Bitcoin’s price recently bounced back from the crucial support level at $53,980 and is now approaching the $60,000 mark. After hitting a low of $52,270, the cryptocurrency is showing strength, supported by favorable market conditions.

Currently trading at $60,048, BTC is targeting the critical resistance at $61,725. Breaking this level will be essential for sustaining its upward momentum, and investors are closely monitoring Bitcoin’s next price move.

Bitcoin Has a Shot

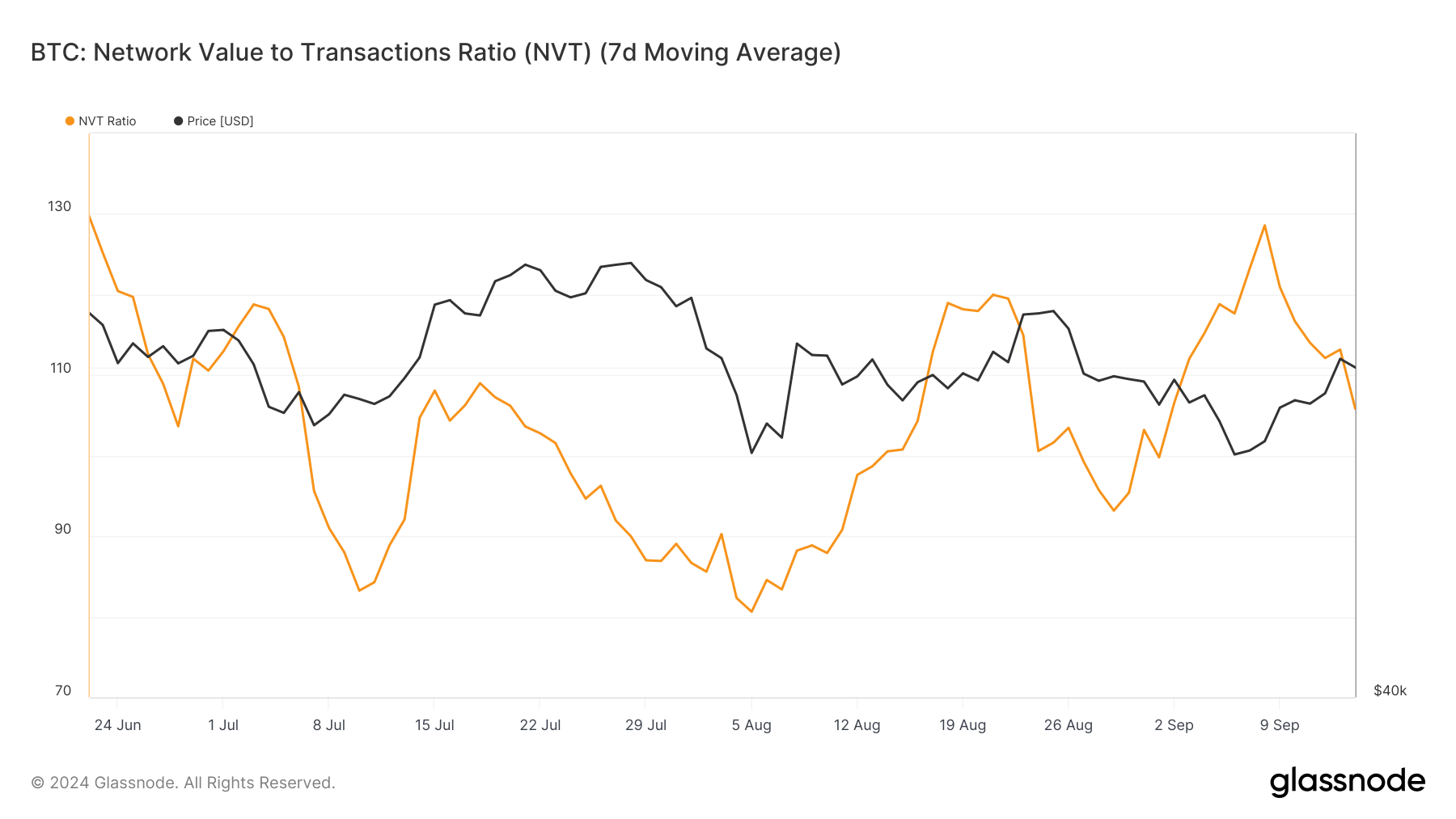

Bitcoin’s Network Value to Transactions (NVT) Ratio, a key metric for evaluating whether the asset is overvalued or undervalued, has shown a short-term decline. While the macro NVT remains on the rise, indicating potential overvaluation in the broader market, the recent dip suggests Bitcoin has a chance of breaking through the $61,725 resistance. If BTC flips this level into support, it could lead to further price gains and boost bullish sentiment among investors.

