Bitcoin’s (BTC) price recently experienced a 7.8% decline, dropping to $60,000. However, as the king of cryptocurrencies recovers from this drawdown, support from a significant group of investors could push the price higher.

Institutional investors, in particular, are playing a key role in driving Bitcoin’s upward momentum, and their influence might propel BTC toward the $70,000 mark.

Bitcoin Notes Solid Demand

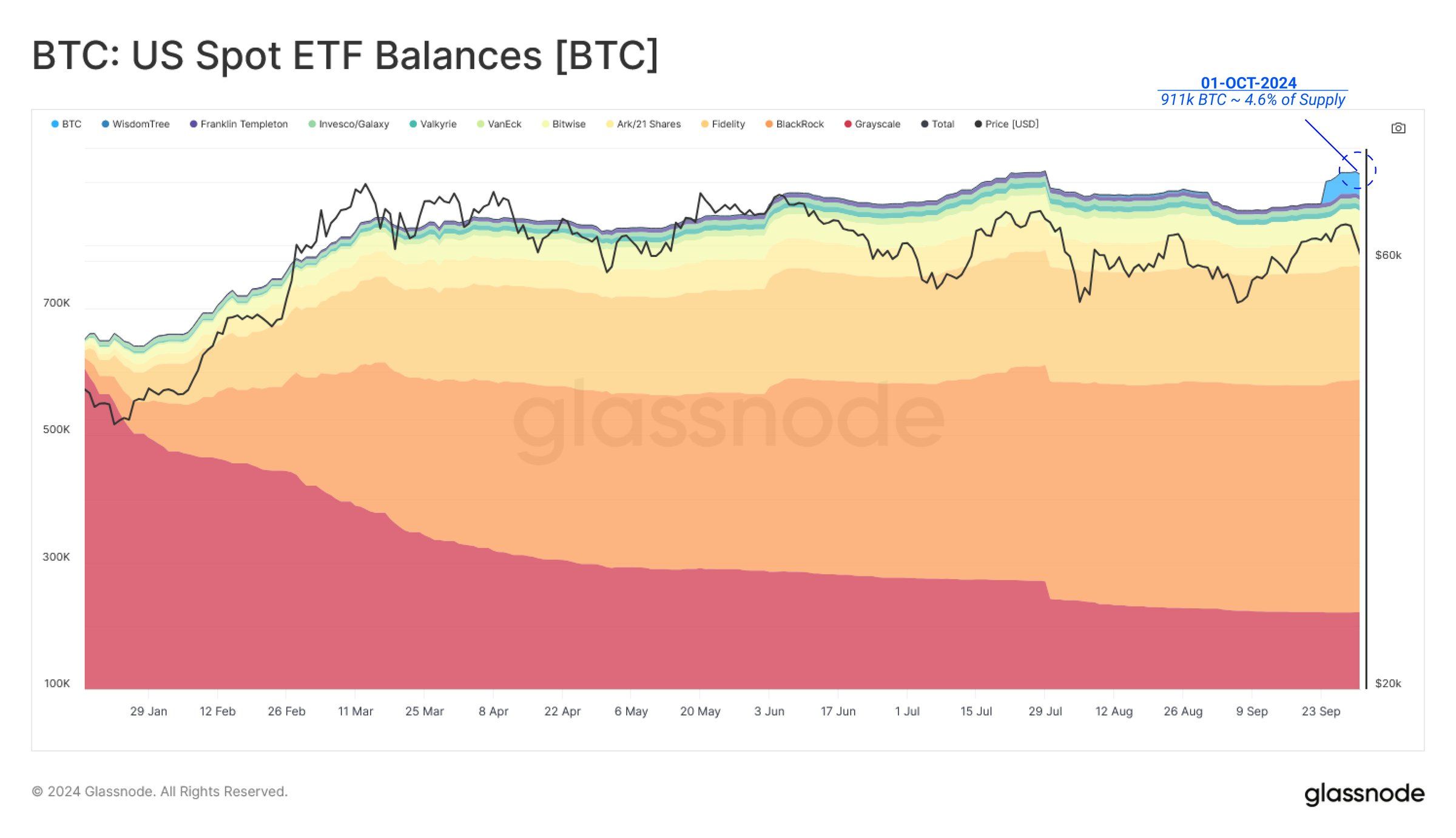

Institutional investors are crucial to Bitcoin’s potential recovery and future growth. According to data from Glassnode, Bitcoin exchange-traded funds (ETFs) now hold over $58 billion worth of BTC. This volume accounts for approximately 4.6% of Bitcoin’s circulating supply, indicating strong demand for regulated exposure to the cryptocurrency.

