The crypto community is entering 2025 with remarkable enthusiasm as major assets like Bitcoin and Solana achieve new all-time highs. Bitcoin’s long-anticipated breakthrough past $100,000 has further fueled optimism, setting the stage for a promising year ahead. Once a niche sector, cryptocurrency has now captured the attention of politicians, nation-states, and global financial institutions.

Phemex, a leading cryptocurrency exchange known for its extensive trading ecosystem, innovative approach, robust security measures, and accessibility, has shared key predictions for the year ahead. Highlighting areas with the greatest potential, these insights explore the forces and narratives that could define the crypto market in 2025.

Phemex is a premier cryptocurrency exchange specializing in spot and derivatives trading. It offers 350+ USDT-margined contract trading pairs with up to 100x leverage, all supporting Hedge Mode, and 400+ popular spot trading pairs. The platform allows users of all levels to instantly buy, sell, and trade cryptocurrencies through a user-friendly and secure interface. Phemex has implemented Merkle-Tree Proof-of-Reserves, enabling users to verify on the blockchain that all funds are 100% backed. As the first exchange to publish both proof-of-reserves and proof-of-solvency using a unique self-proving approach, Phemex distinguishes itself as one of the most trustworthy crypto exchanges available.

Intersection of Blockchain with Real World Assets (RWA)

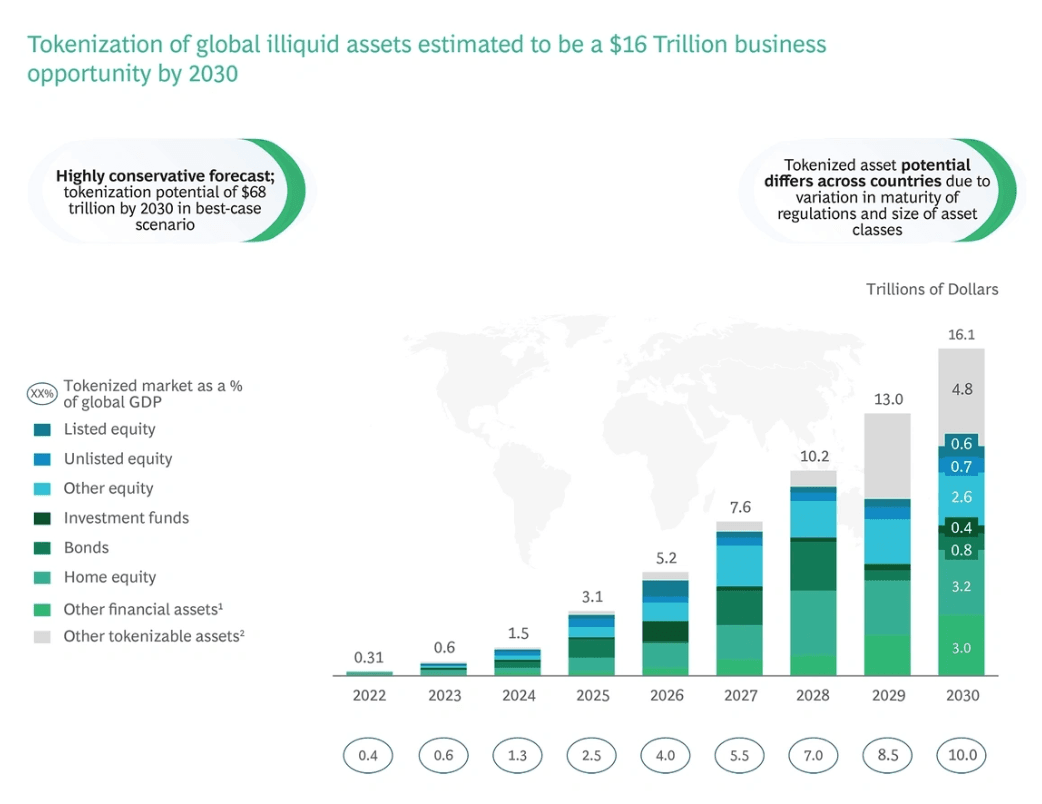

According to a recent US treasury report, “tokenization has the potential to unlock the benefits of programmable, interoperable ledgers to a wider array of legacy financial assets.” In other words, even the US government sees potential in the real world assets narrative especially now with mammoth financial funds like Blackrock being involved.

