Bitcoin price’s ongoing rally has the cryptocurrency leader on the brink of surpassing and forming ATH beyond $90,000. Although today’s pause in the uptrend caused some investor concerns, Glassnode’s latest report indicates that BTC’s rise may not be over just yet.

While there is room for further growth in Bitcoin’s price, all eyes are on where the new all-time high will be established.

Bitcoin Has Support

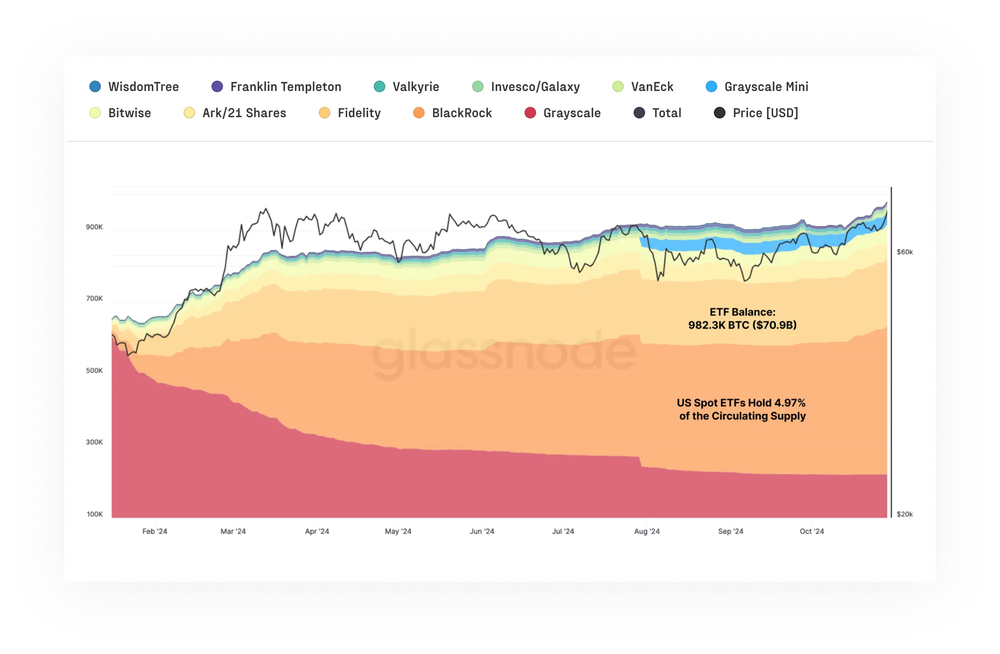

According to a report from Glassnode, Bitcoin ETFs are seeing record inflows, indicating growing confidence from mainstream investors. Recently, spot Bitcoin ETF assets have outpaced those of gold ETFs, highlighting strong institutional interest. This surge elevates Bitcoin’s status as a credible asset in traditional finance, suggesting that ETF-driven liquidity will play a significant role in influencing market trends and price dynamics.

Institutional demand for Bitcoin exposure has surged, with total assets managed across all BTC ETFs now reaching a market value of $70.9 billion. These ETFs collectively hold approximately 4.97% of Bitcoin’s circulating supply, reflecting substantial interest from institutional investors.

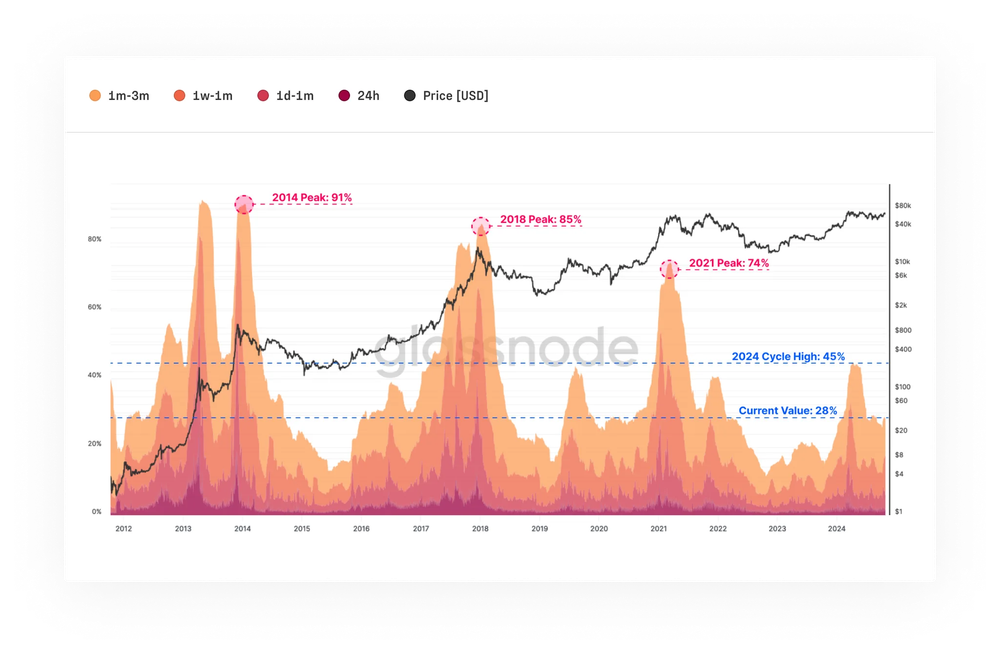

Furthermore, Past trends suggest a strong possibility for continued growth. Analysis of market cycles reveals that, following previous Bitcoin all-time highs, crypto markets have typically entered prolonged periods of expansion. With Bitcoin’s latest peak, current indicators imply a similar stage in the cycle, presenting an ideal entry opportunity for institutions aiming to leverage ongoing bullish momentum.

