Coinbase-backed Base is setting new standards in the Ethereum Layer-2 space, with its daily transaction volume surpassing an all-time high of over 6 million.

This milestone solidifies Base’s leadership in the sector, demonstrating its increasing popularity and the strength of its growing ecosystem.

Base Commands Around 60% of Ethereum Layer-2 Transactions

In the past three days, Base has experienced a notable surge in transaction volume, consistently processing over 6 million transactions each day. According to DeFillama data, the network first reached this peak on October 10, when it recorded 6.2 million transactions.

Since then, the momentum has continued, with 6.1 million transactions on October 11 and 6.09 million on October 12.

Read more: A Beginner’s Guide to Layer-2 Scaling Solutions

Base’s rapid rise in transaction activity has placed it ahead of other prominent Layer-2 solutions like Arbitrum and Optimism. Data from IntoTheBlock indicates that Base now accounts for as much as 60% of all L2 transactions.

The growth can be attributed to its ability to handle over 70 transactions per second (TPS). This significantly outpaces rivals like Arbitrum One, which processes fewer than 20 TPS, according to L2Beat.

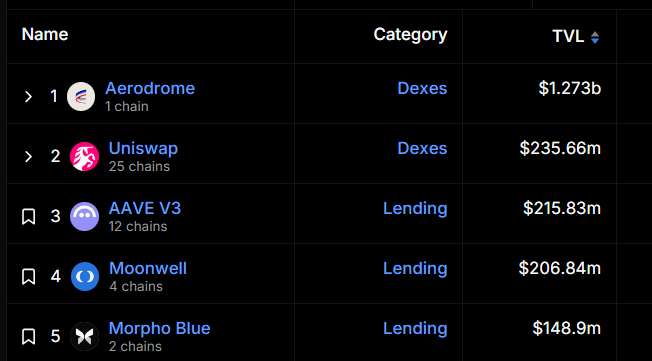

Meanwhile, the surge in transactions has also led to an increase in Base’s total value locked (TVL). DeFiLlama reports that Base’s TVL has reached $2.36 billion, slightly surpassing Arbitrum’s $2.35 billion. However, L2Beat provides a different perspective, noting that Arbitrum still holds the lead with $13.24 billion in assets compared to Base’s $7.54 billion.

Base’s lead developer Jesse Pollak explained the discrepancy between these figures. He noted that platforms like L2Beat measure the value of all assets on a network, including both bridged and native assets. In contrast, DeFiLlama focuses solely on the value locked in DeFi protocols.

“We think about AOP (assets on the platform) as a measure of latent capital and TVL as a measure of productive capital. Both [are] useful for measuring different things,” Pollak said.

Base’s quick growth has come within a year of its launch. Market observers noted that this is driven in part by its close integration with Coinbase. One standout factor has been the introduction of cbBTC, a wrapped Bitcoin product that has improved accessibility to Bitcoin on DeFi platforms.

This innovation has attracted both retail and institutional users, thanks to the security and reliability provided by Coinbase’s established systems.

Read more: Layer 1 vs. Layer 2: What Is the Difference?

Moreover, Base’s expanding ecosystem of decentralized applications (dApps) — such as decentralized exchanges (DEXs) like Aerodrome and lending protocols like Aave — has played a pivotal role in its growth. These diverse use cases continue to attract users to the platform, enhancing its position in the competitive Layer 2 space.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.