XRP has witnessed a surge in selling activity since it climbed to a three-year high of $1.63 on November 23. Currently trading at $1.41, the altcoin has since noted a 13% price dip.

On-chain data has revealed a significant spike in profit-taking activity over the past few days. This highlights a potential continuation of the XRP price dip. What should token holders look out for?

XRP Traders Book Gains

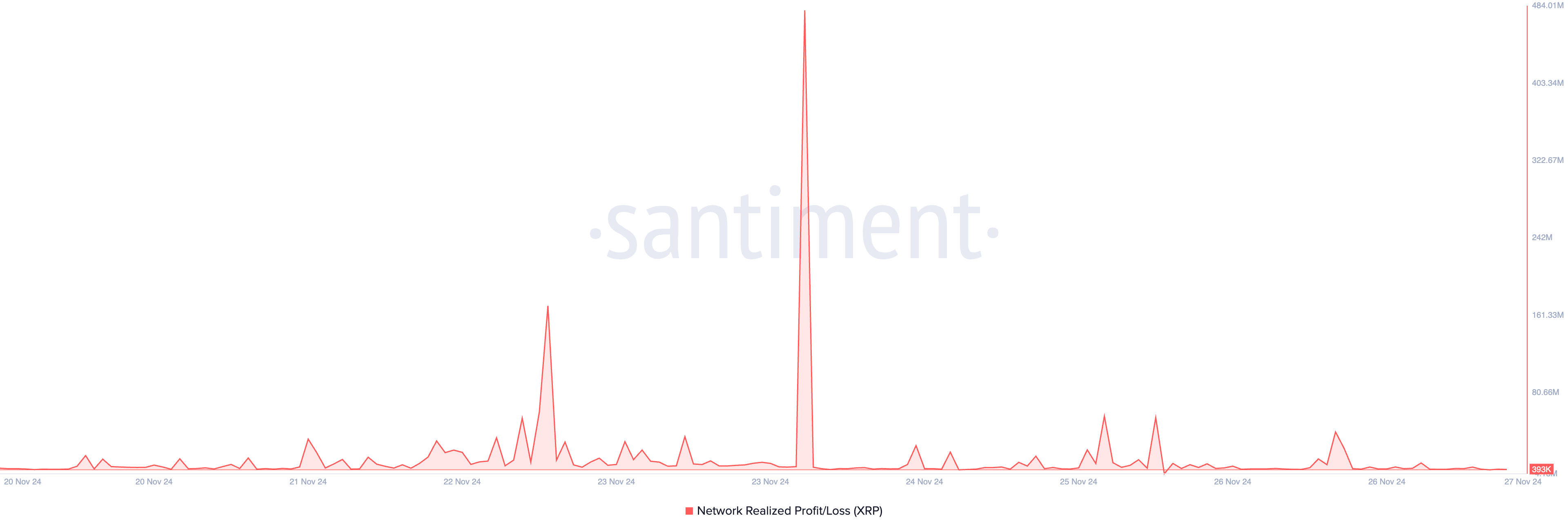

BeInCrypto’s assessment of XRP’s on-chain performance has shown a surge in profit-taking activity among its holders, reflected by its rocketing realized profit. According to Santiment’s data, over the past seven days, XRP’s realized profits have totaled $1.84 billion, the highest since April 2021.

An asset’s network realized profit measures the overall profit gained by network participants based on the price at which tokens were last moved. A spike in this metric indicates that many holders are selling their assets at a significant profit compared to their acquisition price.

This often occurs during periods of high market activity. It signals a profit-taking trend and hints at potential changes in sentiment. As this selling pressure increases, the downward price action persists.

