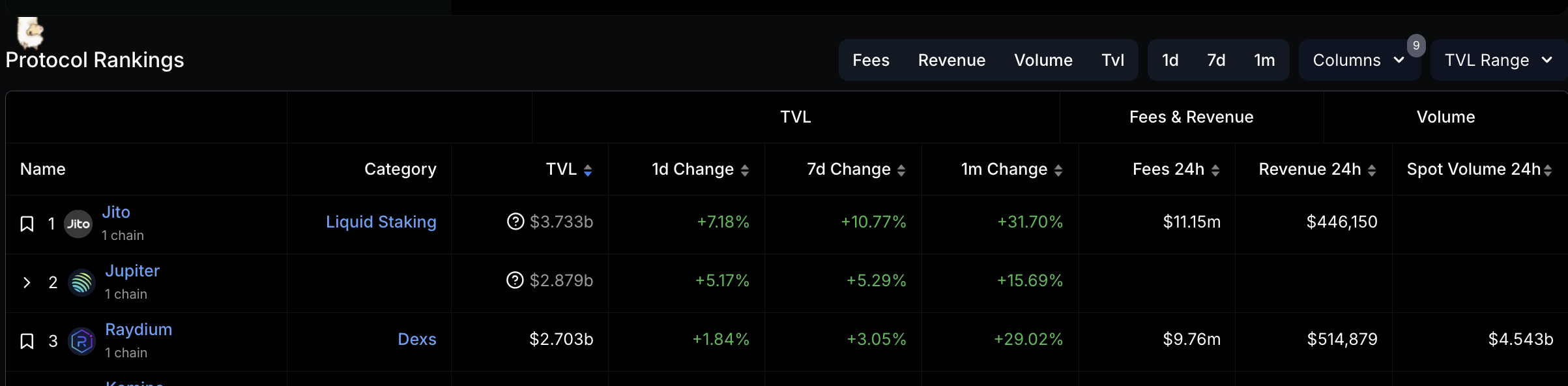

Jupiter’s total value locked (TVL) has now surpassed Raydium’s, positioning it as the second-largest protocol on the Solana blockchain. This comes after a series of positive developments within the decentralized exchange (DEX) over the past week.

Its JUP token has grown significantly, emerging as the market’s top gainer over the past 24 hours. With growing activity on the DEX and surging demand for JUP, it appears poised to extend these gains.

Jupiter Outranks Raydium on Solana

Jupiter’s TVL has surged by 5% over the past week. According to DefiLlama, it now stands at $2.87 billion, securing its place as the second-largest protocol on Solana by TVL. This recent surge has displaced Raydium, which now sits in third place with a TVL of $2.70 billion.

he surge in TVL follows a series of positive developments announced by the DEX at the Catstanbul 2025 event. Notably, Jupiter revealed its acquisition of a majority stake in Moonshot and SonarWatch to create a Solana portfolio tracker. Additionally, the DEX committed to allocating 50% of its protocol fees toward JUP buybacks and a planned burn of 3 billion tokens.

These announcements have driven increased activity on the DEX, boosting its TVL significantly over the past few days.

JUP Bulls Drive Up Value

Jupiter’s JUP token has reacted positively to these developments. It has seen increased demand in recent days, driving up its value. The altcoin trades at $1.19 at press time, noting a 24% price uptick in the past 24 hours. During the review period, it has outperformed the top 100 cryptos, making it the market’s top gainer.

