Toncoin (TON) price has struggled to break free from its downward trend, despite Bitcoin reaching new all-time highs this week. Investor sentiment around TON remains bearish, contributing to the cryptocurrency’s recent price stagnation.

Low adoption rates have compounded this pressure, weakening market confidence in Toncoin’s potential rebound.

Toncoin Is Failing to Gain New Investors

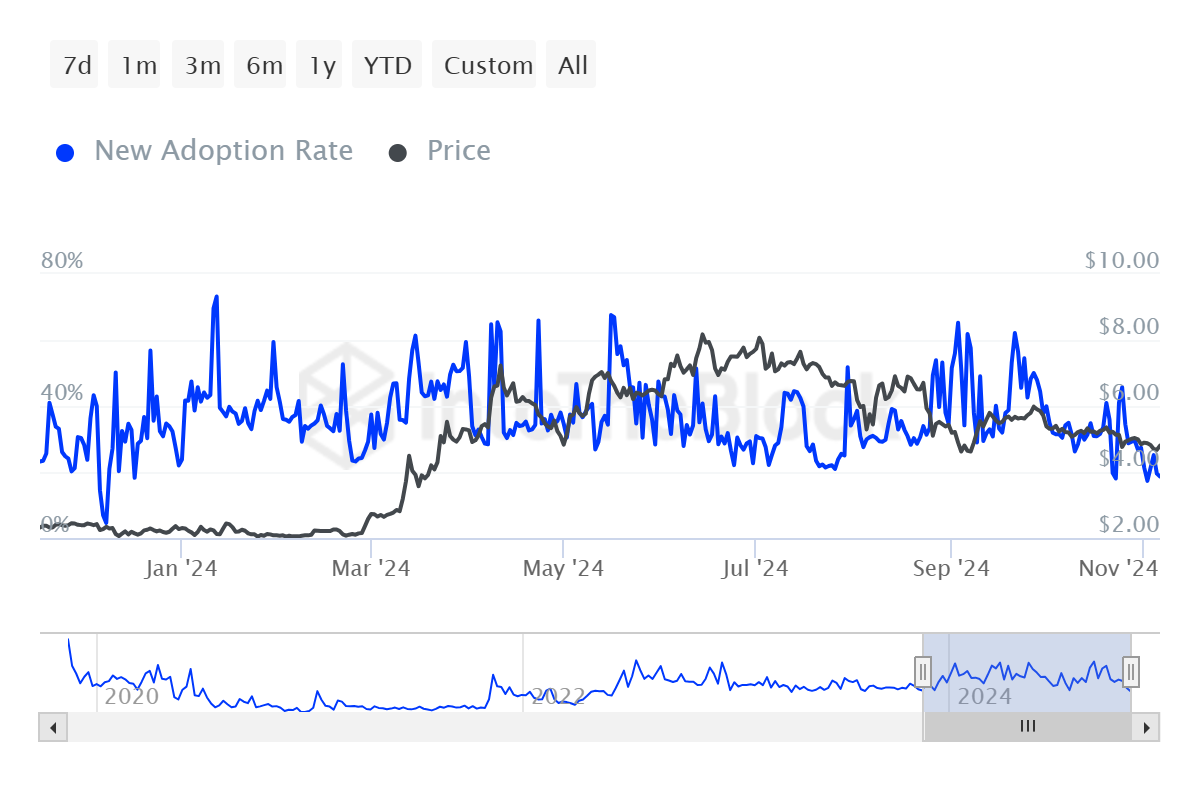

The adoption rate for Toncoin, which measures the percentage of active addresses that are conducting a transaction for the first time, has seen a sharp decline. Currently sitting at 18.64%, this figure is the lowest since December 2023, signaling a lack of fresh investor interest. A ten-month low adoption rate suggests that potential new users are finding limited reasons to invest in TON, hindering the asset’s ability to attract fresh capital and participation.

This dwindling adoption rate could indicate a larger issue within the Toncoin network. When new addresses make up a small portion of active addresses, it suggests that the asset is losing traction, with existing holders maintaining control over transactions. This lack of growth in the user base may be contributing to TON’s struggle to regain upward momentum, as investor interest and new inflows remain subdued.

Read more: What Are Telegram Bot Coins?

