Toncoin’s price has fallen by 6% over the past month, currently trading at $5.19. The Telegram-linked token is facing growing downward pressure as buying interest diminishes, hampering its recovery efforts.

Technical indicators suggest Toncoin may approach a 30-day low, with bearish sentiment driving further potential declines.

Toncoin Struggles With Waning Demand

Toncoin’s price currently sits below its Ichimoku Cloud, which gauges its market trends, momentum, and support/resistance levels.

When the price of an asset falls below the Cloud, it suggests that the asset is in a downtrend. This confirms the negative market sentiment, showing that sellers are in control and the price may continue declining. In this scenario, the Cloud acts as a resistance level, making it more challenging for the price to rise above it without a surge in buying pressure.

Read more: 6 Best Toncoin (TON) Wallets in 2024

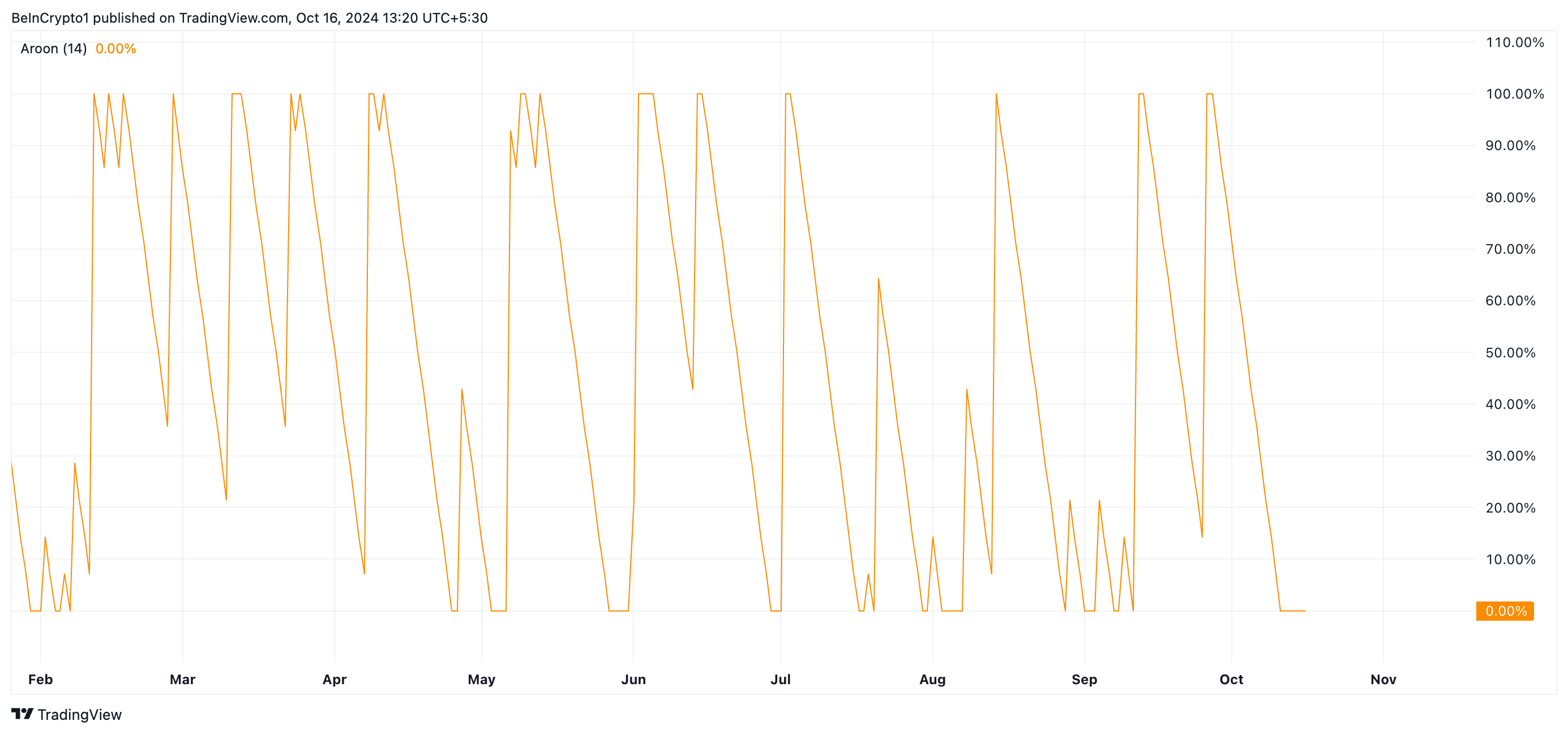

Furthermore, TON’s Aroon Up Line is at 0%, signifying that its price has not reached new highs in recent times. The Aroon indicator measures the strength and direction of a trend.

