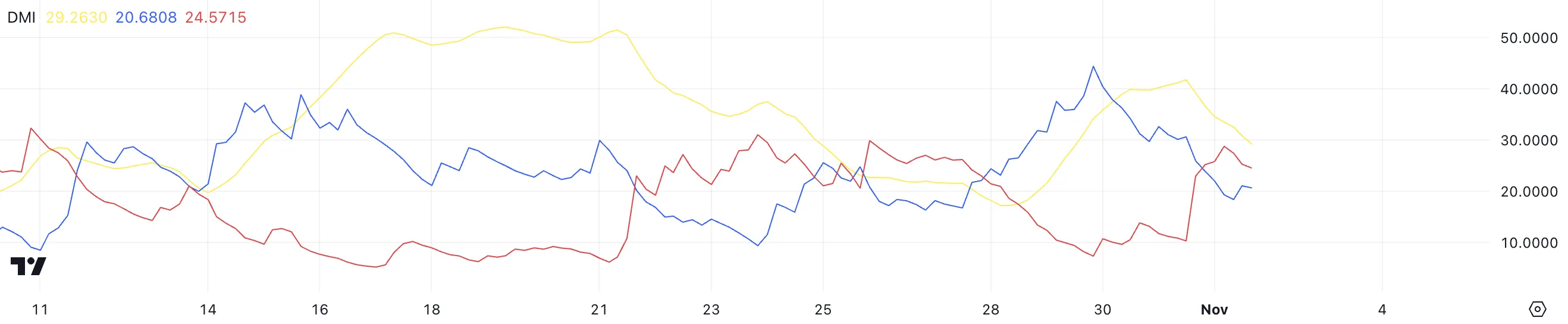

Bitcoin (BTC) price has shown shifts in sentiment after recently reaching a very close level to its all-time high. DMI highlights a softening in BTC’s uptrend momentum, suggesting some pullback in buying intensity.

