Worldcoin’s (WLD) price, which has recently dropped below $2, threatens to deepen losses for an already-battered investor base. Currently, 80% of WLD holders are in the red.

But more trouble may be ahead as market pressure mounts and sell-offs continue. This analysis explores the factors supporting the extended decline and what could be next for WLD.

Worldcoin Eyes Heavier Losses

On October 7, Worldcoin’s price hit $2.05, with many investors hoping that the development would be the start of a run toward the peak it reached earlier this year. But that did not happen, as WLD is now trading at $1.75.

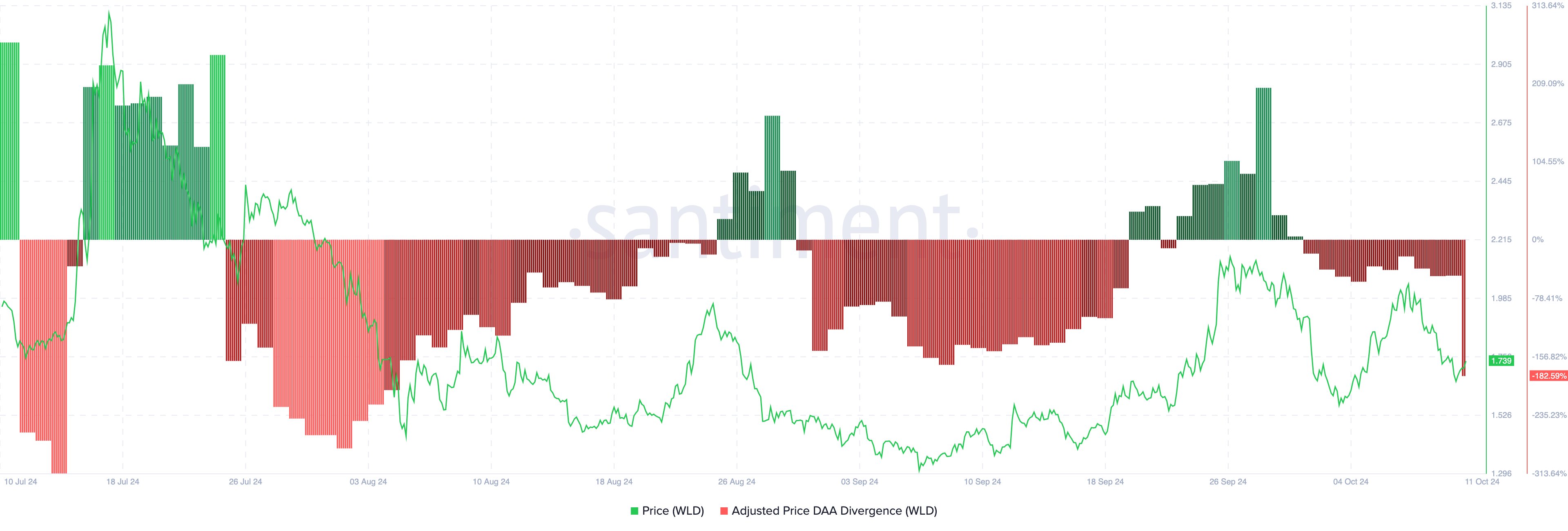

BeInCrypto’s findings reveal that the massive sell-off by both retail and institutional investors is one reason WLD failed to hold the $2 mark. Additionally, Santiment data suggests that WLD may struggle to recover in the near future due to the unfavorable price-DAA divergence.

As the name implies, the adjusted price DAA divergence shows the relationship between a cryptocurrency’s value and its Daily Active Addresses. When it rises, it means that user participation is increasing on the network, which could be a strong buy signal preceding higher prices.

Read more: What Is Worldcoin? A Guide to the Iris-Scanning Crypto Project

However, as of this writing, the metric has plummeted by 186%, suggesting that activity on Worldcoin’s network continues to hit new lows. Consequently, this decline is a sell signal, meaning Worldcoin’s price might drop much lower than $1.75.