The institutional demand suggests that large-scale investors view Bitcoin as a viable and valuable asset. As these investors continue to accumulate BTC through ETFs and other regulated means, they contribute to the coin’s long-term growth and stability. Their influence could be key in pushing Bitcoin’s price toward $70,000, especially if demand remains consistent.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

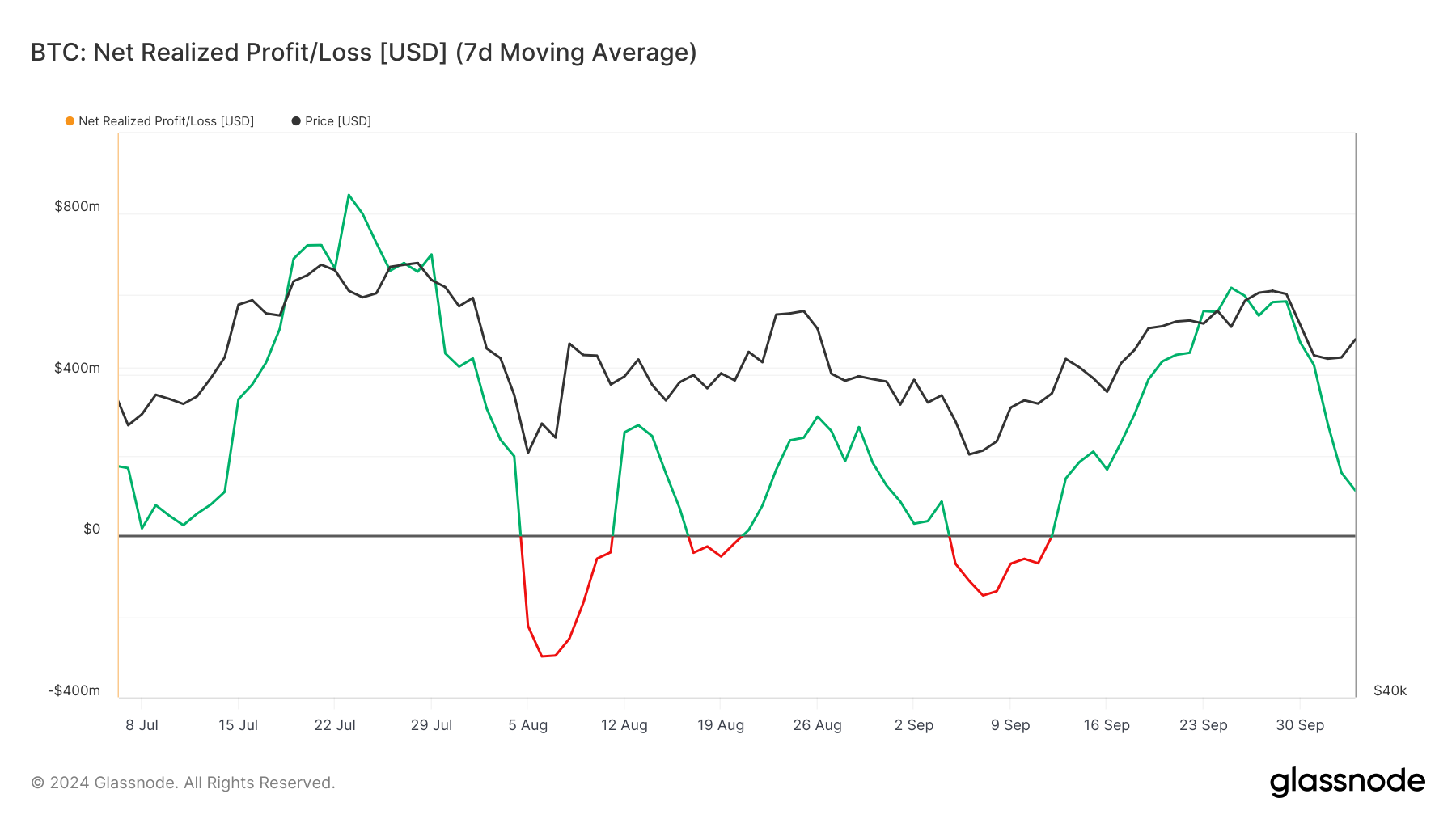

Bitcoin’s overall macro momentum also appears favorable for a potential price rise. The net realized profit/loss indicator, which tracks investor sentiment and behavior, recently noted a downtick, signaling that profit booking is slowing down. This shift suggests that selling pressure is decreasing, giving Bitcoin the necessary breathing room for a comeback.

As selling sentiment wanes, Bitcoin’s price could benefit from a more balanced market. This reduction in profit-taking allows for a more stable price environment, increasing the chances of a sustained recovery. With institutional demand remaining strong and selling pressure subsiding, Bitcoin could be on track for a price surge.

BTC Price Prediction: Rallying Hopes

Bitcoin is currently trading at $62,353, just above the crucial support level of $61,868. While this is a positive sign, BTC still faces a significant barrier at $65,292 before it can aim for $70,000. Breaking this resistance is essential for the next leg up in Bitcoin’s price movement.

The factors mentioned above suggest that a price rise is possible, but it will require steady growth supported by continued institutional demand. If institutional investors maintain their interest in BTC, Bitcoin could breach the $65,292 barrier and move closer to $70,000.

Read more: Bitcoin Halving History: Everything You Need To Know

However, if institutional demand weakens or large investors pull back, Bitcoin may struggle to break past $65,292. In such a scenario, BTC could test its support level at $61,868, potentially invalidating the bullish outlook and delaying further gains.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.