Bitcoin’s (BTC) price is at a crucial make-or-break point as the market anticipates Wednesday’s Federal Open Market Committee (FOMC) meeting. However, expectations for the event are no longer evenly split, despite being so just two days ago.

If the meeting results in a lower basis point (bps) adjustment, historical trends suggest that BTC’s price may undergo a significant correction. A higher rate cut delivered by the Fed, led by Chair Jerome Powell, should boost Bitcoin’s price. This on-chain analysis explains why any potential gains in the latter scenario may be short-lived.

Bitcoin Whales Sell the News

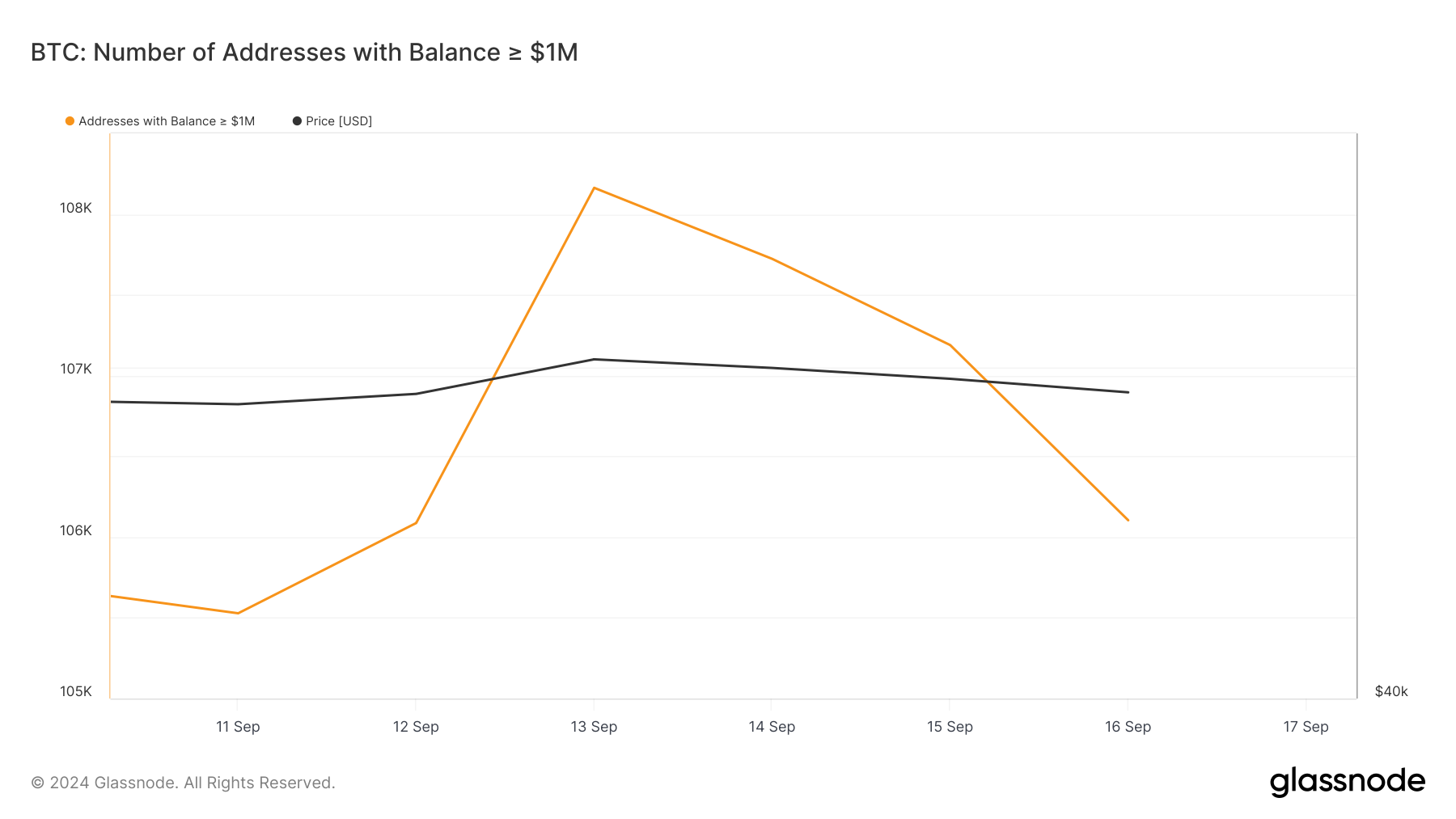

Data from Glassnode shows that Bitcoin whales are selling off ahead of the highly anticipated FOMC meeting. For instance, on September 13, the number of addresses holding over $1 million worth of BTC was 108,163.