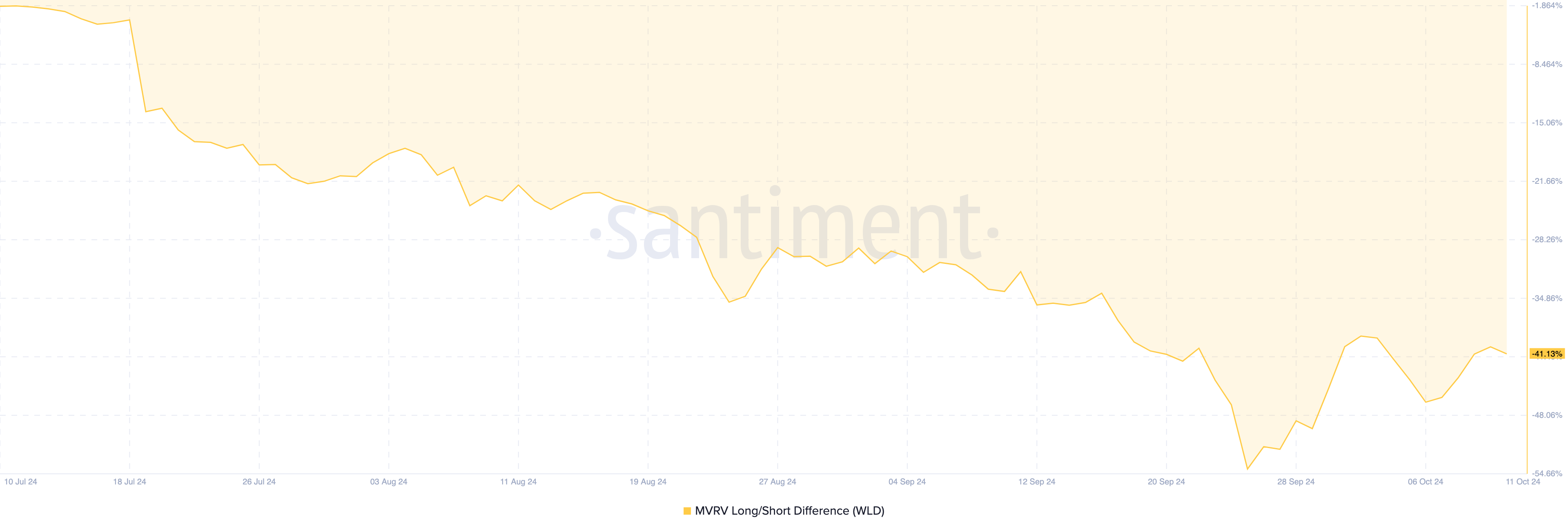

The Market Value to Realized Value (MVRV) Long/Short Difference is another key metric signaling a potential price decline for WLD. This metric tracks profitability in the market.

When it rises, long-term holders are seeing greater unrealized profits compared to short-term investors, which is usually bullish. However, a drop indicates short-term holders are more profitable, suggesting a bearish outlook.

At press time, the MVRV Long/Short Difference stood at -41.13%, implying that the latter and suggesting that WLD might continue to succumb to bearish forces.

WLD Price Prediction: Bearish Pattern Suggests Deeper Slide

Based on the daily chart, Worldcoin continues to trade within a descending triangle. A descending trendline and flatter horizontal support characterize this bearish chart pattern. Without breaking out of the triangle, WLD’s price might continue to trade lower.

Furthermore, the 20 and 50-day Exponential Moving Averages (EMAs) are positioned around the same spot. The EMA is a technical indicator that hints at potential price trends. When the shorter EMA is above the longer one, the trend is bullish.

Conversely, if the longer EMA is above the shorter one, the trend is bearish. In Worldcoin’s case, the current position of the indicators suggests that bulls and bears are struggling to control the altcoin’s next direction.

Read more: Where To Buy Worldcoin (WLD): 5 Best Platforms for 2024

However, bears still have the edge, suggesting that WLD’s price might decrease. If that remains the case, the token’s value could sink to the horizontal support at $1.31. Meanwhile, a break above the descending trendline might invalidate this prediction. In that scenario, WLD could jump to $2.12 and probably rally to $4.19 in the near term.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.