Dogecoin (DOGE) recently surged to a three-year high of $0.43 on November 12 before retreating to $0.38, maintaining a 3% daily increase.

However, on-chain data shows that the price spike has led many long-term holders (LTHs) to take profits. If this trend persists, DOGE risks losing much of its recent gains in the short term.

Dogecoin’s LTHs Sell For Profit

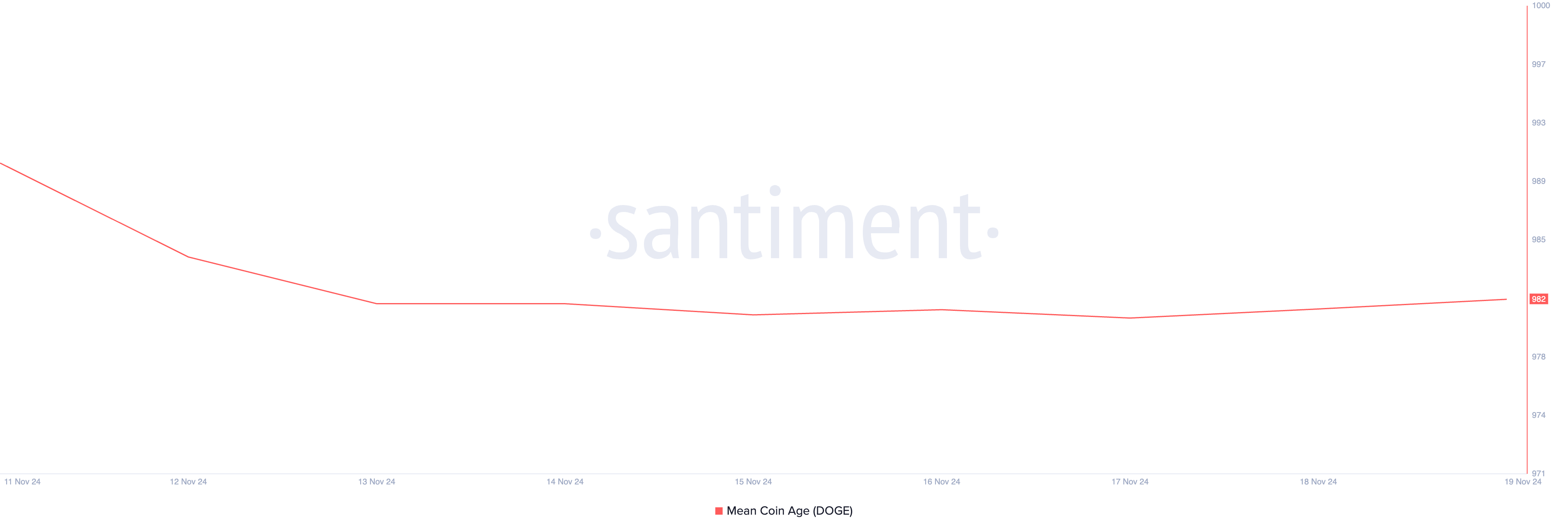

BeInCrypto’s assessment of Dogecoin’s on-chain performance has revealed a decline in its Mean Coin Age over the past week. Per Santiment, this has dropped by 1% over the past seven days.

Mean coin age refers to the average age of the coins in circulation. It gives insight into how long their owners have held coins before being moved or sold. When this metric falls, it means coins that have been held for a long time are being moved or traded more frequently. It is often a bearish sign that indicates that LTHs could be cashing out their profit.

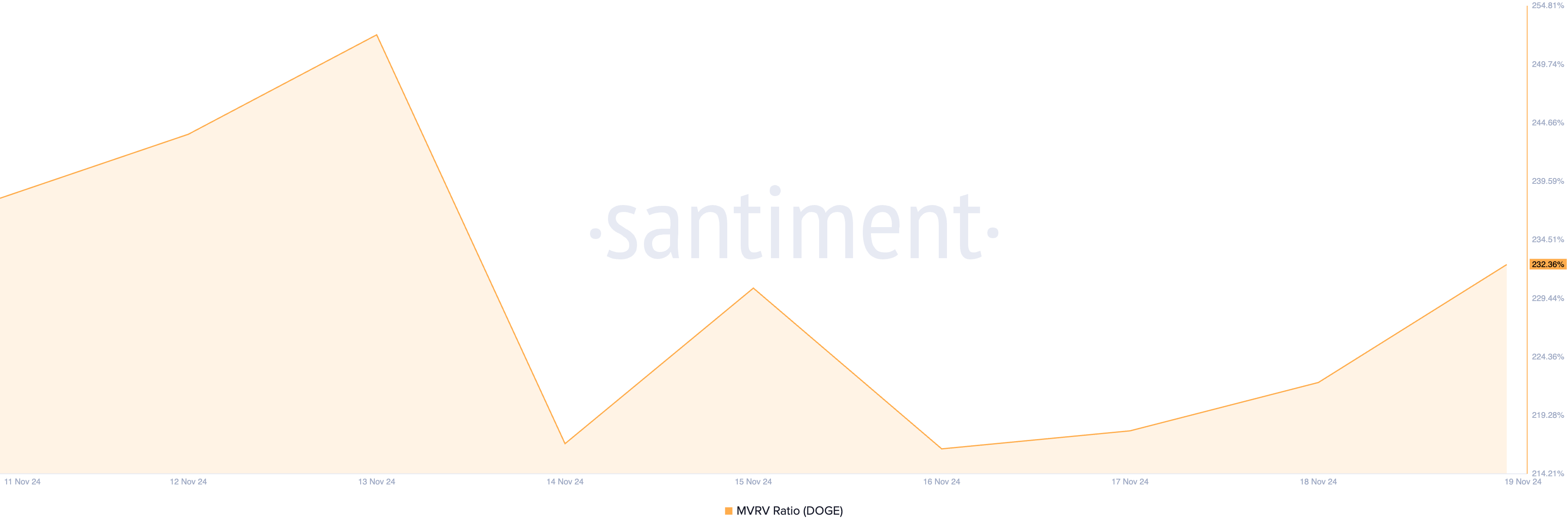

Moreover, the positive readings from DOGE’s market value to realized value (MVRV) ratio suggest that the meme coin is currently overvalued. This may have prompted its LTHs to want to sell for profit. According to Santiment’s data, DOGE’s current MVRV ratio is 232.36%.

The MRVR ratio is a key metric used to analyze a cryptocurrency’s valuation relative to its historical price trends. It compares the market value (the current price of all coins in circulation) to the realized value (the price at which coins last moved on the blockchain).

A positive MRVR ratio suggests that the market value is greater than the realized value. This indicates that the asset is overvalued. Historically, many view this as a signal to sell their holdings for profit.

At 236.36%, DOGE’s MVRV ratio suggests that its current market value is 236% higher than its realized value. Therefore, if all its holders were to sell, they would realize 236% gains on average. Such a high MVRV hints at a prolonged period of price correction as more investors take profits.

DOGE Price Prediction: Why LTHs Must Stop Selling

Currently trading at $0.38, DOGE sits just below the $0.39 resistance level. Increased selling pressure could push the price down to its support at $0.31.

A failure to hold this level may trigger a sharper decline, pushing DOGE below the $0.30 mark and potentially toward $0.21. Such a move would further distance the DOGE meme coin price from any rally beyond $0.47 and a return to $0.50, last seen in May 2021.

However, if market sentiment turns positive and long-term holders (LTHs) hold their positions, increased demand for DOGE could drive its price past $0.47, bringing the $0.50 price zone back into reach.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.