Leading cryptocurrency Bitcoin (BTC) briefly fell below the critical $90,000 mark during Monday’s intraday trading session, marking its first dip below this support level in two months.

This price dip comes amid a broader market decline and sentiment shifts from bullish to bearish. As of this writing, the king coin trades at $92,385, rebounding 4% from the day’s low of $89,028. With waning buying pressure, the coin could extend its decline in the short term.

Bitcoin Continues to Face Bearish Pressure

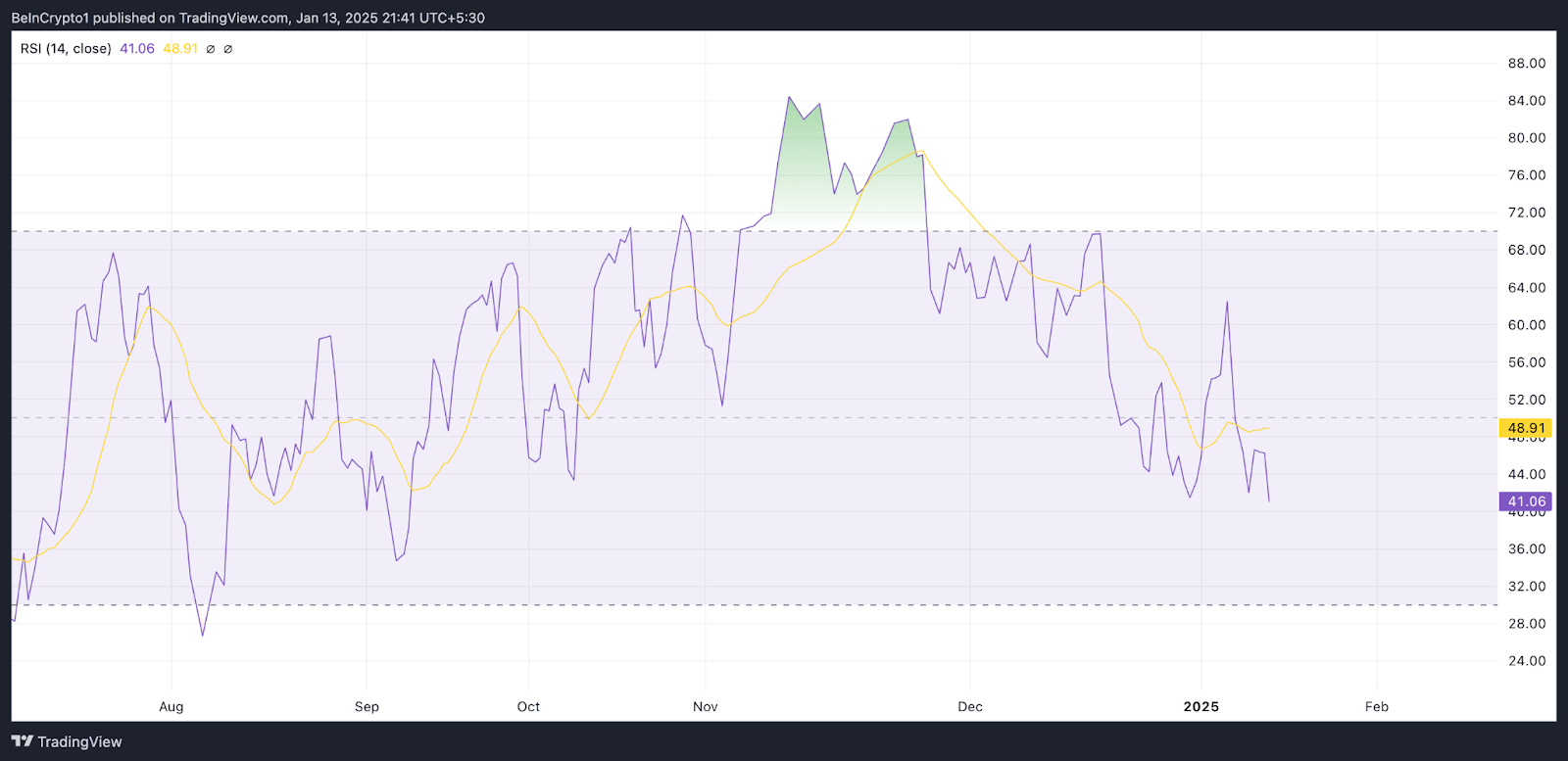

Bitcoin’s Relative Strength Index (RSI), assessed on a one-day chart, confirms this bearish outlook. As of this writing, this momentum indicator, which measures an asset’s oversold and overbought market conditions, is in a downward trend at 41.06.

Further, BTC currently trades below the dots of its Parabolic Stop and Reverse (SAR). This indicator tracks an asset’s price trends and identifies potential reversals by plotting dots above or below an asset’s price.

When the asset’s price trades above the SAR dots, it suggests it is in an uptrend, signaling bullish momentum. Conversely, if the price is below the SAR dots, it indicates a downtrend or that a bearish reversal may be underway.

BTC’s Parabolic SAR indicator reflects the bearish sentiment towards it among market participants, hinting at more decline in the short term.

BTC Price Prediction: Coin Teeters Between $85,000 Support and $102,000 Rally Potential

A resurgence in selloffs will push BTC’s price back below $90,000. In this scenario, it could plummet to support at $85,224.

However, if Bitcoin maintains its current uptrend, it could breach the resistance at $95,513 and rally toward $102,538

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.