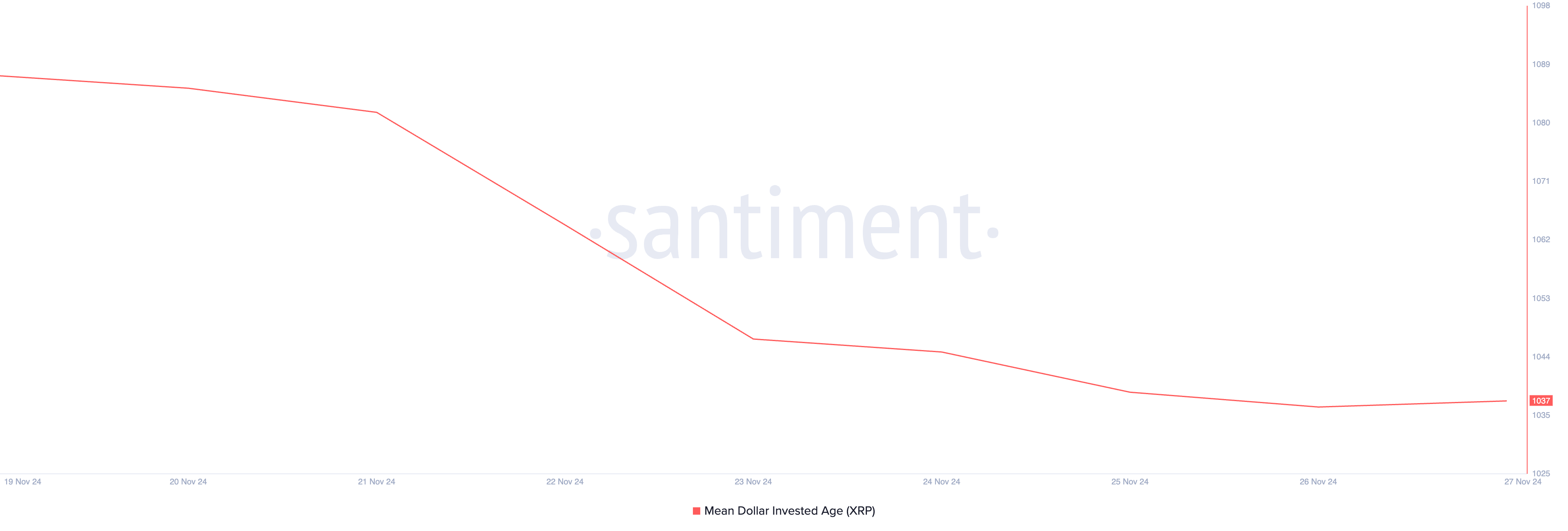

Notably, XRP’s long-term holders contribute to the downward pressure on its price. They have taken advantage of the token‘s rally to a multi-year high to book gains, as evidenced by the decline in XRP’s Mean Dollar Invested Age (MDIA) over the past week.

This metric tracks the average age of all dollars invested in an asset, reflecting how long tokens have been held in wallets. When it falls, it indicates increased network activity as older coins are being moved or spent.

As in XRP’s case, when the MDIA falls during a price rally, long-term holders are actively selling their assets, contributing to the bearish pressure on the altcoin’s price. The reason for this is not far-fetched.

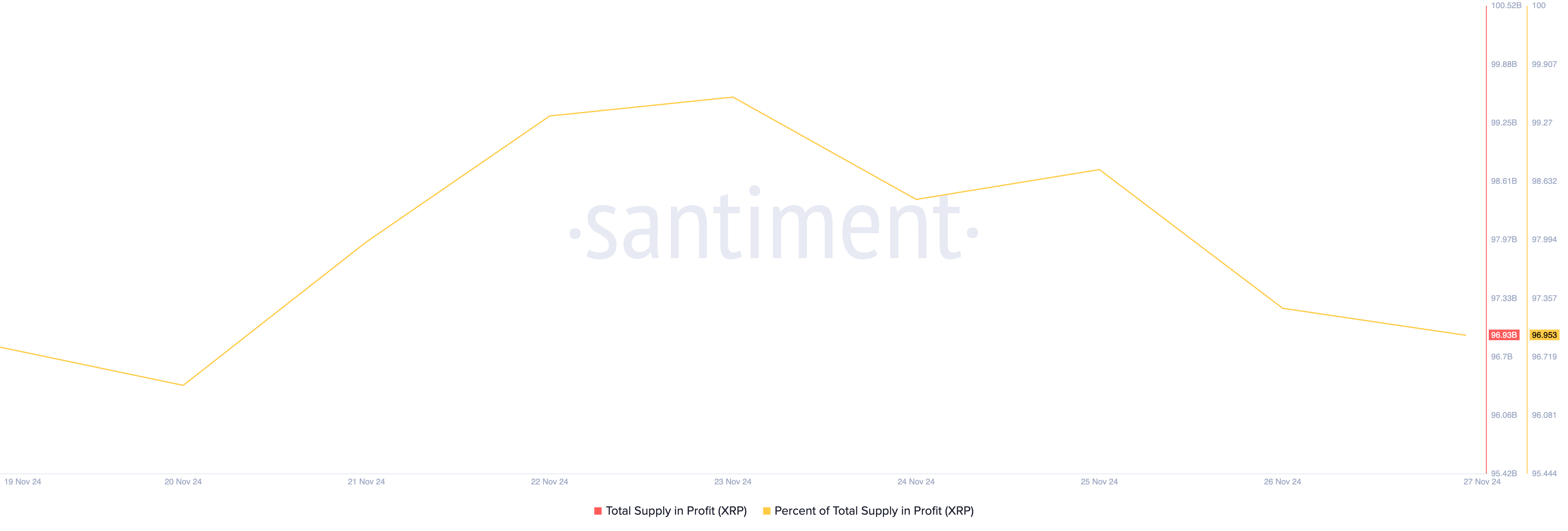

The percentage of XRP supply in profit recently crossed 90%. This means that most XRP holders are now making a profit. As of this writing, nearly 97% of the token’s circulating supply of 99 billion is in profit.

XRP Price Prediction: Token Risks Falling Below $1.30

XRP currently trades at $1.41, above support formed at $1.33. Sustained profit-taking activity by token holders will pull XRP’s price to test this support level. If it fails to hold, the downward trend strengthens, and the XRP price dip may extend to $1.28.

On the other hand, this bearish projection will be invalidated if buying activity resumes. This may push XRP’s price toward revisiting its three-year high of $1.63.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.