Tokenizing a real-world asset (RWA) means creating a digital representation of that asset on the blockchain, and they can represent various items like real estate, art, bonds, intellectual property, and more. This process improves traceability, facilitates fractional ownership, and can increase liquidity for illiquid assets such as high-end art.

In 2024, BlackRock launched its first tokenized asset fund, known as BUIDL, which operates on the Ethereum blockchain and managed to raise $240 million within its first week. Citigroup is also exploring the tokenization of financial assets using a private blockchain. The bank claims this approach will enable clients to transfer assets 24/7, significantly reducing processing times from days to mere minutes.

Market forecasts suggest that interest in asset tokenization is on the rise. The tokenization market, valued at $2.81 billion in 2023, is projected to reach $9.82 billion by 2030 with a compound annual growth rate (CAGR) of nearly 20%.

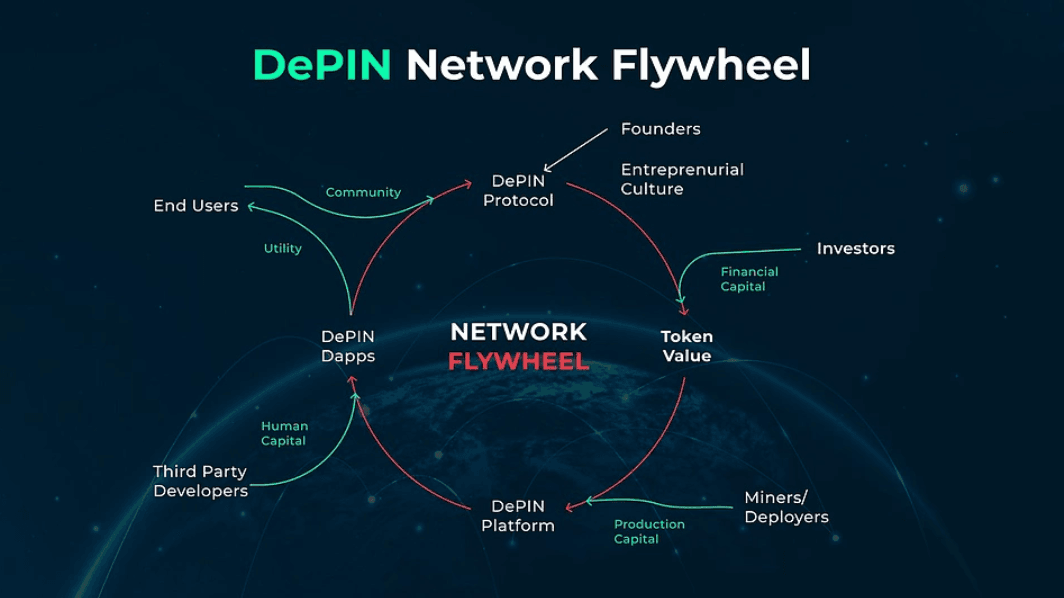

Intersection of AI and Crypto for DePIN

AI is evolving from a mere tool to a key driver of transformation in the blockchain space, stepping into roles as fully autonomous agents. Projects like Terminal of Truth and AIXBT from ai16z demonstrate this shift, using cryptocurrency to execute transactions and unlocking a wide range of creative content opportunities. Their potential extends far beyond these applications, as AI agents can act not only on human instructions but also as independent network participants.