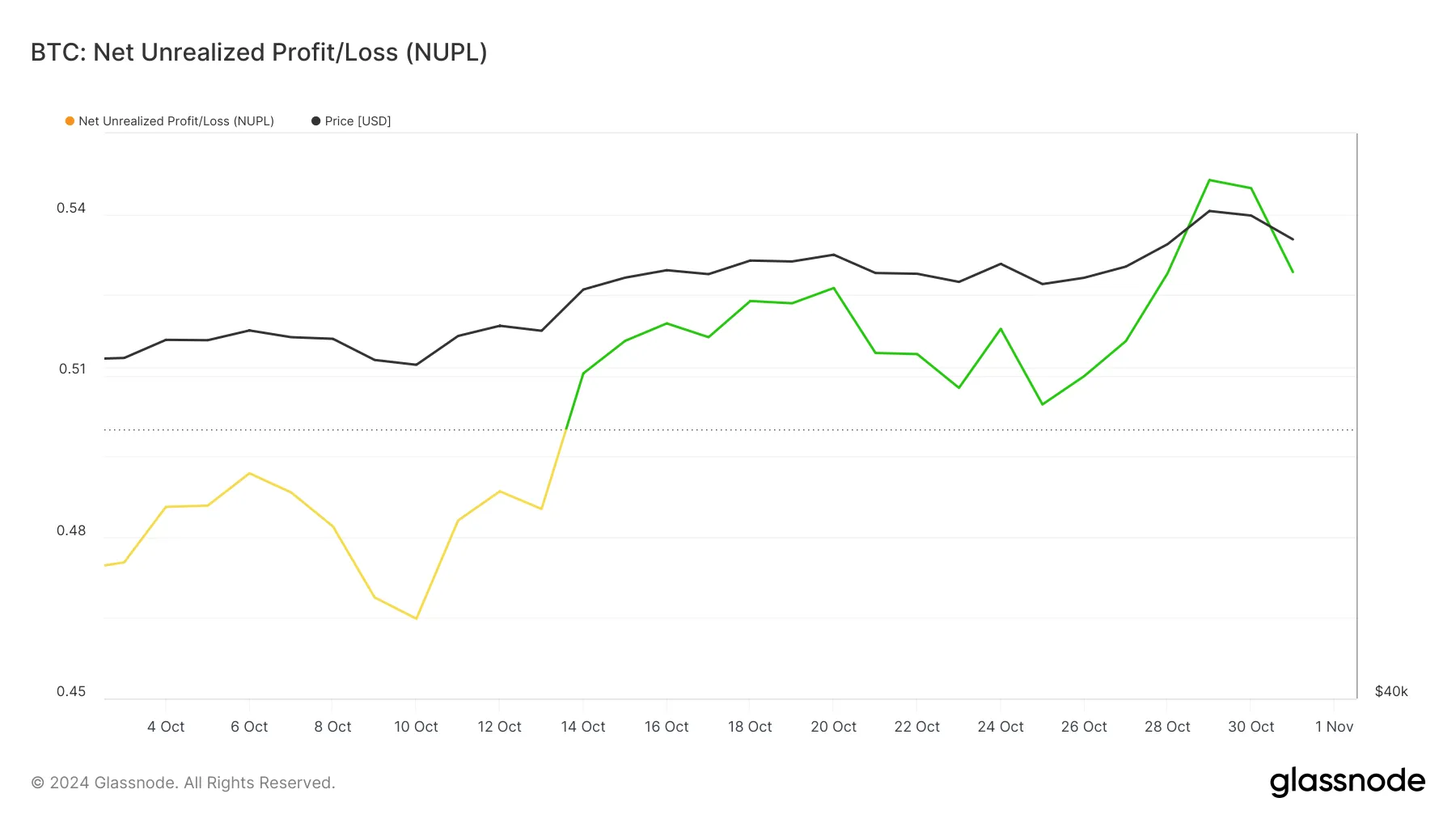

Similarly, while NUPL remains in a positive phase, it reveals a more cautious outlook among holders compared to the euphoria levels seen in past cycles. Together with BTC’s price chart, these indicators suggest a period of consolidation or minor correction before any potential move to new highs.

BTC DMI Shows Sentiment Recently Changed

The BTC DMI chart reveals that its ADX is now at 29.26, down from over 40 days ago. ADX, or the Average Directional Index, measures trend strength without showing direction.

An ADX above 25 indicates a strong trend, while values below 20 suggest a weak or non-existent trend. With ADX moving lower from above 40, the strength of BTC’s recent uptrend has softened.

Read more: 7 Best Crypto Exchanges in the USA for Bitcoin (BTC) Trading

DMI uses two lines, D+ and D-, to indicate the direction of the trend. BTC’s D+ currently stands at 20.6, while D- is at 24.5. This suggests sellers are momentarily stronger than buyers.

However, just a few days ago, BTC was in a stronger uptrend, with D+ above 40 and D- around 10, showing that buying pressure far outweighed selling. Though BTC price is technically in an uptrend, the balance between buying and selling forces has shifted slightly, with D- edging higher than D+.

Bitcoin NUPL Is Far From The Euphoria Level

BTC’s NUPL is currently at 0.529, slightly lower than the 0.546 level reached a few days ago. This drop indicates a modest decline in unrealized profit among holders, reflecting some recent profit-taking or a pause in overall market optimism.

Despite the decrease, BTC’s NUPL remains positive, meaning most holders are still in profit but are approaching a more cautious sentiment.

NUPL, or Net Unrealized Profit/Loss, is a metric that calculates the difference between unrealized gains and losses among holders, indicating general market sentiment.

Although BTC’s NUPL has dipped, it still sits in the belief-denial phase and is currently well below the euphoria-greed level where extreme optimism historically occurs.

BTC Price Prediction: A Stronger Correction Before a New All-Time High?

BTC’s price chart shows its short-term EMA lines positioned above the long-term EMAs, indicating a bullish trend. This alignment suggests stronger recent momentum compared to the longer-term trend, often a sign of increased buying interest and positive sentiment, potentially setting up further gains.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

However, the narrowing gap between the EMAs signals that bullish momentum has slowed in recent days. If the uptrend regains strength, BTC could aim for new highs above $73,618. Conversely, BTC may first pull back to test support at $65,503; if this level fails, a dip to $62,043, marking an 11.4% correction, could follow.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.