Token unlock involves releasing tokens that were previously blocked under fundraising terms. Projects carefully schedule these releases to avoid market pressure and prevent a drop in token prices.

However, factors like lack of liquidity or early investor profit-taking can significantly impact an asset’s dynamics. Here are three major unlocks to watch next week.

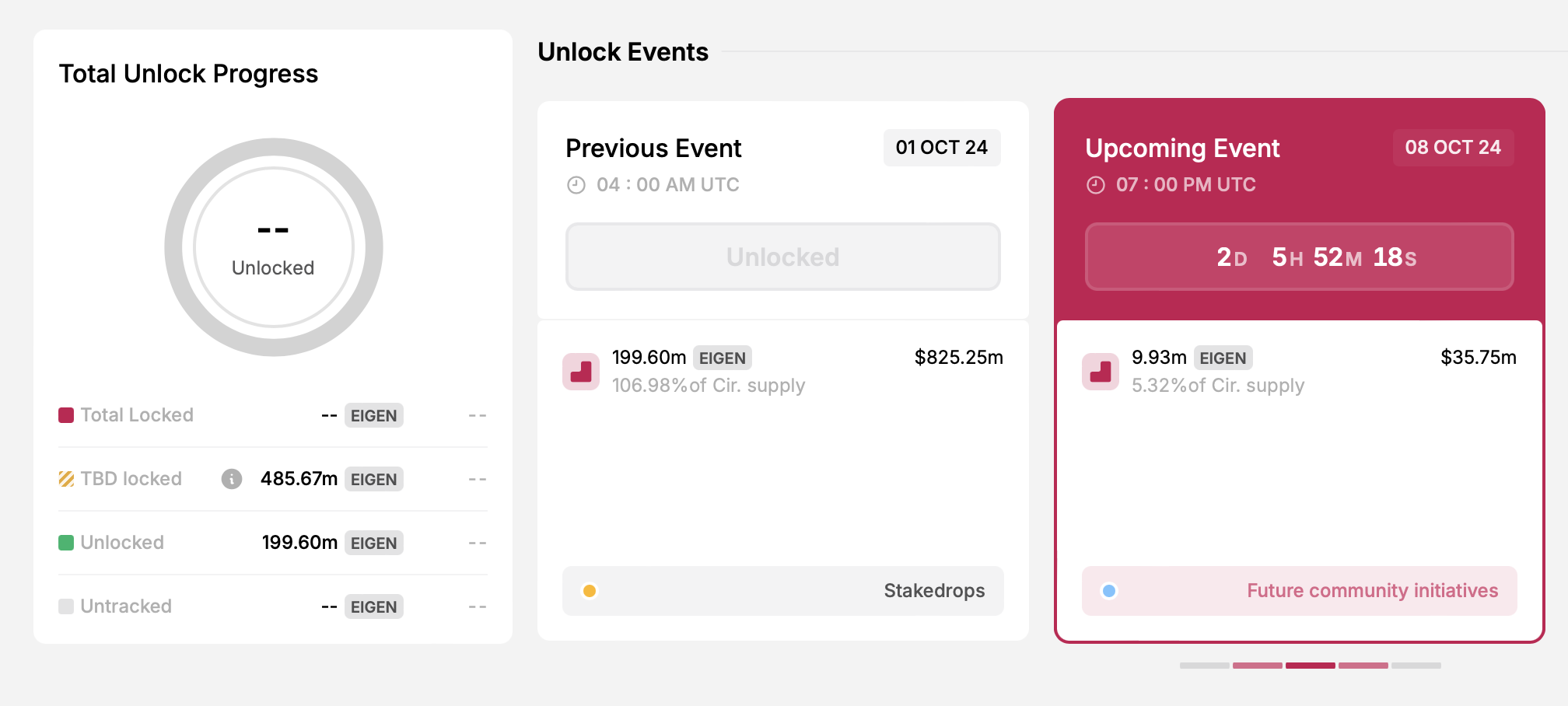

EigenLayer (EIGEN)

- Unlock date: October 8

- Number of tokens unlocked: 9.93 million EIGEN

- Current circulating supply: 186.58 million EIGEN

Ethereum-based restaking protocol EigenLayer kicked off October by listing its EIGEN token on major exchanges. On October 8, the project will unlock nearly 10 million EIGEN, valued at $35.75 million as of this writing. These tokens will be allocated for future community initiatives, so the unlock is unlikely to impact the token’s price.

