Ethereum has faced notable volatility recently, with its price declining by 12% over the past week. This drawdown led to significant losses among investors.

However, the sentiment appears to be shifting as Ethereum holders have opted to accumulate assets instead of selling, suggesting renewed confidence in the cryptocurrency’s potential recovery.

Ethereum Investors Move to Accumulate

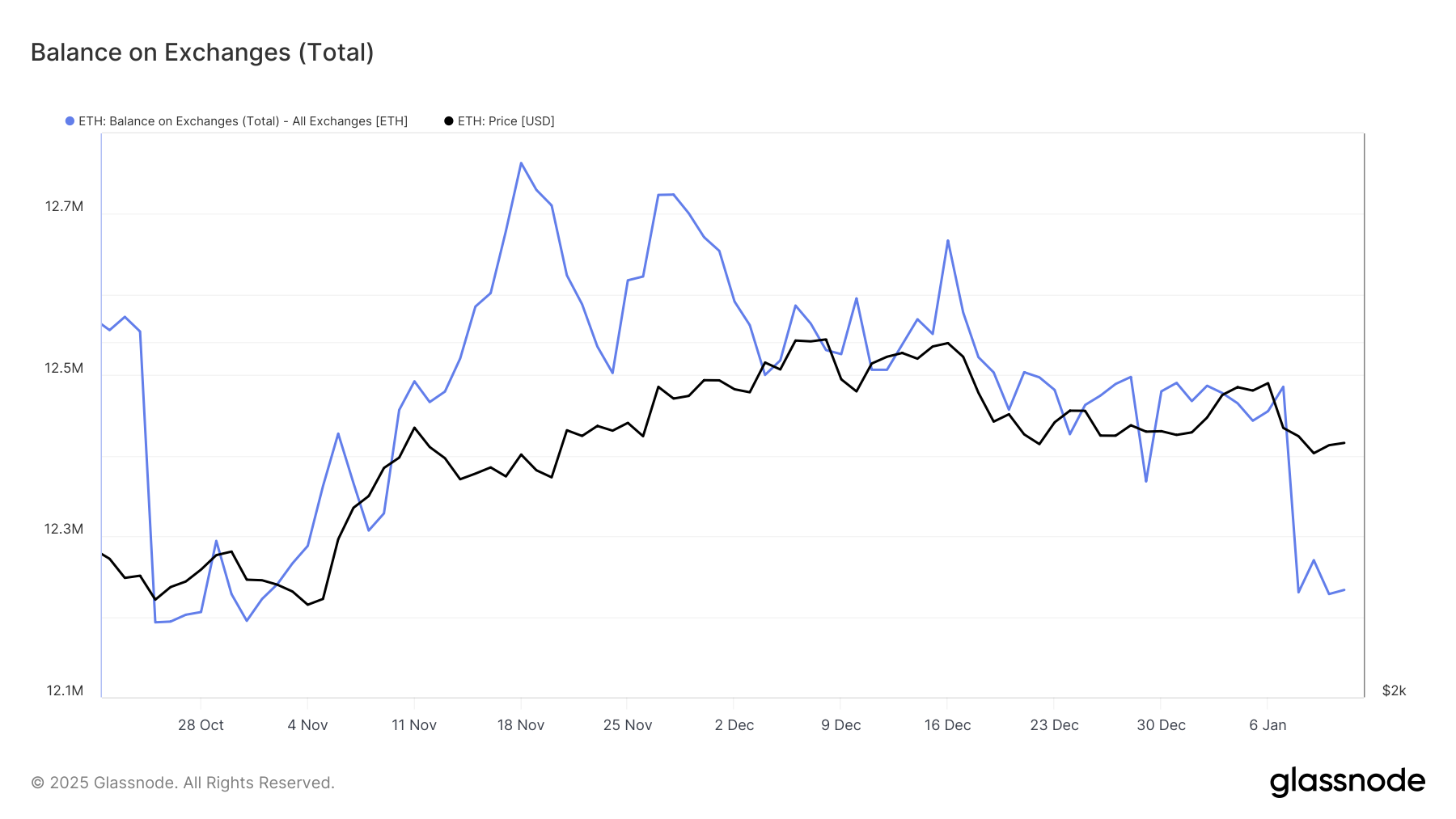

The balance of Ethereum on exchanges has decreased significantly this week, with a notable 12.5 million ETH decline. This shift reflects accumulation by investors who purchased approximately $815 million worth of Ethereum during the price dip. The rapid movement of ETH from exchanges to private wallets highlights optimism among holders looking to capitalize on the reduced price.