With control over crypto wallets, private keys, and digital assets, these AI protocols are paving the way for entirely new use cases. For instance, they could manage and verify nodes in decentralized physical infrastructure networks (DePINs), such as overseeing distributed energy systems. They are also poised to play pivotal roles in gaming ecosystems. Looking ahead, a blockchain network entirely owned and operated by AI could emerge, eliminating the need for human involvement.

The concept of a Decentralized Autonomous Chatbot (DAC) is also gaining traction. These chatbots could build a following by creating engaging or informative content and operating on decentralized social media platforms.

With the ability to generate income from their audience through various channels and independently manage crypto assets, DACs represent a transformative innovation. Powered by a permissionless network of nodes and guided by a consensus protocol, such a chatbot holds the potential to become the first fully autonomous billion-dollar entity.

To address the challenge posed by AI-powered deepfakes, there’s a growing need for a “proof of personhood.” This could be another growing element in 2025, because proof of personhood increases the cost and difficulty for AI to impersonate humans or compromise network integrity. While humans can obtain unique identifiers for free, it becomes significantly more expensive and complex for AI systems to do the same.

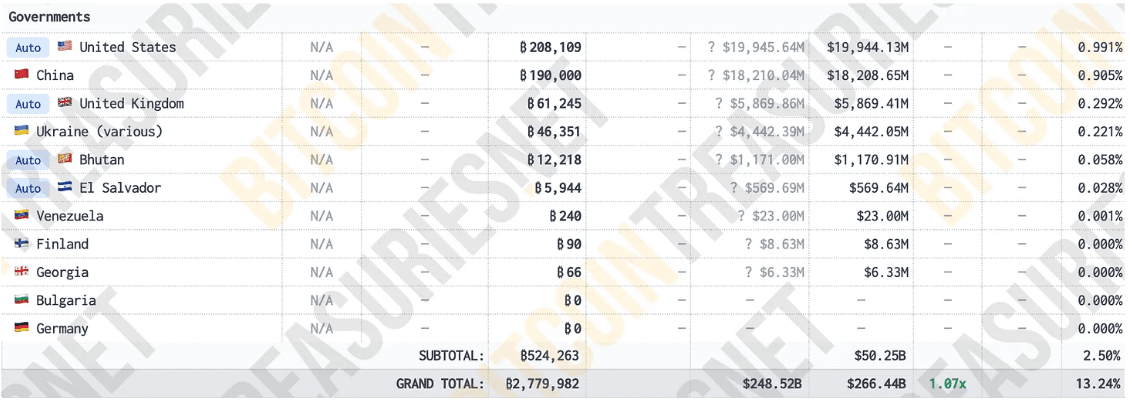

Greater Adoption by Enterprise and Governments

Decentralized finance (DeFi) and utility projects are anticipated to regain momentum in 2025, driven in part by the new Trump administration. Both President Trump and Vice President J.D. Vance have previously expressed support for utility crypto tokens, signaling potential favorable policies for the sector.

Stablecoins have achieved strong product-market fit in the cryptosphere because they offer a fast, low-cost way to send digital dollars globally. Unlike traditional payment systems, stablecoins enable seamless payments without the need for gatekeepers, minimum balance requirements, or proprietary SDKs.

While early adoption of stablecoins is visible in peer-to-peer payments and some enterprise interest is growing, a larger wave of experimentation is expected by 2025. Small and medium-sized businesses (SMBs) — such as restaurants, cafes, and corner stores — are likely to be the first to shift away from credit cards. Larger enterprises are also expected to follow suit because bypassing credit card companies would effectively add up to 2% directly into their profit margins.

Pro-innovation governments worldwide may begin experimenting with issuing government bonds on-chain. The UK is already making strides in this area, with its Financial Conduct Authority (FCA) testing digital securities through a regulatory sandbox.

Additionally, HM Treasury and the Exchequer have signaled interest in issuing digital financial instruments, including government-backed digital bonds or “digital gilts.” These initiatives reflect a growing recognition of blockchain’s potential to streamline financial systems and increase transparency.

Disclaimer

In compliance with the Trust Project guidelines, this guest expert article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.