Neiro on Ethereum (NEIRO) has surged dramatically in recent weeks. Currently priced at $0.002005, it has soared over 5000% in the past month, outpacing most of the market. NEIRO briefly touched an all-time high of $0.0021 on Saturday before retreating to its current level.

As traders rush to lock in profits, the token is likely to see a near-term pullback. The key question now is how far NEIRO’s price will drop in the coming days.

NEIRO Is Ready To Let Go Of Some Gains

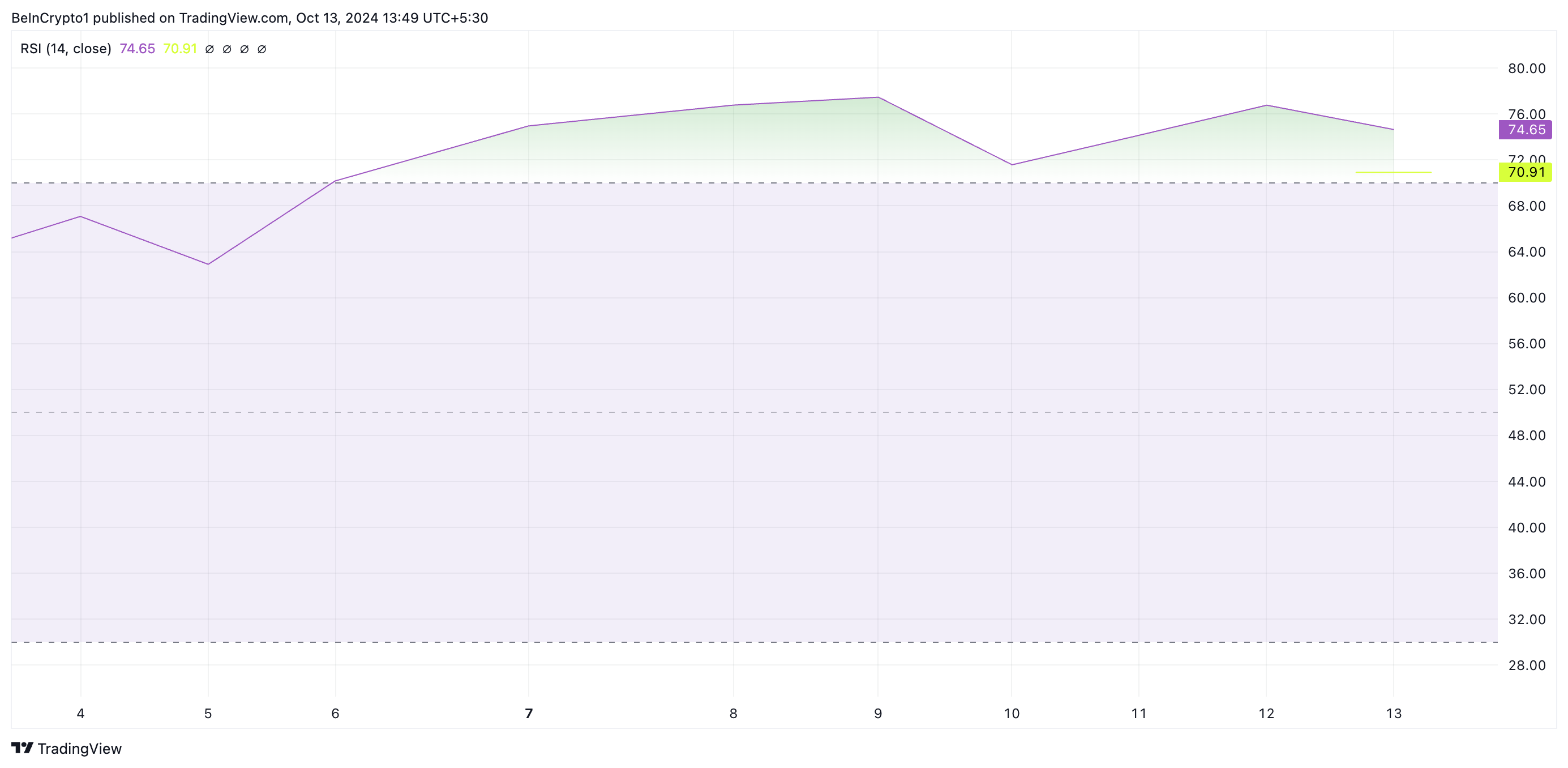

NEIRO’s Relative Strength Index (RSI), assessed on a one-day chart, is 74.65, indicating that the market is overheated and due for a correction. This indicator measures an asset’s oversold and overbought market conditions.