These accumulation patterns indicate a strategic approach by investors, aiming to leverage the current low prices for potential future gains. This activity demonstrates bullish sentiment, as Ethereum’s scarcity on exchanges could create upward pressure on the price in the coming days.

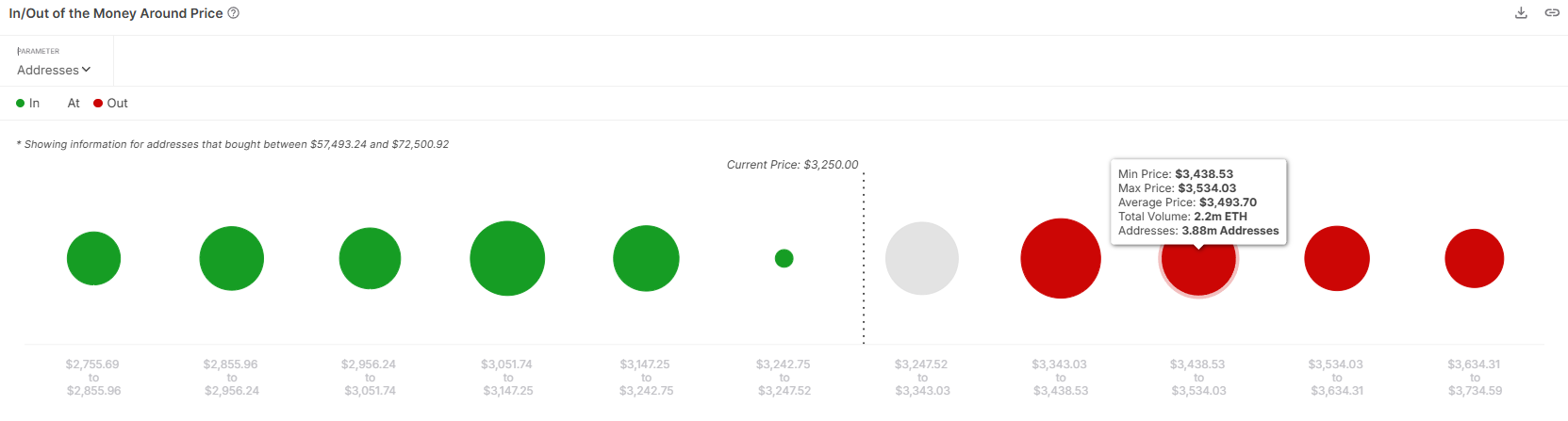

The broader macro momentum for Ethereum suggests the potential for recovery. According to the IOMAP (In/Out of the Money Around Price) data, bullish sentiment from recent accumulation could push Ethereum toward its next resistance level at $3,524.

Between the current price and this resistance, approximately 12.5 million ETH was acquired. As the price rises, this supply, worth $40 billion at the time of writing, will become profitable.

If Ethereum successfully breaches the $3,524 resistance, it could establish a stronger bullish case. Profit-taking at this level is likely, but the renewed confidence could counterbalance selling pressure and pave the way for a more sustained rally.