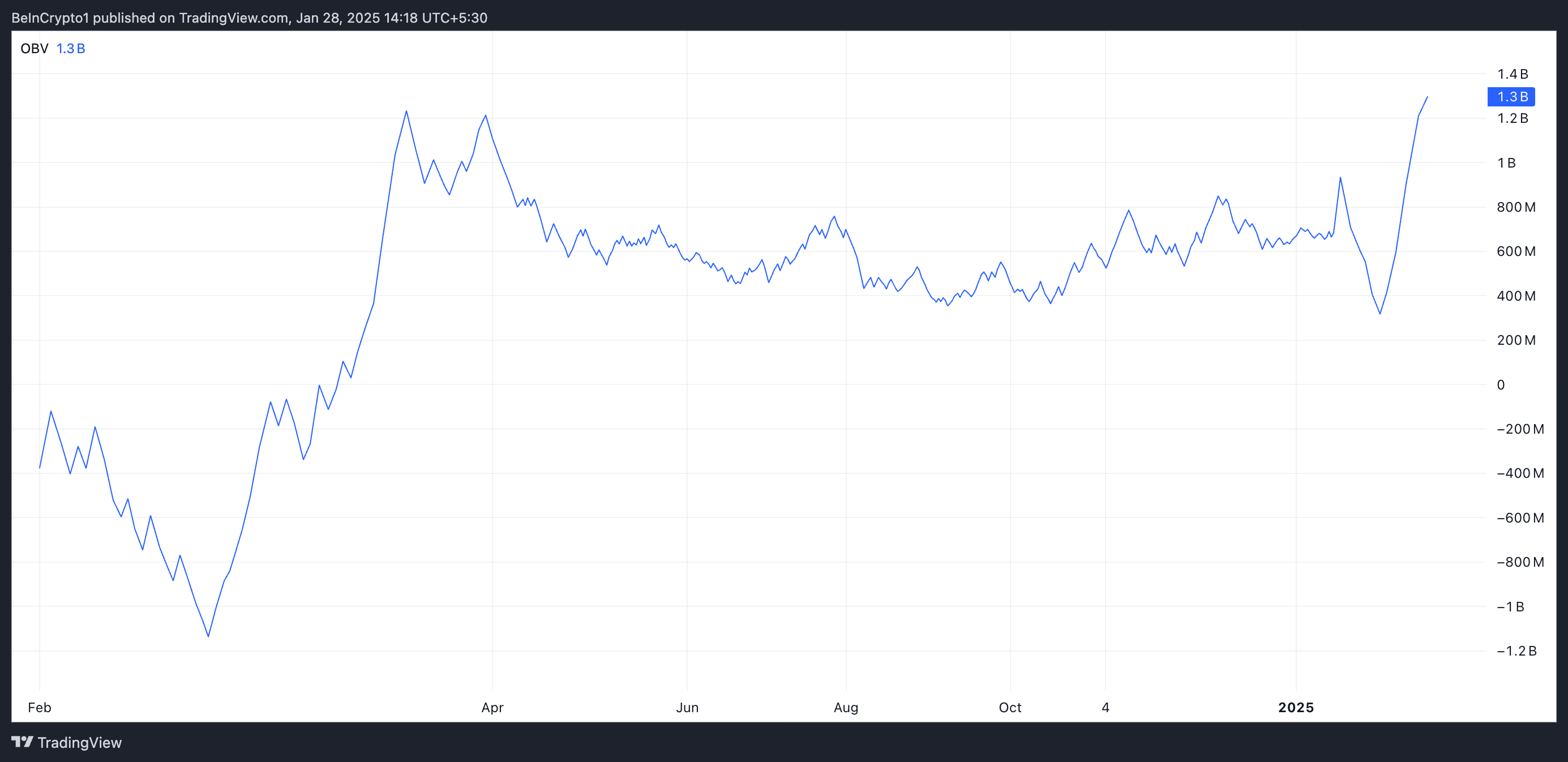

An assessment of the JUP/USD one-day chart reveals the possibility of an extended rally. At press time, the token’s on-balance volume (OBV) is in an upward trend, sitting at an all-time high of 1.3 billion.

An asset’s OBV measures money flow into and out of it to predict price movements. It suggests increasing buying pressure when it climbs like this, as more volume is associated with upward price movement, indicating a potential bullish trend.