When the Up Line is 0%, the asset’s price has not recorded a new high within the lookback period (typically 14 days). The absence of new highs points to bearish sentiment in the market, as the lack of upward momentum suggests buyers have lost their strength.

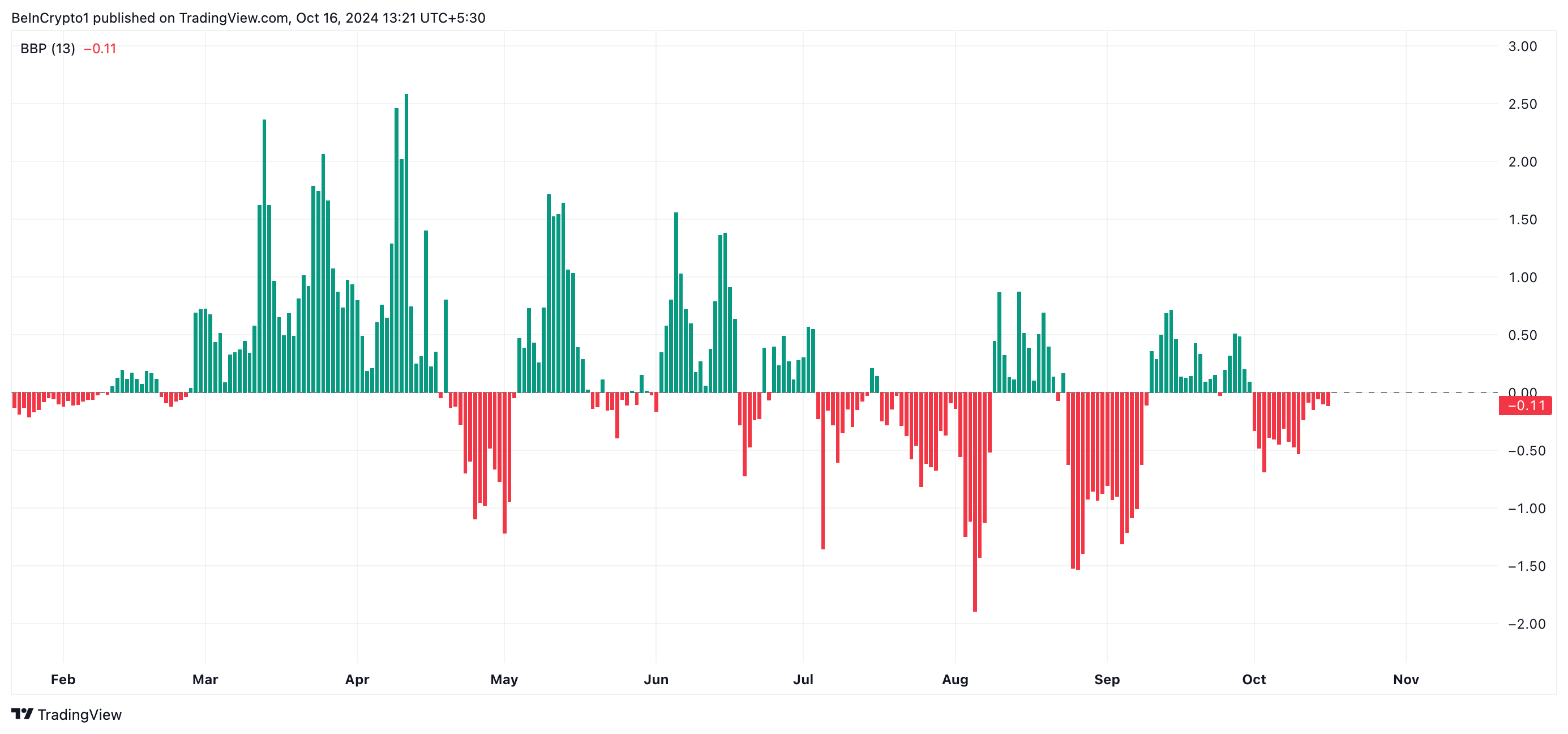

The negative readings from Toncoin’s Elder-Ray Index confirm this. At press time, this indicator, which measures buying and selling pressure in the market, is below zero at -0.11. When an asset’s Elder-Ray Index is negative, the bears dominate the market.

TON Price Prediction: A Double-Digit Drop Is Imminent

If selling pressure spikes, Toncoin’s price is poised for a potential 15% drop, possibly trading down to its September 4 low of $4.45. According to its Fibonacci Retracement tool, this price point represents its next major support level.

Read more: Top 9 Telegram Channels for Crypto Signals in October 2024

However, this bearish outlook could be invalidated if the altcoin experiences a resurgence in demand. Should buying pressure increase, Toncoin’s price may break above the resistance established by its Ichimoku Cloud, paving the way for a rally toward $7.46.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.