We have all heard the warning, ‘past performance is not a guarantee of future results.’ However, this warning is hard to ignore when an asset like Bitcoin has generated profits across more than 94% of its lifetime.

This is exactly the case with Bitcoin (BTC), a cryptocurrency that is a little more than a decade old with a history of shattering its previous all-time highest values.

Bitcoin’s Impressive Track Record

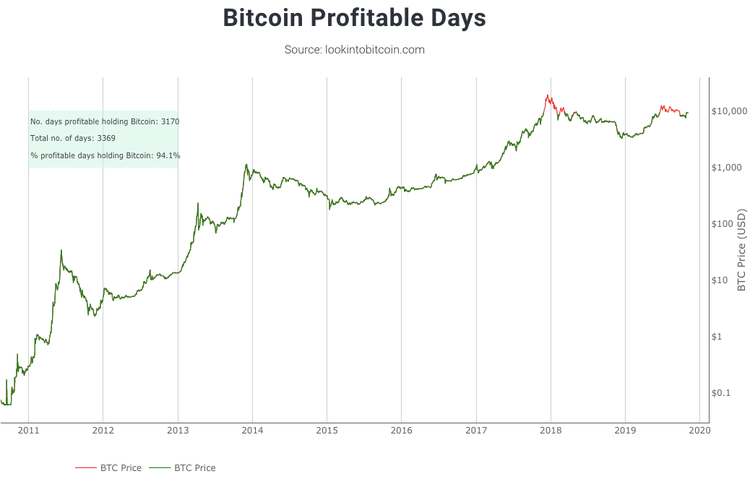

According to data collected by LookIntoBitcoin, Bitcoin has had a trackable price for around for 3,368 days as of today (Nov 07, 2019). In all this time, Bitcoin has had a total of 3,170 profitable days, while investing during just 198 would put you in the red. This is calculated by looking at the number of days Bitcoin had a value lower than its current value of around $9,200. Based on this, if an investor had purchased Bitcoin on over 94% of days throughout its trading history, and held until today, that investment would now be in a profit. Looking at the chart above, parts of the graph line shown in green represent days where BTC was valued at lower than its current price. Conversely, parts shown in red illustrate days where Bitcoin is valued at higher than its current price.

Based on this graph, it is clear to see that anybody buying BTC throughout its first seven years of existence would now be in a huge profit. However, anybody buying at the end of Dec 2017, early 2018, and some parts of mid-2019 might be in a losing position at this time.

Looking at the chart above, parts of the graph line shown in green represent days where BTC was valued at lower than its current price. Conversely, parts shown in red illustrate days where Bitcoin is valued at higher than its current price.

Based on this graph, it is clear to see that anybody buying BTC throughout its first seven years of existence would now be in a huge profit. However, anybody buying at the end of Dec 2017, early 2018, and some parts of mid-2019 might be in a losing position at this time.

Looking at the Numbers

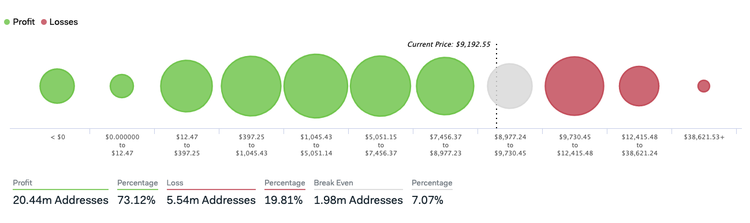

However, although Bitcoin has been profitable for the great majority of its history, this doesn’t provide much insight into whether investors have actually capitalized on this opportunity. After all, Bitcoin trading volume reached its peak when Bitcoin reached its all-time and yearly high value in 2017, as well as the period of reaching $13.8k earlier this year. As such, a huge influx of new investors may have entered the market during these periods, leaving them in a loss if they are still holding to this day. Fortunately, IntoTheBlock offers a unique wallet tracking tool that allows us to determine exactly what proportion of BTC holders are in a profit or loss. By tracking almost 28 million Bitcoin addresses and calculating the value of its balance across its trading history, IntoTheBlock is able to determine whether each wallet is in a profit, loss, or roughly breaking even right now. As it stands, a total of 20.4 million addresses can be considered to be in profit, whereas just 5.5 million addresses are in a loss. This means approximately 73.1% of Bitcoin holders are in the green, compared to just 19.8% currently out of the money.

As it stands, a total of 20.4 million addresses can be considered to be in profit, whereas just 5.5 million addresses are in a loss. This means approximately 73.1% of Bitcoin holders are in the green, compared to just 19.8% currently out of the money.

Did you know you can trade sign-up to trade Bitcoin and many leading altcoins with a multiplier of up to 100x on a safe and secure exchange with the lowest fees — with only an email address? Well, now you do! Click here to get started on StormGain!

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Daniel Phillips

After obtaining a Masters degree in Regenerative Medicine, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite any evidence to the contrary. Nowadays, Daniel works in the blockchain space full time, as both a copywriter and blockchain marketer.

After obtaining a Masters degree in Regenerative Medicine, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite any evidence to the contrary. Nowadays, Daniel works in the blockchain space full time, as both a copywriter and blockchain marketer.

READ FULL BIO

Sponsored

Sponsored