Read more: Ethereum Restaking: What Is it and How Does it Work?

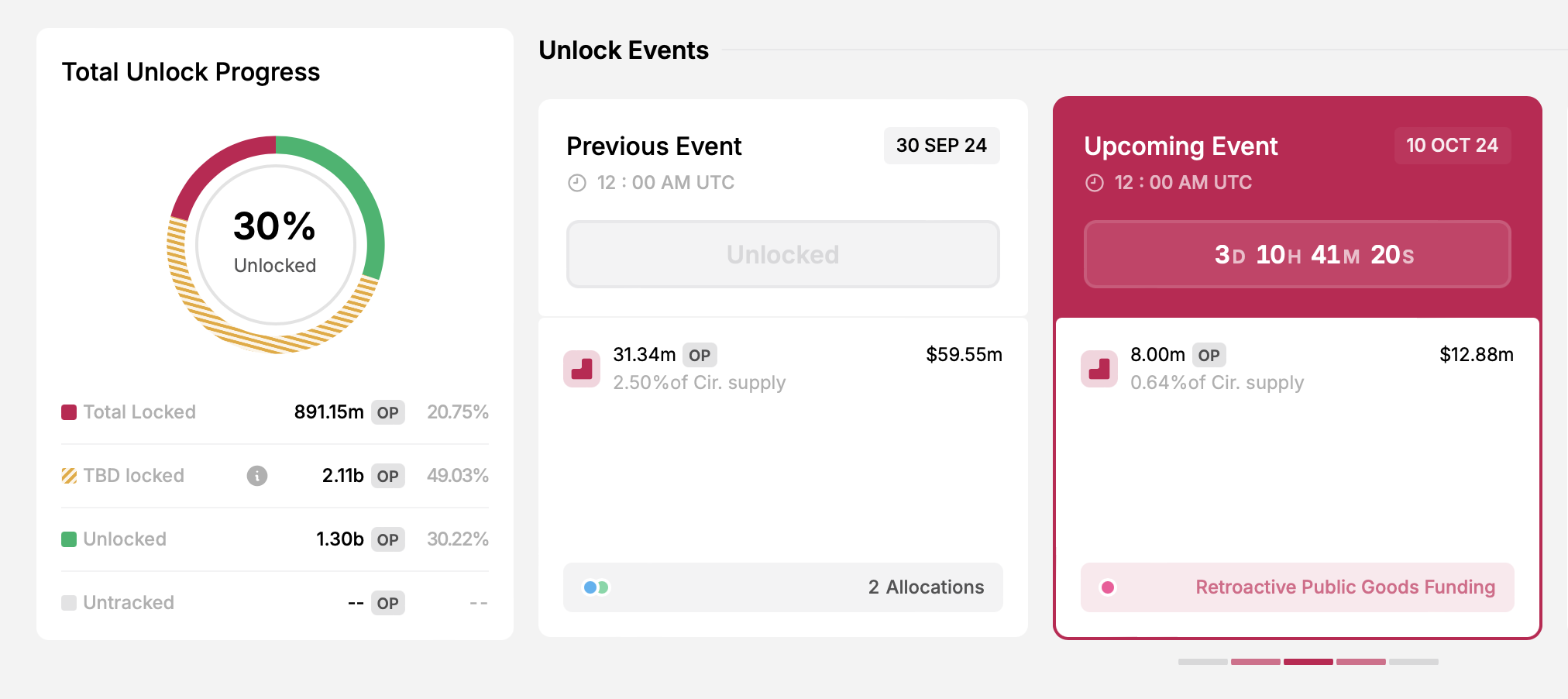

Optimism (OP)

- Unlock date: October 10

- Number of tokens unlocked: 8 million OP

- Current circulating supply: 1.25 billion OP

Optimism is a Layer-2 scaling solution designed to improve the speed and lower the costs of transactions on the Ethereum mainnet. The OP token plays a crucial role in governance, allowing holders to vote on proposals and decisions that shape the network’s development and management.

On October 10, Optimism will increase its circulating supply by 8 million OP. According to TokenUnlocks, the project will use these tokens for retroactive public goods funding.

