Recent data suggests Ethereum could benefit from diminishing interest in Bitcoin (BTC). At press time, ETH’s price had fallen by nearly 2%, similar to BTC’s movement.

However, during this period, market interest in ETH has grown, while Bitcoin has seen a drop in trader activity. This raises the question: is a capital rotation from BTC to altcoins starting?

Ethereum Gains Ground Against the Number One Coin

On August 26, Bitcoin’s open interest (OI) stood at over $12 billion. As of now, it has dropped to $11.55 billion, indicating that positions worth $500 million have been closed in the past 24 hours. In contrast, Ethereum’s OI has risen from $5.25 billion yesterday to $5.38 billion today.

Open interest tracks the flow of money in and out of the crypto market. An increase in OI means traders are gaining more exposure to a cryptocurrency by adding liquidity to their contracts, while a decrease signals reduced net positioning and capital flowing out of the market.

The recent rise in Ethereum’s OI, coupled with Bitcoin’s decline, suggests traders are shifting their focus from BTC to ETH, seeking better returns from Ethereum’s price movements.

Read more: Best Ethereum Wallets To Pick in 2024

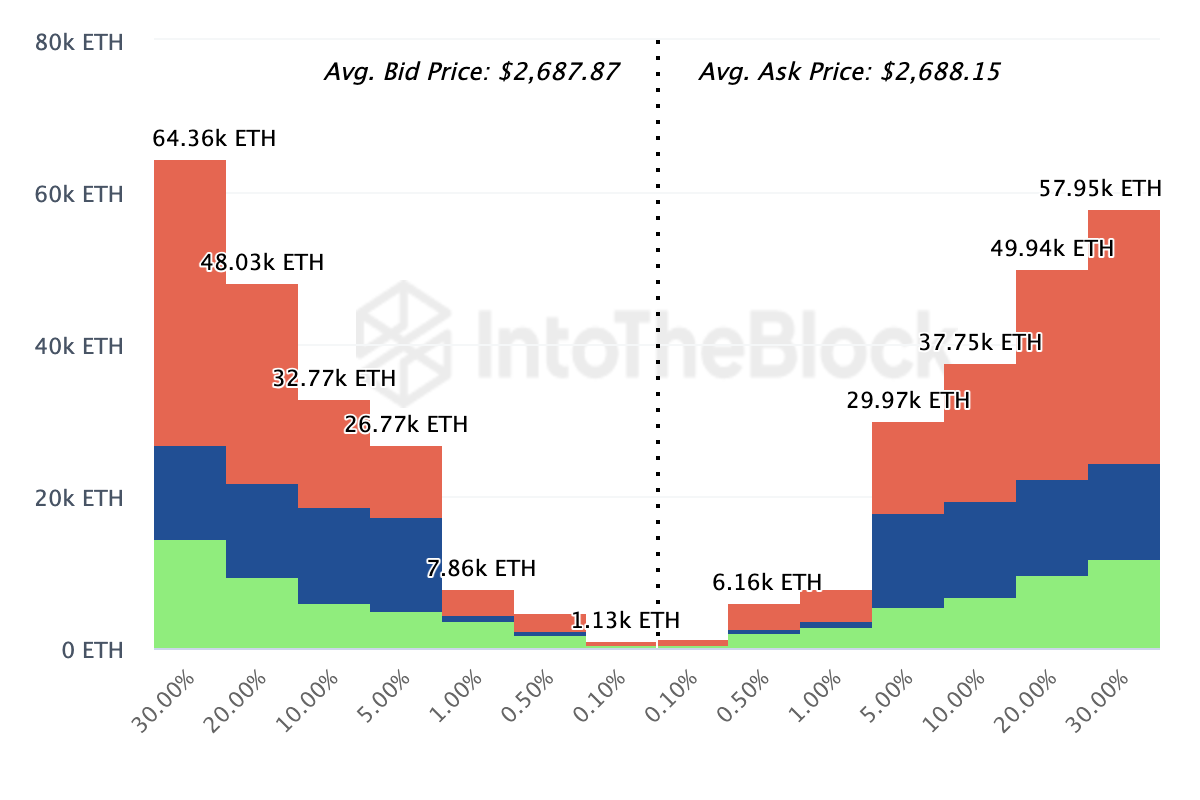

Interestingly, this sentiment extends beyond derivatives market activity. According to IntoTheBlock, market participants are more inclined to gain exposure to ETH on the spot market rather than rotating capital out of the altcoin.

This trend is reflected in the buying and selling volumes visible on the order books of the top 20 exchanges. As shown below, participants are bidding (buying) 185,700 ETH, valued at around $2,687 each.

These coins, worth approximately $500 million, slightly exceed the volume of those looking to sell. If the bid side continues to outpace the ask, ETH’s price could be poised for a bounce.

ETH Price Prediction: The $2,800 Resistance Presents Challenges

Ethereum’s daily chart reveals a sharp downtrend in early August, with ETH’s price falling from $3,392 to $2,109. However, in recent weeks, the cryptocurrency has entered a consolidation phase, indicating a complex scenario where the market is uncertain about the next move.

Key support at $2,556 suggests that ETH may not drop below this level in the short term. Additionally, the Commodity Channel Index (CCI) shows that ETH’s current price of $2,647 is significantly below its fair value.

The CCI measures an asset’s price relative to its average price over a given period. A high CCI reading indicates an asset is overvalued, signaling a potential price drop. Conversely, a low CCI suggests the asset is undervalued, presenting a potential buying opportunity.

In Ethereum’s case, the CCI’s decline points to the current price being below its historical average, a relatively positive sign that could support a more optimistic outlook.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

For now, ETH might continue trading sideways. However, if the altcoin can overcome the current market hesitation in buying large volumes, it could challenge resistance at $2,810, potentially break the $3,000 barrier, and aim for $3,360.

On the flip side, failure to break through the overhead resistance could invalidate the bullish outlook for ETH. In that scenario, ETH’s price might retest lower support levels around $2,556.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.