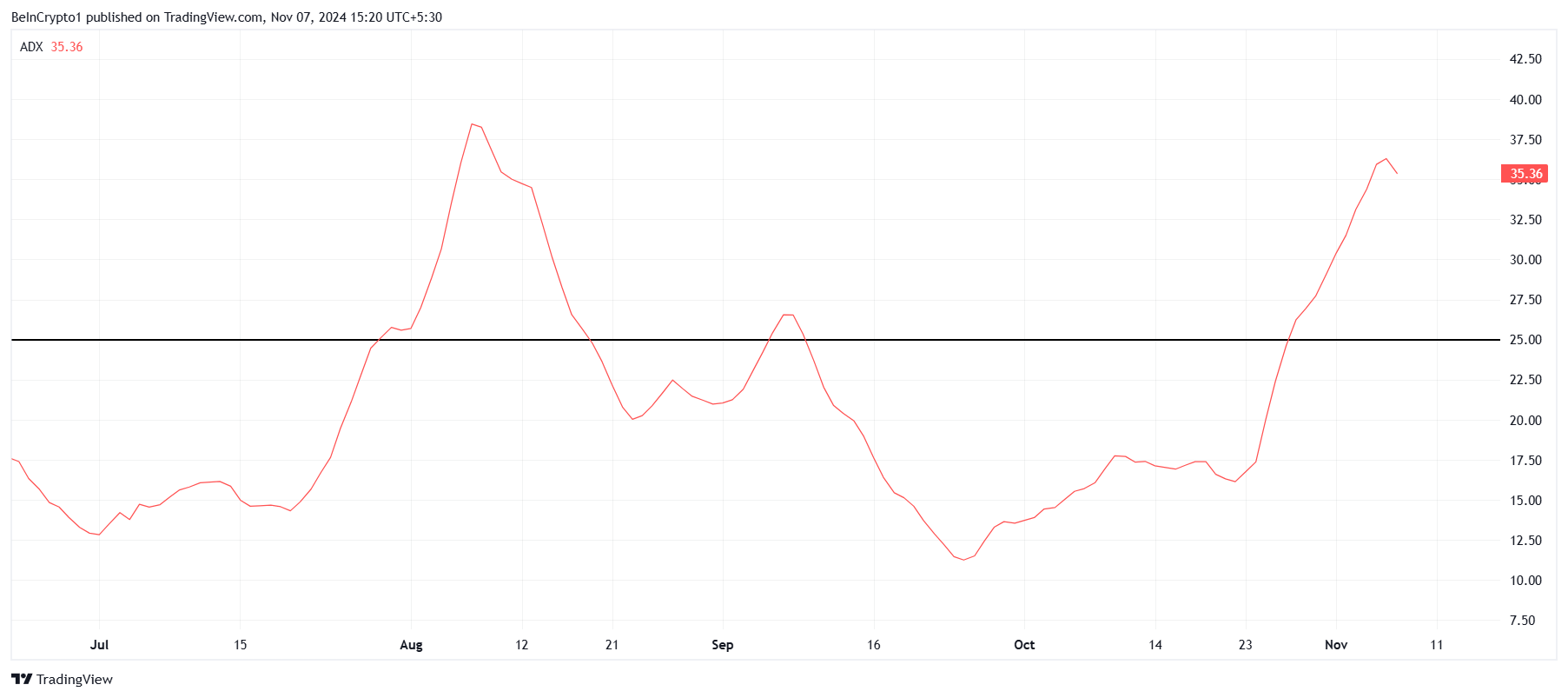

Toncoin’s macro momentum reflects bearish sentiment, supported by technical indicators like the Average Directional Index (ADX), which is currently at 33.0. An ADX above the 25.0 threshold typically signals a strong trend, and since TON’s current trend is downward, this does not bode well for its near-term price movement.

The elevated ADX reinforces that TON’s downtrend is solidifying, making it difficult for the cryptocurrency to mount a meaningful recovery. Despite sporadic attempts to regain lost ground, the strength of the current trend suggests that sellers maintain control. This ongoing pressure raises the likelihood of further declines unless a significant shift in market sentiment occurs.

TON Price Prediction: Downtrend Continues

Toncoin’s price is attempting to flip the $4.86 resistance level into a support. Achieving this could help TON break out of its month-long downtrend, offering a path toward recovery. A successful breach would provide investors with hope for a rebound, but sustained buying power will be crucial.

However, current market indicators suggest that TON may struggle to secure this breakout. Should TON fail to establish $4.86 as support, a drop to $4.61 is likely. If it loses this level, the asset could see intensified losses, as bearish momentum would be reinforced by the lack of new buyers entering the market.

Read more: What Are Telegram Mini Apps? A Guide for Crypto Beginners

If TON manages to breach and sustain $4.86 as support, however, it could potentially challenge its downtrend line. Successfully reaching and testing the $5.37 resistance level would invalidate the current bearish outlook, signaling a potential shift toward bullish momentum and improved prospects for Toncoin.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.