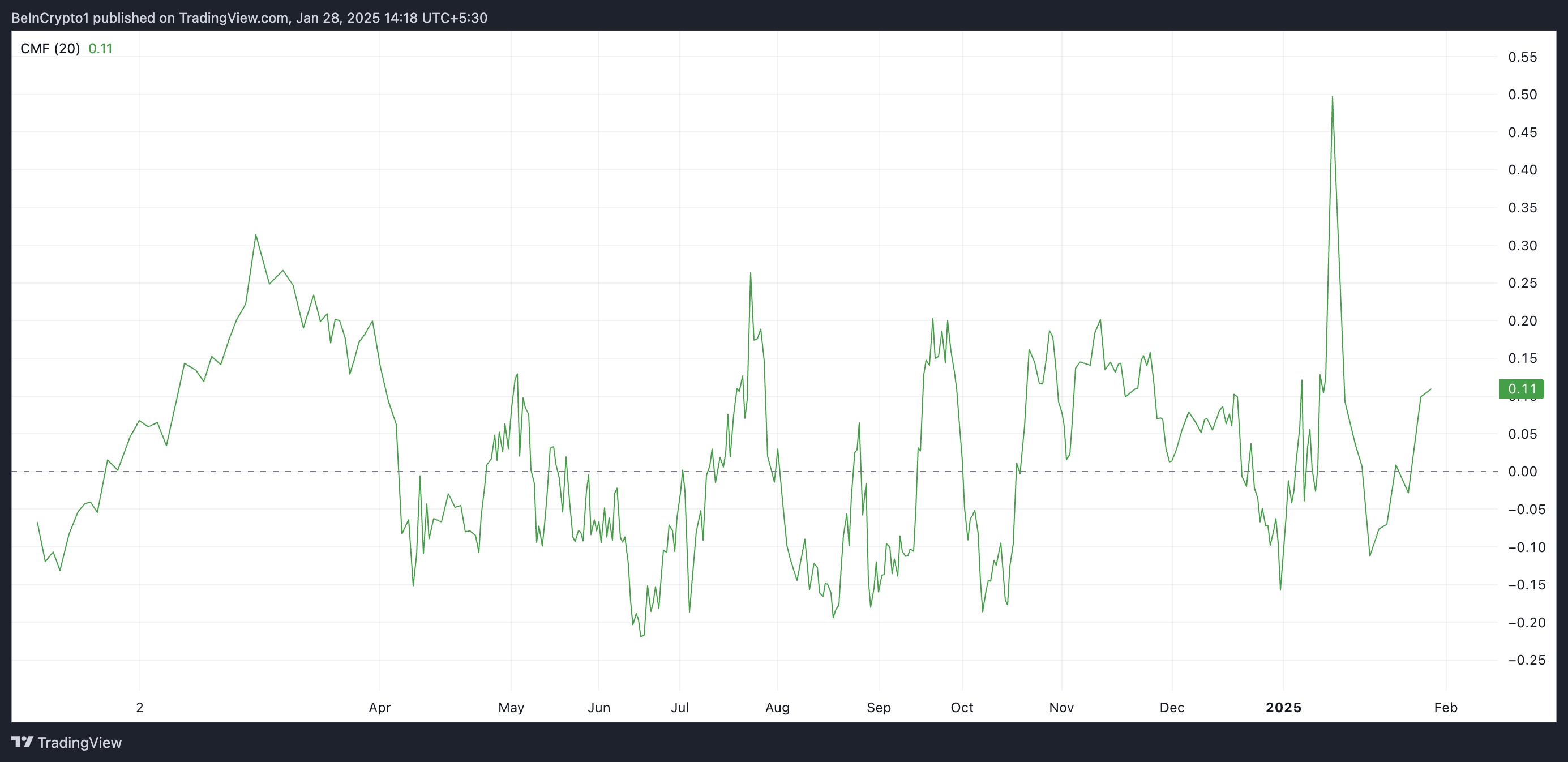

Furthermore, JUP’s Chaikin Money Flow (CMF) sits above the zero line at 0.11 as of this writing. This indicator also measures how money flows into and out of an asset.

When this indicator is positive, it indicates buying pressure in the market, suggesting that the asset is experiencing accumulation.

JUP Price Prediction: Token Hangs Between $1.46 and $1.08

At press time, JUP trades at $1.19. If it continues to see a surge in demand, this could drive its value above the resistance formed at $1.22 and toward $1.46.

Conversely, this bullish outlook will be invalidated if the token witnesses a resurgence in selloffs. In that case, JUP’s price could drop to $1.08.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.