Telegram coin Notcoin (NOT) price has dropped 20% in value over the past 30 days, with 71% of holders now “out of the money.” As a result, Notcoin’s price remains well below its all-time high, showcasing contrasting trends among popular assets.

However, this on-chain analysis suggests that NOT’s downtrend could be nearing an end, potentially easing losses for holders. Here’s how.

Notcoin Selling Pressure Eases

One reason Notcoin’s price decreased was the notable rise in selling pressure. However, according to IntoTheBlock, that is no longer the case, specifically due to the indications from the Coins Holding Time.

Coins Holding Time shows the amount of time a cryptocurrency has been held without being sold or transacted. Typically, the higher the holding time, the stronger the chances of an uptrend. On the other hand, when the metric decreases, it means that the price is likely to fall.

For Notcoin, the holding time has increased by 30% in the last seven days. If this continues, Notcoin’s price might avoid experiencing another correction.

Read more: What is Notcoin (NOT)? A Guide to the Telegram-Based GameFi Token

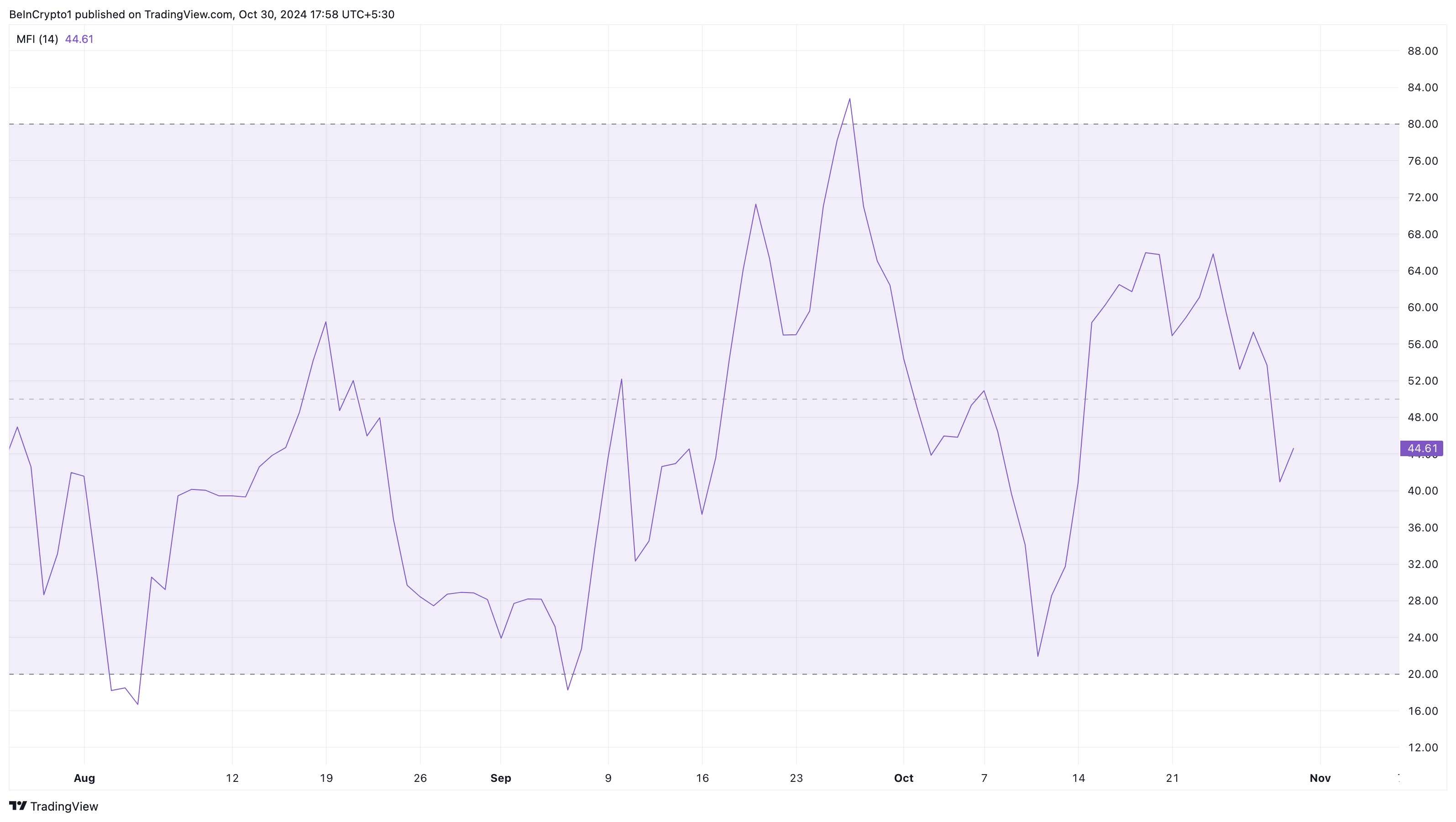

Another potential sign of a rebound is the Money Flow Index (MFI), a technical oscillator that combines price and volume data to gauge buying and selling pressure.

When the MFI shows an upward reading, it signals an influx of buying pressure, indicating a possible price increase. Conversely, a drop in the MFI suggests heightened selling pressure, which could push the price down.

Currently, the MFI for Notcoin is slowly rising, implying that buyers are stepping in. If this trend persists, it could further support the case for a price recovery.

NOT Price Prediction: Falling Wedge Pattern Indicates Bullish Potential

A glance at the daily chart reveals that Notcoin has formed a falling wedge pattern, a bullish reversal indicator in technical analysis. This pattern occurs when prices are moving lower but within converging trendlines, signaling a potential breakout to the upside once the asset exits the wedge.

If NOT breaks above the wedge’s resistance line with strong volume, it could mark the beginning of a new upward trend. Currently, Notcoin’s price is $0.0068 and is close to rising above the resistance positioned at $0.0077.

Read more: 5 Top Notcoin Wallets in 2024

Should the altcoin rise above this point, then the Telegram coin’s Notcoin price could rise by 70% and rally to $0.012. However, rejection at the resistance level could invalidate this thesis. If that happens, then NOT could slide to $0.0062.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.