Dogecoin (DOGE) price has been facing a prolonged downtrend for over five months, with the meme coin struggling to break free. Recent price action suggests that DOGE’s anticipated breakout might not materialize anytime soon.

This is because the market indicators are flashing signs of potential overvaluation, jeopardizing DOGE’s bullish hopes.

Dogecoin Has a Huge Responsibility Ahead

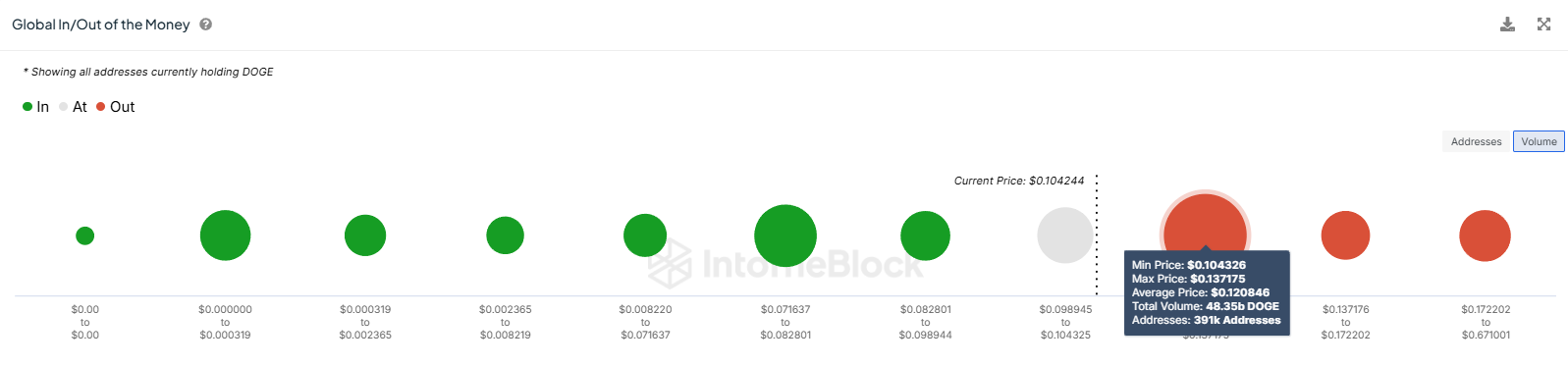

The Global In/Out of the Money (GIOM) indicator reveals significant resistance at $0.108. This area is critical as more than 48.3 billion DOGE, valued at over $5.2 billion, has been bought between $0.104 and $0.137. Investors holding within this range are likely to sell at the first sign of profits, creating a heavy supply wall that could hinder upward momentum.

With such resistance in place, DOGE will need strong support from the broader market to push beyond $0.108. Until then, the supply overhang could suppress the price, preventing the meme coin from achieving a meaningful breakout above this level.

Read more: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

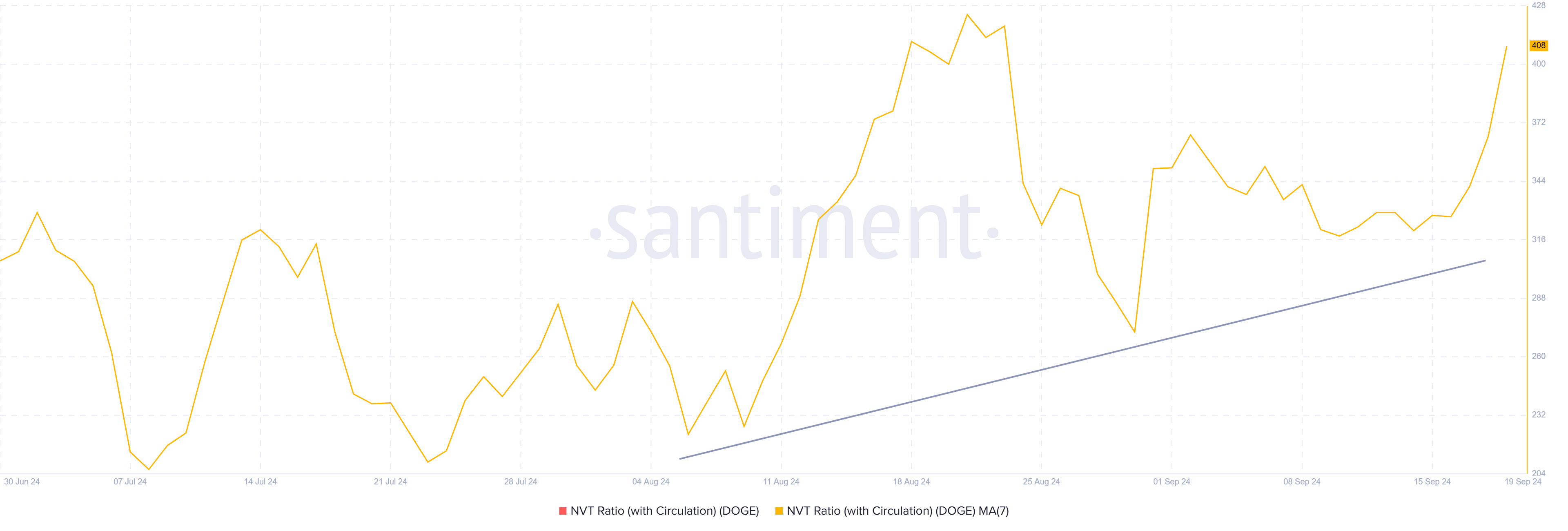

Additionally, the Network Value to Transactions (NVT) ratio, which has been rising since early August, indicates that Dogecoin may be overvalued. This indicator compares the market cap of an asset to its transaction volume, and a rising ratio suggests that valuation is outpacing network activity.

Such a trend is concerning for Dogecoin, as it typically precedes a correction. Overvaluation, combined with low transaction volume, often signals that a price drop may be on the horizon.

DOGE Price Prediction: Keep on Moving

Dogecoin’s price is currently trading around $0.104 and faces the dual challenge of breaking out of the five-month downtrend while also overcoming resistance at $0.108. Given the broader market cues, this feat may not be achievable in the short term.

The likelihood of consolidation under the $0.108 barrier remains high. This is because the broader market cues are not strong enough to fuel a significant rally. DOGE could remain rangebound between $0.108 and $0.091 in the near future.

Read More: Dogecoin (DOGE) Price Prediction 2024/2025/2030

However, if broader market conditions improve and investors hold onto their positions instead of selling, Dogecoin could break through $0.108. This move would open the door for a 16% rally toward $0.122, potentially invalidating the bearish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.