In a recent post on X, Coinbase CEO Brian Armstrong made a bold statement about the future of the US Securities and Exchange Commission (SEC). He suggested that the next SEC chair should withdraw what he calls “frivolous cases” and apologize to the American public.

Armstrong expressed deep frustration over the impact of the SEC’s current enforcement approach, specifically under Chair Gary Gensler’s leadership.

Armstrong Demands Apology, Reform from Next SEC Chair

Armstrong’s comments come just days before the November 5 US election, which has the potential to reshape the regulatory field.

“The next SEC chair should withdraw all frivolous cases and issue an apology to the American people. It would not undo the damage done to the country, but it would start the process of restoring trust in the SEC as an institution,” Armstrong posted.

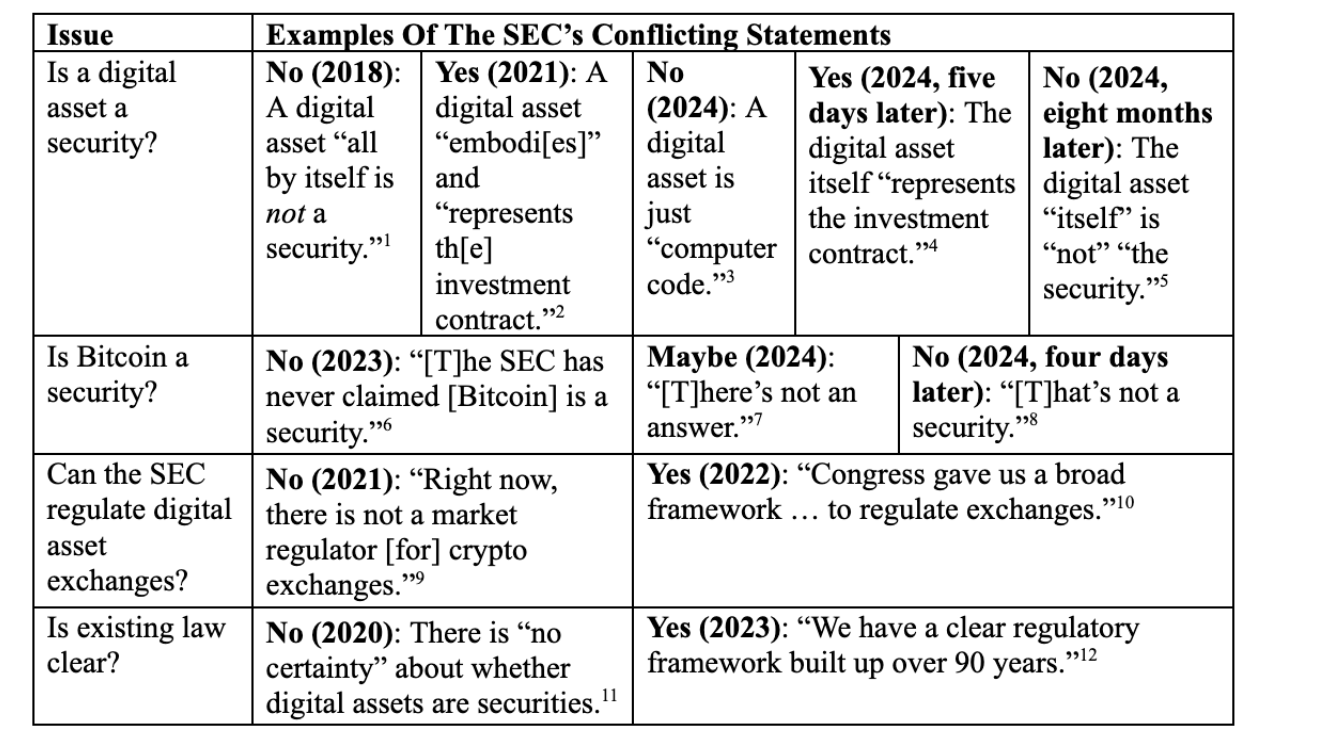

His statement reflects growing discontent within the crypto industry over what many see as excessive regulatory scrutiny. The SEC has also been called out for ambiguous enforcement actions under Gensler’s tenure. The Coinbase executive also highlighted some of the financial regulator’s contentious statements.

Read more: Who Is Brian Armstrong? A Deep Dive Into the Coinbase Founder

Calls for an apology and the withdrawal of “frivolous” cases highlight the growing rift between the SEC and the crypto industry. Coinbase has faced legal challenges from the SEC, as have other major US crypto firms like Binance, fueling debates on regulatory overreach. Coinbase CEO Brian Armstrong has consistently advocated for clearer guidelines that encourage innovation without hindering growth.

Meanwhile, Gensler’s position as SEC chair could be at risk if former President Donald Trump takes office as the 47th US President. According to Polymarket, Trump currently leads with a 66% probability of winning, compared to Kamala Harris, who stands at 34.2%. A Trump victory would likely lead to significant changes at the SEC after previously criticizing Gensler’s policies. He also suggested he would replace Gensler immediately after he ascended office.

Trump advertises his approach to crypto regulation as markedly different from what the industry currently endures under Gensler’s leadership. While Gensler has advocated for stringent regulation and launched multiple enforcement actions against crypto firms, Trump has promised a regulatory overhaul that could loosen restrictions on the crypto industry.

As BeInCrypto reported, Dan Gallagher, a known proponent of clearer regulatory frameworks for digital assets, is a strong candidate to take over as SEC chair. Gallagher’s appointment would likely signal a friendlier stance toward crypto and could encourage a more collaborative regulatory environment.

Alternatively, Hester Pierce, alias Crypto Mom, may also succeed Gensler in case a Republican administration takes office. Her name was floated around multiple times ahead of the spot Bitcoin ETF approval.

“Should a Republican get elected President, Chair Gensler would likely resign and the senior Republican appointed SEC Commissioner (in this case famed “crypto-mom” Hester Peirce) would possibly become acting Chair,” former SEC official John Reed Stark explained.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

As the election nears, the potential for an SEC shake-up could bring significant changes to the regulatory outlook for crypto. Whether or not Armstrong’s vision of a reformed SEC becomes a reality, the election outcome could redefine the future of crypto regulation in the US.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.