Today, Bitcoin’s whale holdings have dropped to 106,104 BTC, signaling a sell-off of over 2,059 BTC valued at more than $2 billion. This “sell the news” behavior reflects growing caution among large holders, who may be preparing for potential volatility as the market awaits clues on future monetary policy.

For instance, Lookonchain reported that a whale sold 500 BTC on Monday. A day before that, another Bitcoin whale deposited 119 BTC to Binance. This massive sell-off suggests that whales are positioning themselves defensively, anticipating possible short-term turbulence before, amid, and after the meeting.

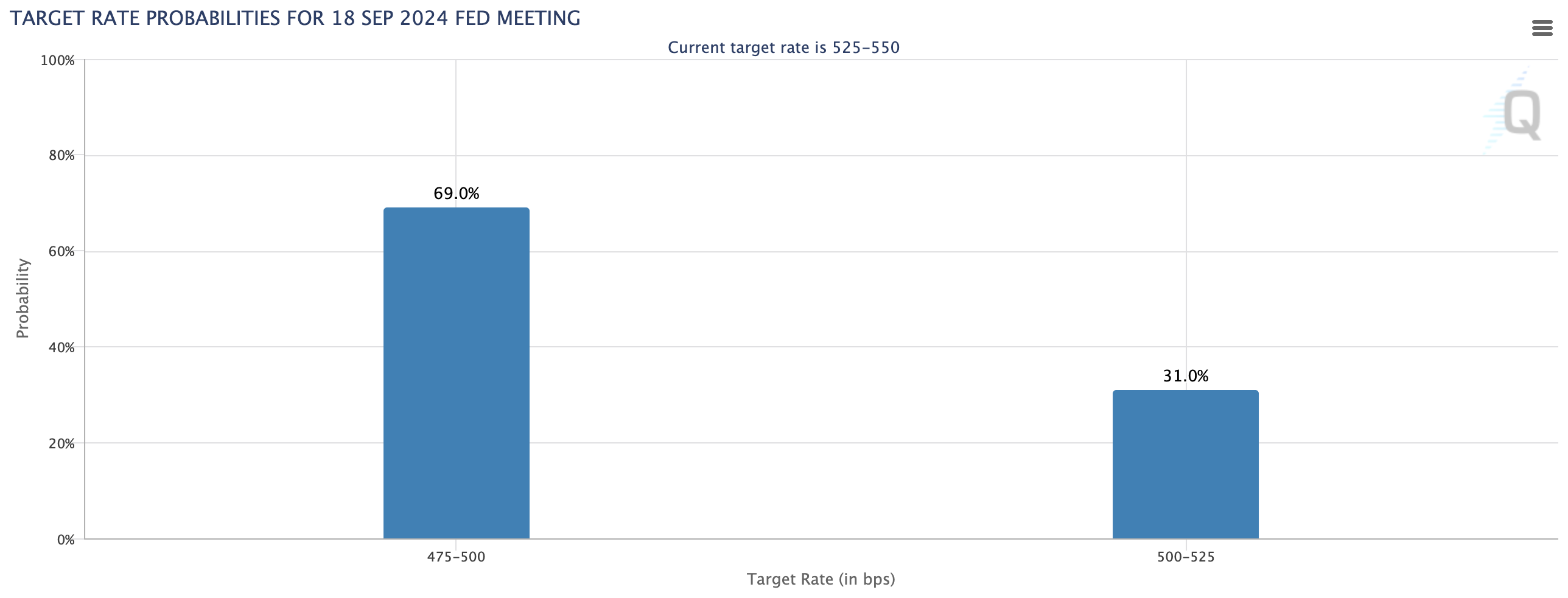

According to the CME FedWatch tool, the chance of 50 bps is 69%, while that of 25 bps is 31%. For context, the tool measures the likelihood of an interest rate cut.

In August, Fed Chair Powell hinted at a rate cut during the Jackson Hole Speech. The statement at that time gave Bitcoin’s price a brief push above $62,000. Over the weekend, the cryptocurrency jumped to $60,000 but currently trades below that region.

Read more: Top 7 Platforms To Earn Bitcoin Sign-Up Bonuses in 2024

Likely Rate Cut Could Offer Unsustainable Boost

While the broader market might be bracing up for a rebound due to the above-highlighted probability, some analysts believe the aftereffect might not be sustainable.

