Polymarket data will soon be available on Bloomberg, allowing its Terminal service to offer real-time election odds as users actively bet on the outcome of the upcoming US election.

The integration highlights the growing significance of prediction markets in US elections, even as they face ongoing regulatory challenges.

Bloomberg Integrates Polymarket Data

According to Michael McDonough, Bloomberg’s chief economist for financial products, the integration of Polymarket data into Bloomberg’s Terminal service is already underway. Once completed, users will be able to view Polymarket’s real-time US presidential election odds, along with data from other prediction markets and polling services.

“We are in the process of adding Polymarket data to WSL Election,” McDonough wrote.

With this integration, Polymarket data will become accessible on one of the world’s leading financial data platforms. Bloomberg, which reportedly has around 350,000 subscribers worldwide, controls approximately one-third of the financial data services market.

It points to increasing recognition of the role of the decentralized prediction platform, which runs atop the Ethereum scaling network, Polygon. The growing popularity draws from the oncoming US elections, with bettors actively predicting the outcome of the November ballot. The platform leverages smart contracts for transparent trading and payouts.

Read more: How Can Blockchain Be Used for Voting in 2024?

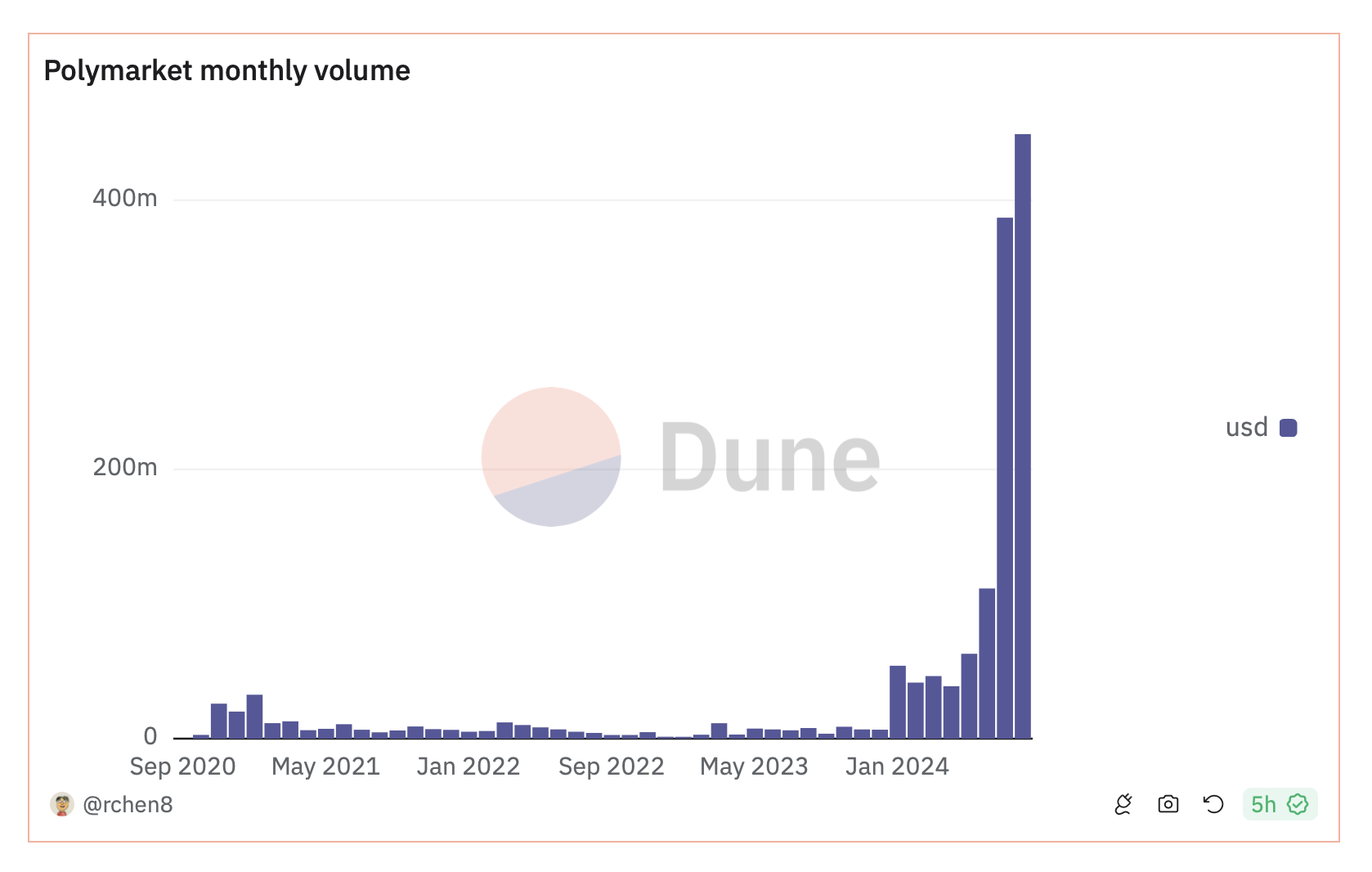

As BeInCrypto reported, the platform’s volume metrics are soaring. Data from Dune shows almost $450 million in August monthly volume and over 60,000 monthly active traders. Amidst the growing user base, the platform collaborated with AI firm Perplexity to enhance user experience through advanced news summarization features.

Polymarket Faces Challenges Despite Popularity

However, despite its exponential growth, Polymarket faces significant challenges. Chief among them is stiff competition from Drift Protocol, a rival prediction market that operates on the Solana blockchain.

“Notably Drift Protocol prediction markets surpassed Polymarket in 24hr volume. Newer prediction market participants but as traction grows should also be incorporated,” DeFi Connoisseur commented.

Indeed, Solana Floor reported a surge in activity on Drift Protocol’s BET platform, bringing it into the spotlight as its daily trade volume skyrocketed by 3,398%. According to Dune, the cumulative volume on Drift Protocol exceeded $23 million on August 29.

In addition to facing competition, Polymarket is under regulatory scrutiny from the US Commodities and Exchange Commission (CFTC). The commodities regulator has raised concerns that event contracts like those offered by Polymarket, particularly those related to political events, carry risks associated with election-related gambling.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Several prominent figures in the crypto industry, including executives from Gemini and Coinbase, have challenged the CFTC’s stance.

“We urge the CFTC to withdraw this proposal and work alongside academic, industry, and policy stakeholders to develop a more balanced approach that promotes innovation while protecting the public interest,” Coinbase’s Paul Grewal remarked.

Ethereum co-founder Vitalik Buterin has also weighed in. He described prediction markets as “social epistemic tools” that provide insights into what is likely to happen, countering the CFTC’s perspective.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.