This trend is evident across both established and emerging markets, as seasoned investors distribute holdings to newcomers attracted by rapid price gains. Unlike previous all-time high distribution phases, the share of wealth held by new investors has not reached past peak levels, indicating this cycle may still have room to run.

BTC Price Prediction: Aiming at The Target

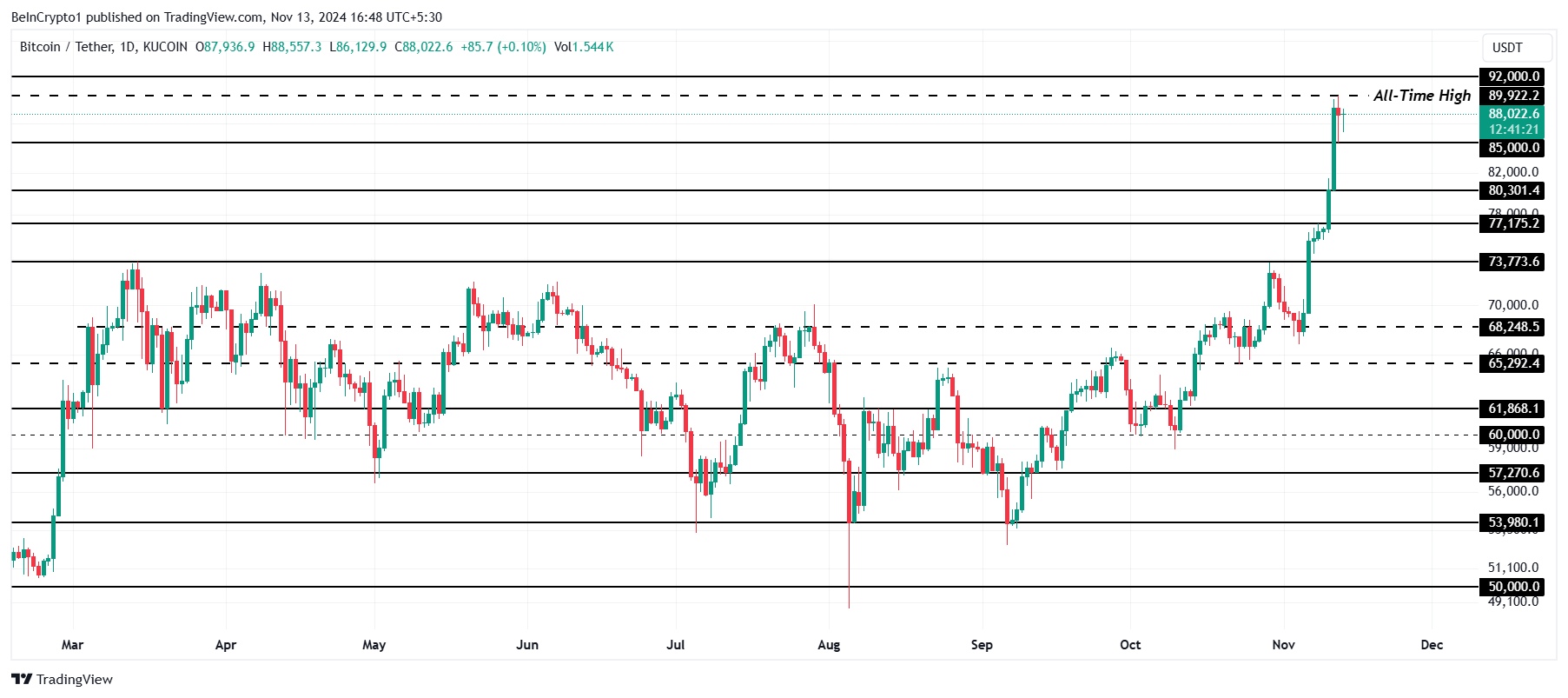

Bitcoin is currently trading at $88,022, reaching a new all-time high (ATH) of $89,922 in recent days. Despite some speculation about a possible decline, Bitcoin’s trajectory remains strong.

Market indicators point to a positive macro outlook for Bitcoin, with the next critical target set at $90,000. Achieving this level could provide insights into BTC’s future price direction and stability.

However, if Bitcoin encounters selling pressure and profit-taking begins, the price could dip to $85,000. Failing to hold at this level may lead to further declines, potentially reaching $80,301 and invalidating the current bullish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.