It ranges from 0 to 100, with readings above 70 suggesting overbought conditions. This implies that NEIRO has been heavily bought in recent sessions, which may lead to a potential price correction as traders start taking profits.

Read more: 12 Best Altcoin Exchanges for Crypto Trading in October 2024

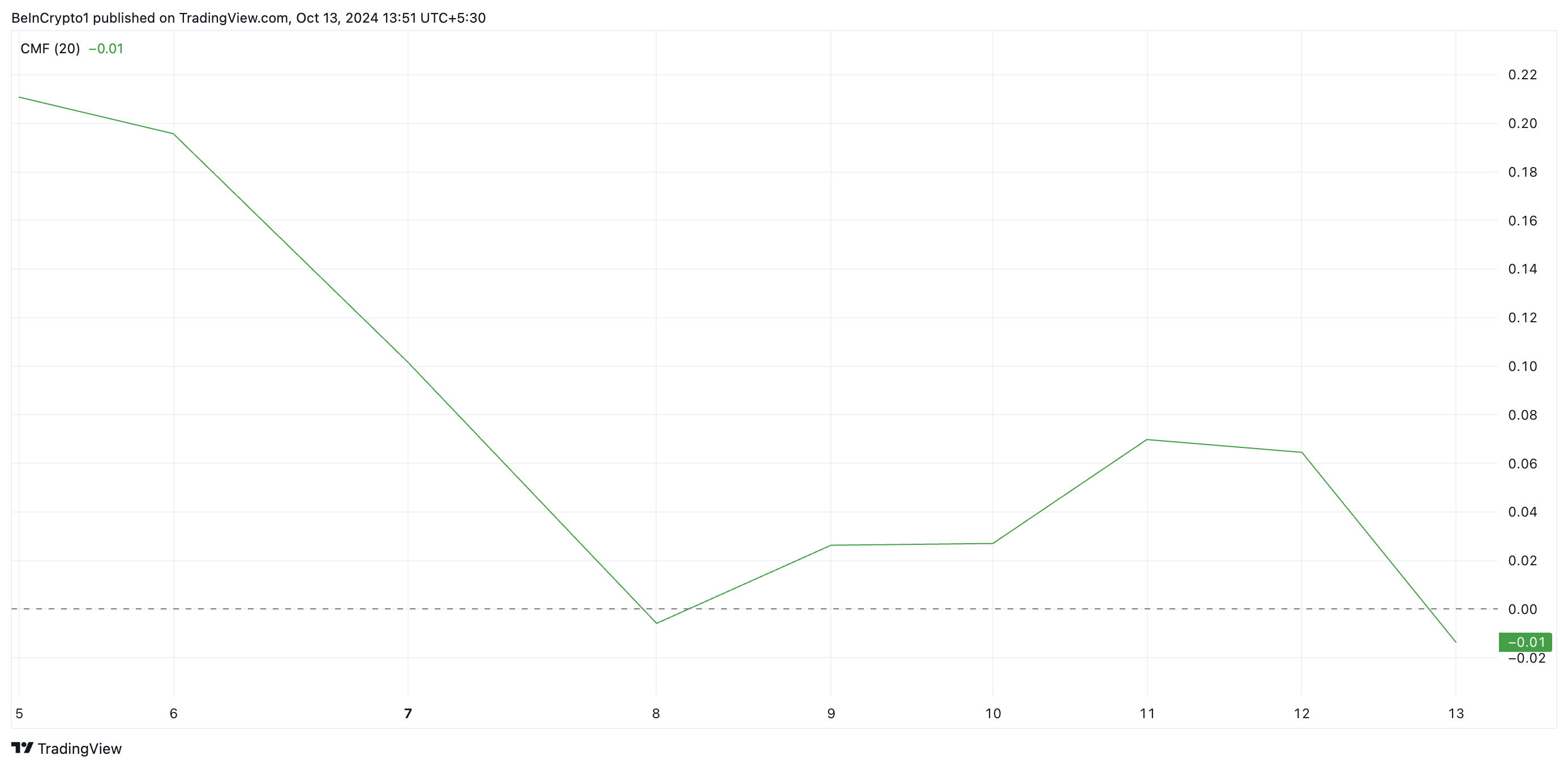

Furthermore, some NEIRO holders have begun to lock in their gains, as evidenced by the token’s declining Chaikin Money Flow (CMF). As of this writing, NEIRO’s CMF is on a downward trend.

A CMF value below zero is a sign of market weakness. NEIRO’s CMF value of -0.01 suggests a gradual uptick in selling pressure. It indicates that sellers slightly outnumber buyers, though the market remains somewhat balanced.

NEIRO Price Prediction: Why Holders Need To Be Cautious

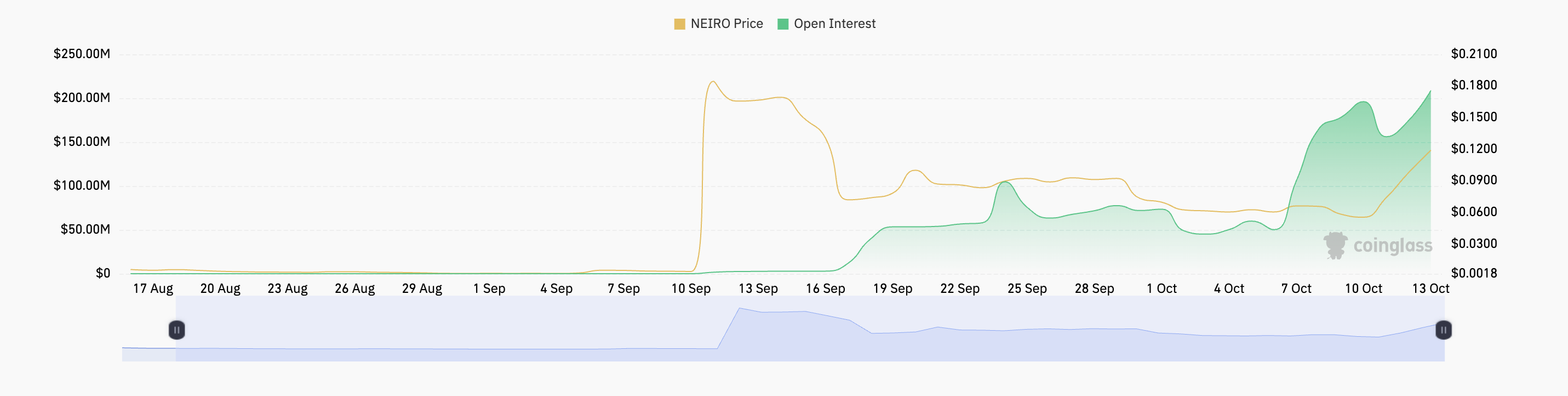

NEIRO’s surging open interest confirms the market is overheated and may be due for a correction or consolidation. This currently stands at an all-time high of $209 million, having risen by 186% since the beginning of the month.

An asset’s open interest measures the value of its outstanding derivative contracts, such as options or futures that are currently active and have not been settled or closed.

Generally, if open interest rises while prices increase, it suggests that new money is entering the market and supporting the upward trend. This often indicates strong market confidence and a continuation of the trend.

However, as in NEIRO’s case, if a surge in open interest is combined with an overbought RSI or extreme market sentiment, it signals an overheated market where buyers are likely to become exhausted.