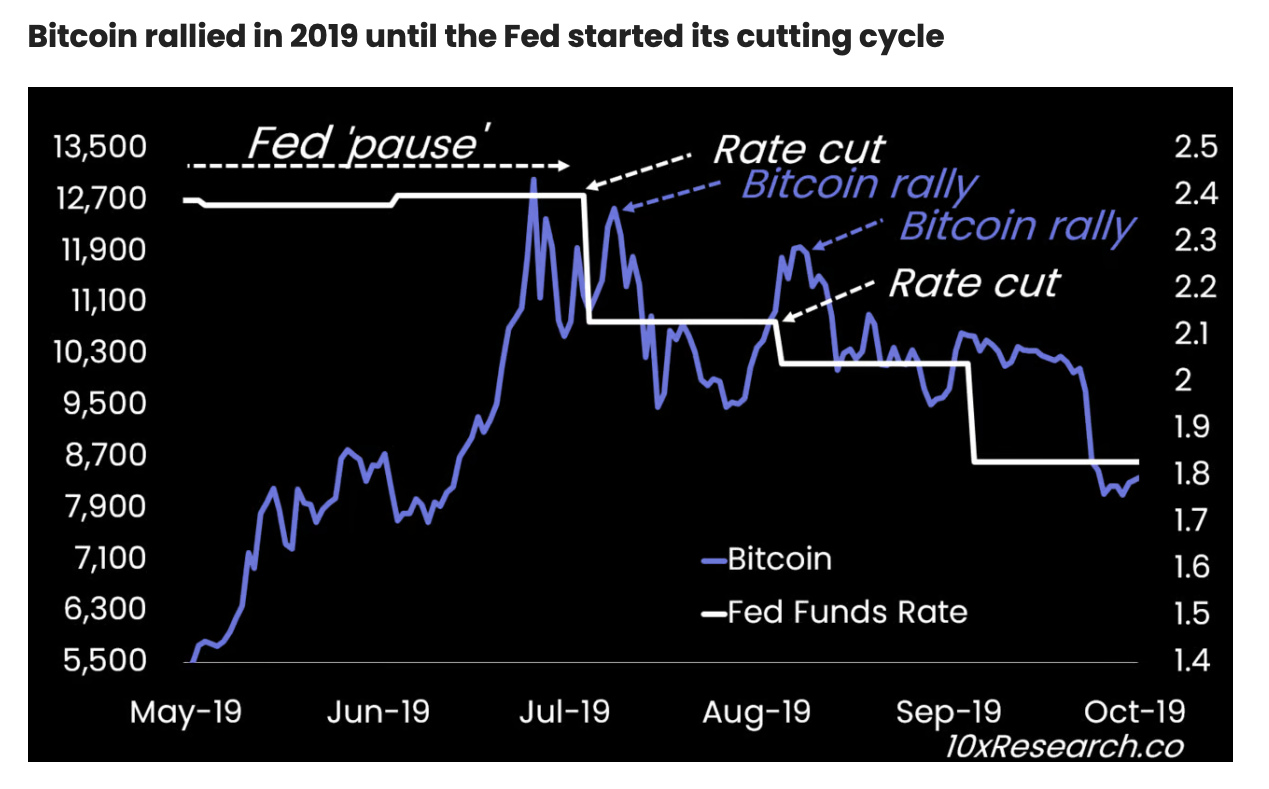

One of those with such sentiment is Markus Theilien, head of research at 10xResearch. In a report dated September 16, the firm noted that a 50 bps is very likely to be the outcome of the FOMC meeting. However, the report also stated that Bitcoin may not see the significant price boost many market participants are anticipating.

“The Federal Reserve should consider a 50 basis point rate cut, but whatever action it takes this week might not provide the significant liquidity boost many hope for. Historically, Bitcoin’s performance following rate cuts has been mixed; for example, after the 2019 rate cut, Bitcoin’s initial gains were short-lived, and the price dropped by 30% a few months later,” Thielen emphasized.

BTC Price Prediction: Bears On the Front Foot

On the daily chart, Bitcoin’s price is grappling with the 20-day Exponential Moving Average (EMA). Trading at $58,646, this position implies that bulls do not yet have a clear path to drive the price higher.

Instead, bears have continued to exert pressure, keeping Bitcoin’s upward momentum in check. BTC also remains below the 50 EMA (yellow), reinforcing the notion that the short-term trend is bearish.

An assessment of the Relative Strength Index (RSI) also indicates a potential correction. As a momentum-measuring technical oscillator, the RSI reading, despite being close to a neutral signal line, has failed to surpass it.

Read more: 10 Platforms That Provide the Best Interest Rate on Stablecoins

Should this remain the same, BTC might drop to $56,224. A highly bearish situation might also see the coin decline to $52,975 after the FOMC meeting. However, if Bitcoin whales return to accumulation after the event, this prediction might be invalidated.

In that scenario, the price might jump to $64,373 and could set the stage for a Q4 rally, which 10x Research says it expects.

“Even if Bitcoin rallies following a Fed rate cut, the surge may not be sustainable, as suggested by the 2019 comparison. With on-chain data currently weak, there is little real activity driving momentum. While a rally in Q4 is likely, timing it perfectly will be crucial. An unexpected event may reignite market enthusiasm and revive investor confidence,” the report stated.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.