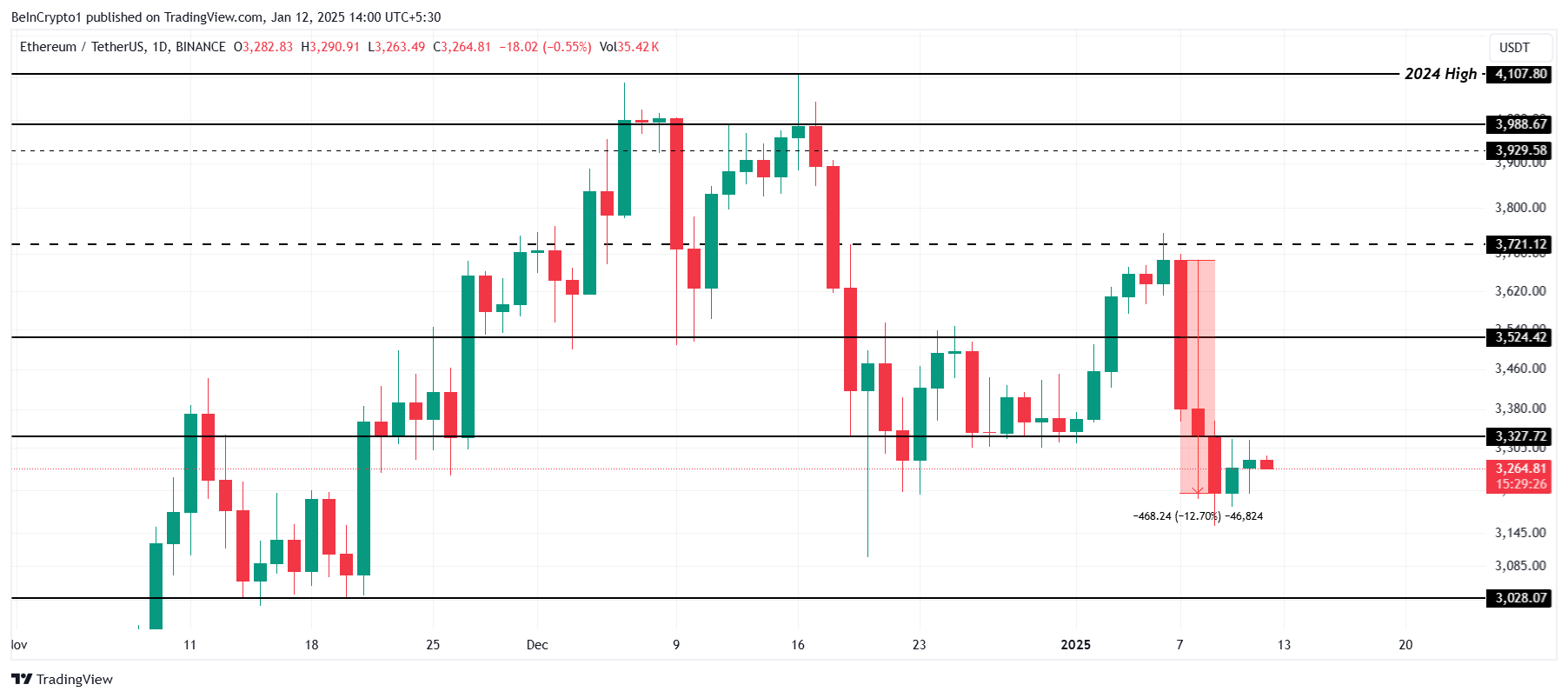

ETH Price Prediction: $3,327 Resistance is Critical

Ethereum is currently trading at $3,264, following a 12% decline earlier this week. It remains under the immediate resistance of $3,327, a critical barrier that must be overcome for further upward momentum. This level is crucial in reversing the recent bearish trend.

Flipping $3,327 into support is key for Ethereum to target $3,524, the next significant resistance level. Sustaining a position above this could reignite the bullish momentum required for a recovery of the losses incurred over the past week.

However, failure to breach $3,327 could push Ethereum’s price lower. A drop to $3,028 would erase recent gains and also invalidate the bullish outlook, further dampening market sentiment and delaying the potential recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.