Read more: Optimism vs. Arbitrum: Ethereum Layer-2 Rollups Compared

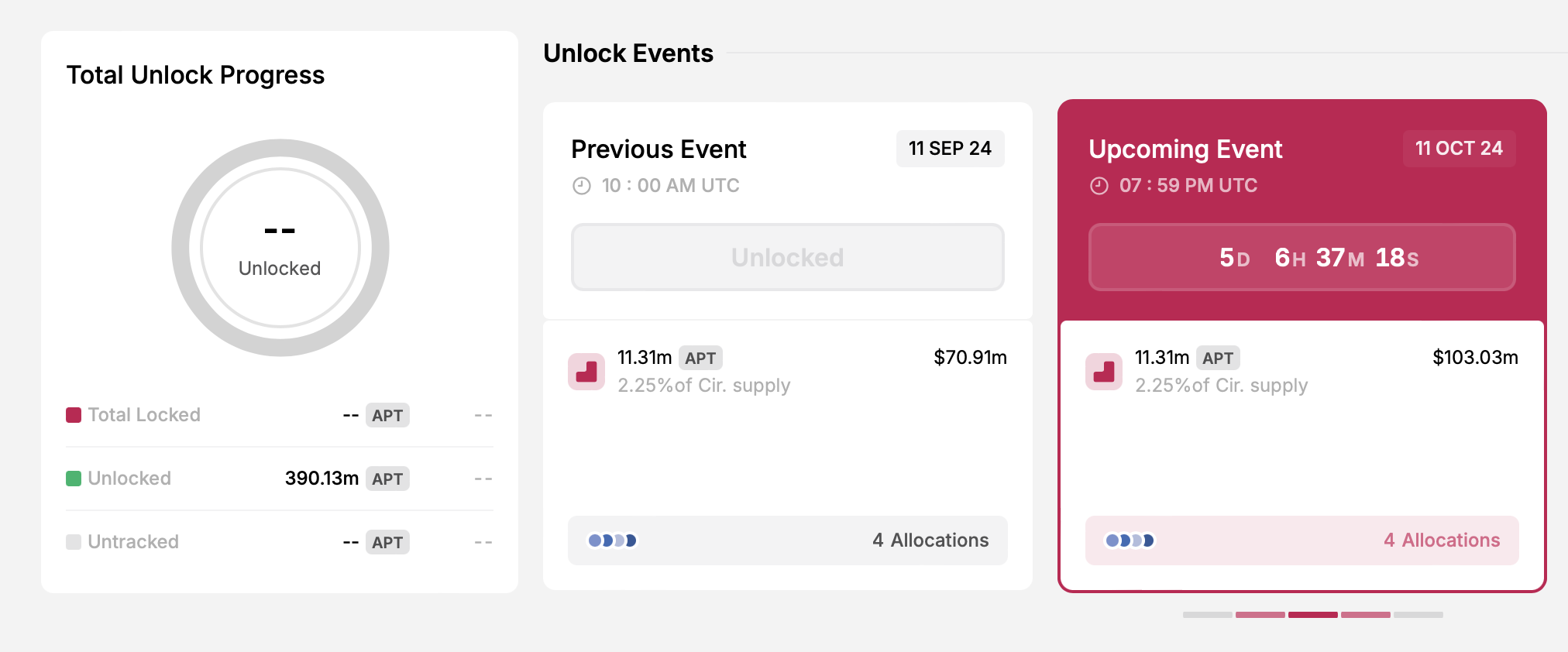

Aptos (APT)

- Unlock date: October 11

- Number of tokens unlocked: 11.31 million APT

- Current circulating supply: 502.84 million APT

Aptos is a Layer-1 blockchain designed to provide a secure and scalable infrastructure for decentralized applications. With a focus on security and performance, it incorporates innovative technologies to enhance the blockchain experience.

Despite being one of the most successful blockchain projects in recent years, Aptos has faced criticism from the crypto community for its tokenomics, which are heavily influenced by venture capital.

A major portion of APT tokens remains locked. On October 11, the project will distribute 11.31 million APT tokens to community members, core contributors, and investors.

Read more: Where To Buy Aptos (APT): 5 Best Platforms for 2024

Other next-week cliff unlocks include Hashflow (HFT), Cardano (ADA), Ethena (ENA), Xai (XAI), and io.net (IO), with a total value exceeding $204 million. While many see token unlocks as bearish, a well-structured schedule can actually support a project’s long-term success. Tied to key milestones and development, unlocks can motivate the team, engage the community, and drive ecosystem growth.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.