The short-term NVT drop indicates that network activity may be better aligning with Bitcoin’s valuation, pointing to a healthier price increase. With favorable macro conditions, a successful breach of $61,725 could mark the start of a new upward trend.

Read more: Bitcoin Halving History: Everything You Need To Know

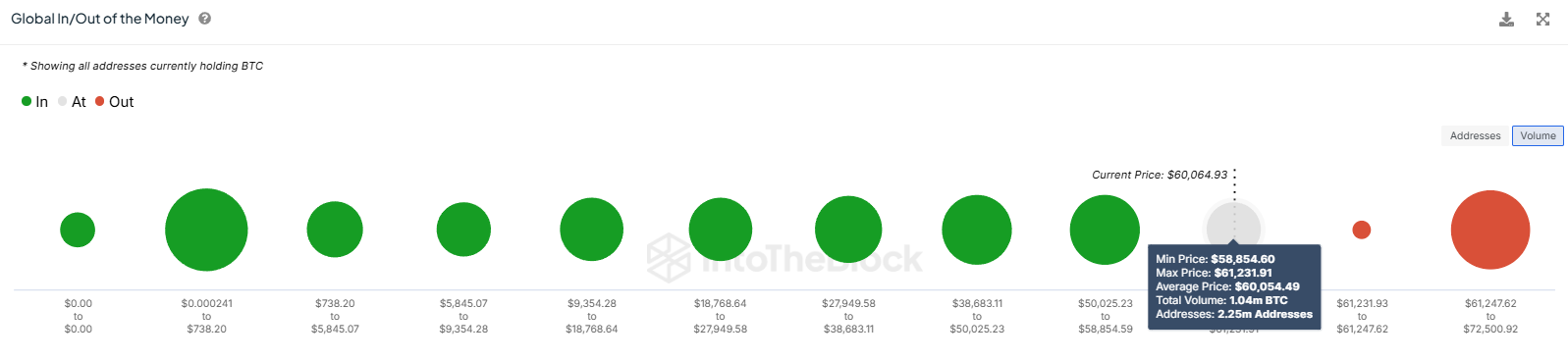

Bitcoin’s macro momentum is showing promising signs, particularly with the Global In/Out of the Money (GIOM) indicator. This indicator reveals that 1.04 million BTC, worth over $62 billion, is on the verge of profitability if Bitcoin can surpass $61,725.

The majority of this supply was purchased between $58,854 and $61,231. This positions these holders for significant gains if Bitcoin breaks through this critical barrier.

If Bitcoin can breach $61,725, the bullish momentum is likely to accelerate as more BTC holders move into profit territory. This could spur additional buying pressure, further driving up Bitcoin’s price and reinforcing its bullish outlook. However, the challenge lies in overcoming this key resistance level, which has historically proven difficult to break.

BTC Price Prediction: Holdup Ahead

Bitcoin is currently trading at $60,048 as market conditions improve. After rebounding from the $57,720 support level, the cryptocurrency appears ready to challenge the $61,725 resistance. If Bitcoin breaks through this barrier, it could signal the start of a new bullish run, with a potential target of $65,000.

Reclaiming $65,000 as support would be a key milestone for Bitcoin, especially after failing to do so in late August. A successful break above this level could attract more buying interest and push the price higher. However, Bitcoin’s ability to sustain this momentum hinges on flipping $61,725 into support.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

If Bitcoin fails to breach the $61,725 resistance, it could consolidate below this level, weakening the bullish outlook. In that case, Bitcoin might struggle to gain new upward momentum, leading to a period of price stagnation as investors await clearer signals.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.