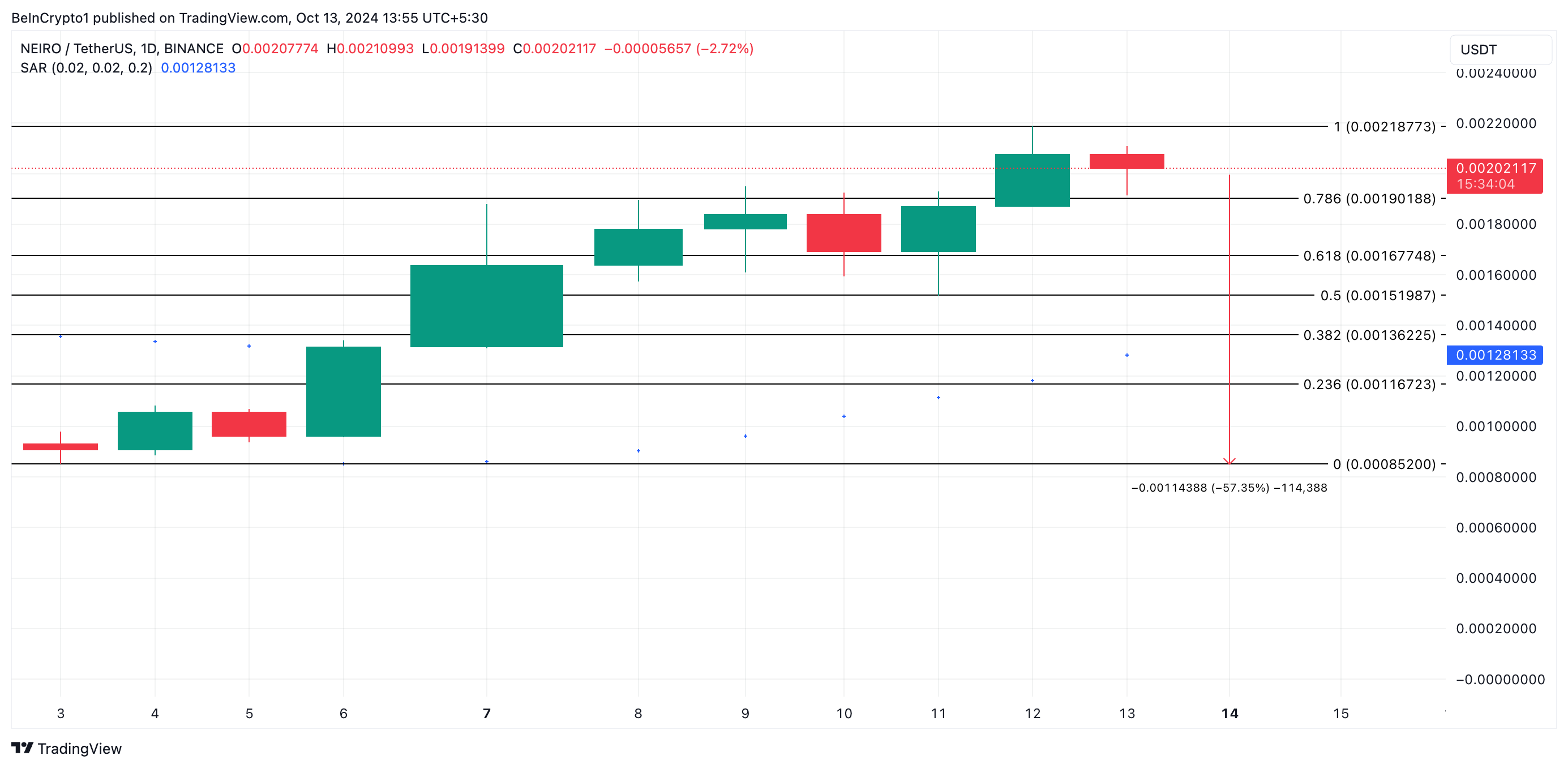

Notably, NEIRO’s Fibonacci Retracement tool readings indicate that if buying pressure weakens, its price could decline to the major support level at $0.00085. This would mark a 57% drop from its NEIRO’s current price of $0.0020.

Read more: Best Crypto To Buy Now: Top Coins To Keep an Eye on in October 2024

On the other hand, if the current momentum holds, NEIRO’s price could reclaim its all-time high of $0.0021 and rally beyond that level.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.